Hello Everyone,

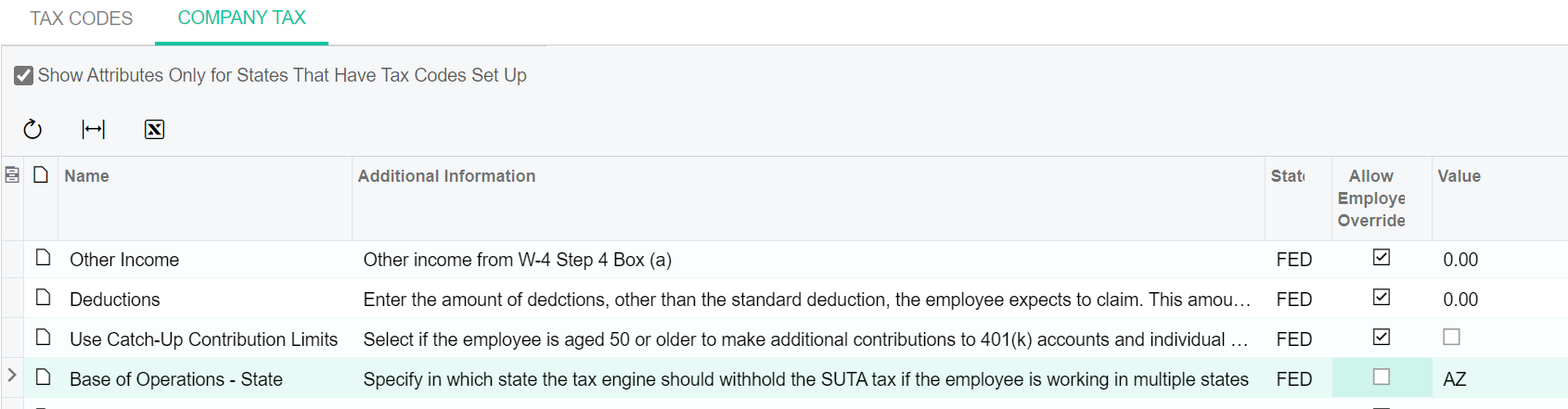

I am trying to clean up some tax issues that arose on the last payroll paybatch we ran after a recent upgrade. Specifically there are a few taxes that have appeared on a recent payroll payrun that were not there before the upgrade.

