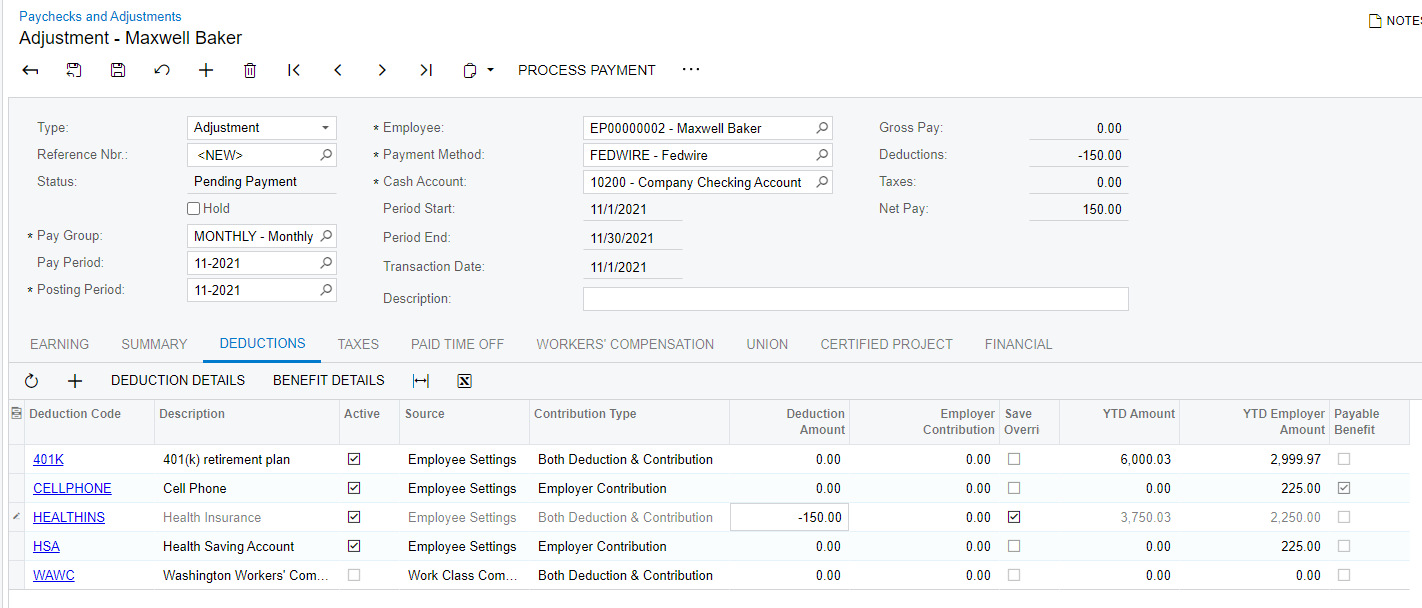

For example: A pay-in-advance Medical deduction of $150 was deducted from the employee paycheck for the upcoming month of coverage. The employee quit or was terminated. We need to refund the $150 on the next/final paycheck. What is the best approach to accomplish this refund?

Solved

What is the best way to refund a prior paycheck deduction?

Best answer by pbennett

i would create a paycode and make sure the taxaction is correct to reverse what was done on the deduction. then user the paycode to refund the employee

Reply

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.