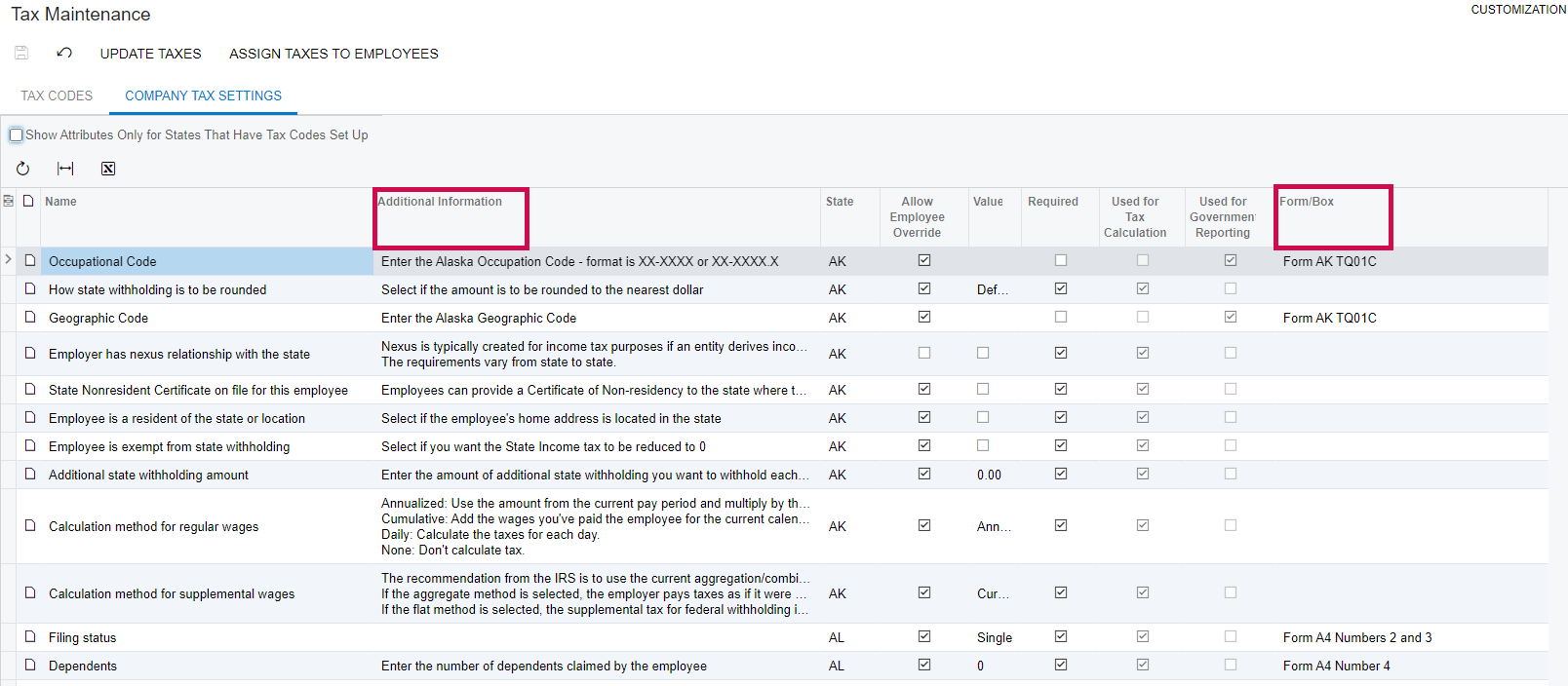

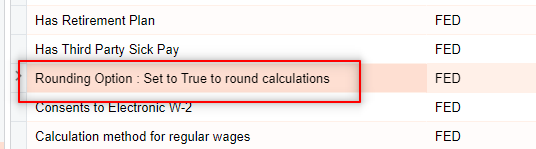

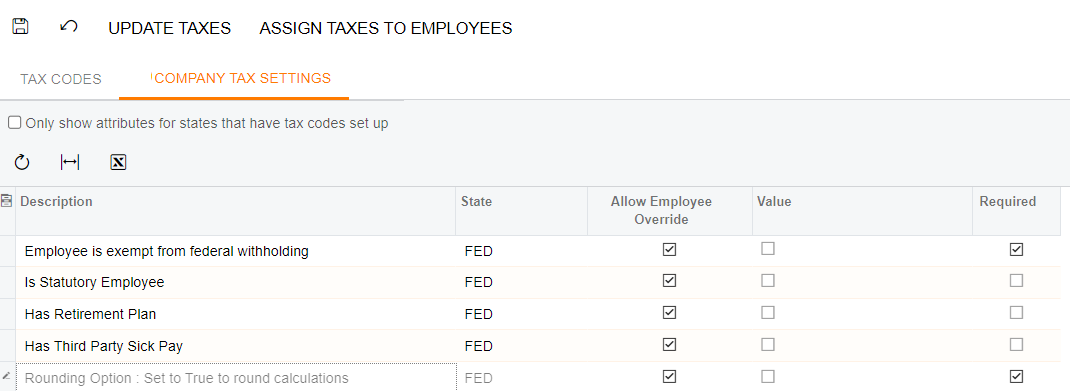

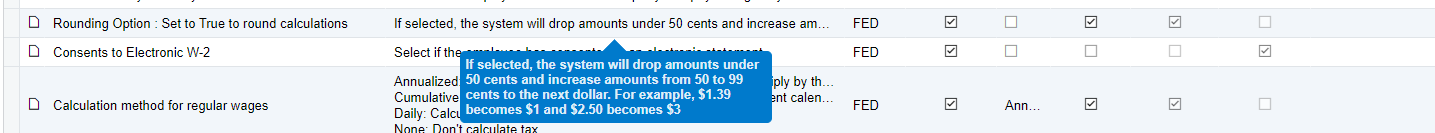

Is there any documentation explaining what all of the options are on the payroll company tax settings? I’m specifically looking for an explanation of what the “Rounding Option: Set to True to round calculations” for the FED payroll tax.

Solved

Payroll Tax Maintenance options documentation

Best answer by Denise Johnson

Does this help?

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.