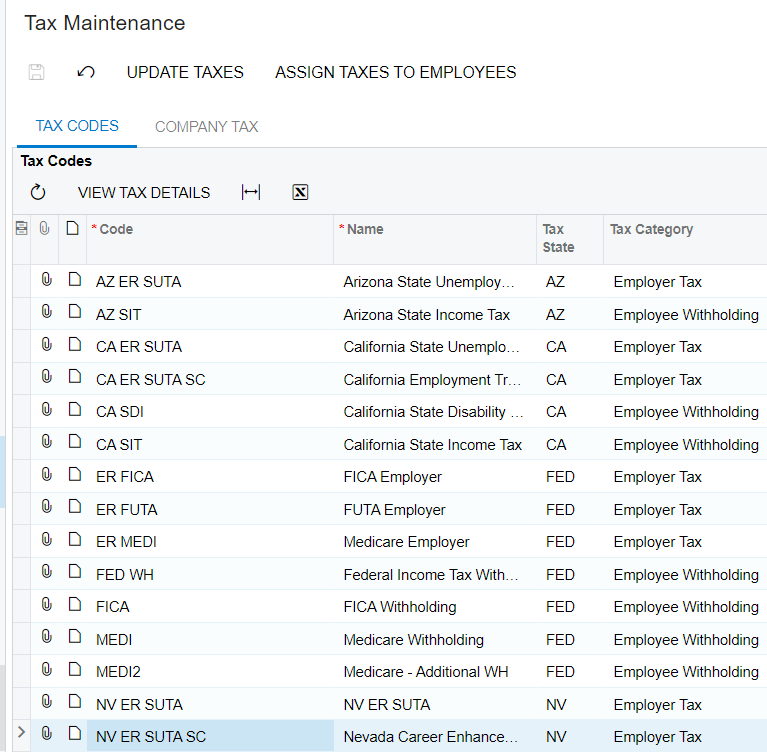

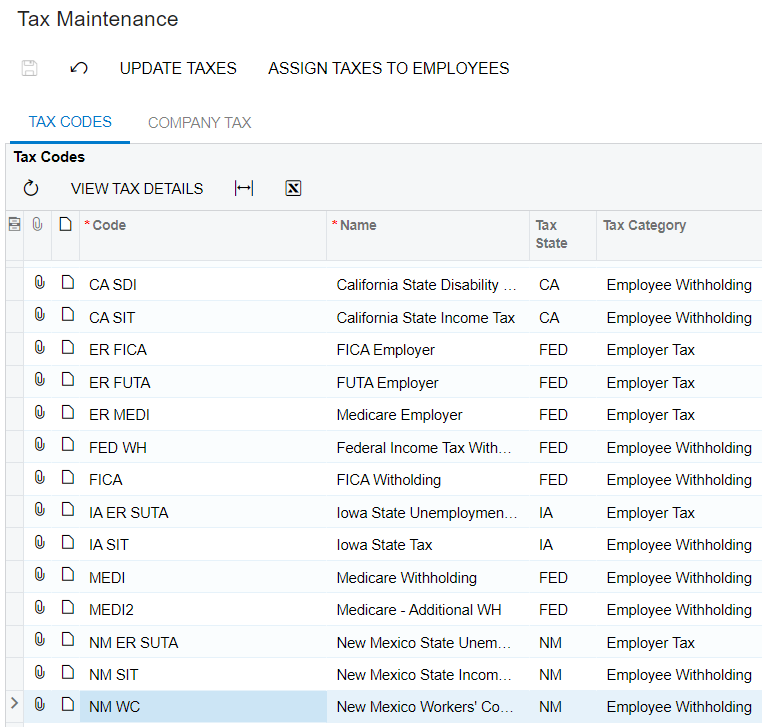

In one case I had the NV ER SUTA SC show up. We caught it on the payroll liabilities bills run. In another case I have New Mexico Workers Comp showing up as a tax on a few employees paychecks as well. We upgraded to 2021R2 21.213.0038.

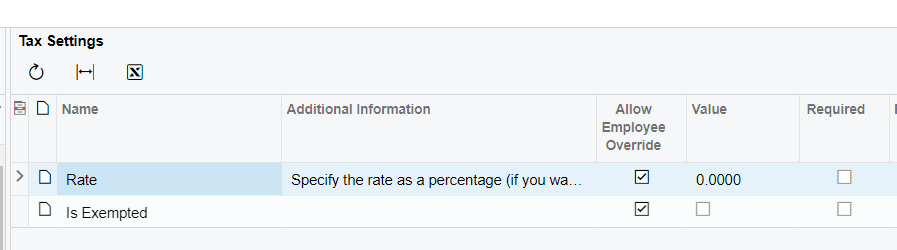

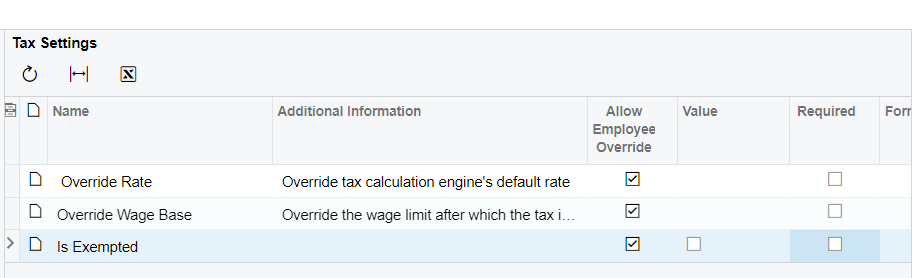

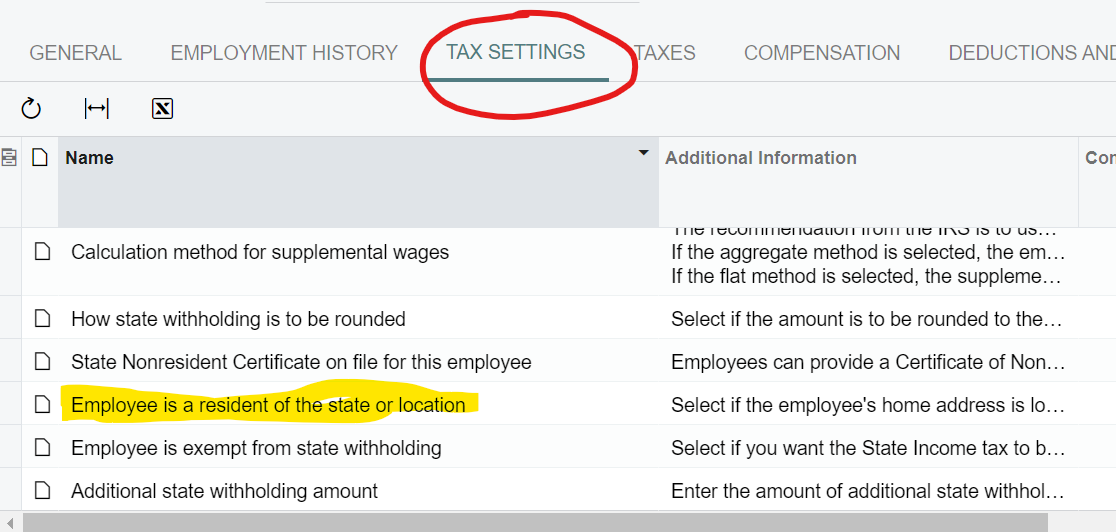

What is the fool-proof way to make sure they do not appear on the paychecks next time? Is it to de-select all the “required” checkboxes and set the rates to 0.00 on the right panel? Then update/assign taxes to employees?

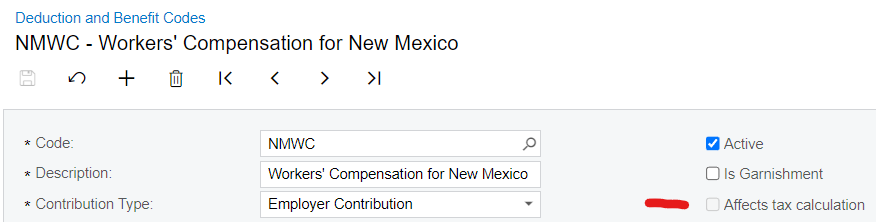

Why would New Mexico Workers Comp show up as a tax? Is there a setting in Deduction Codes or Workers Comp Codes?