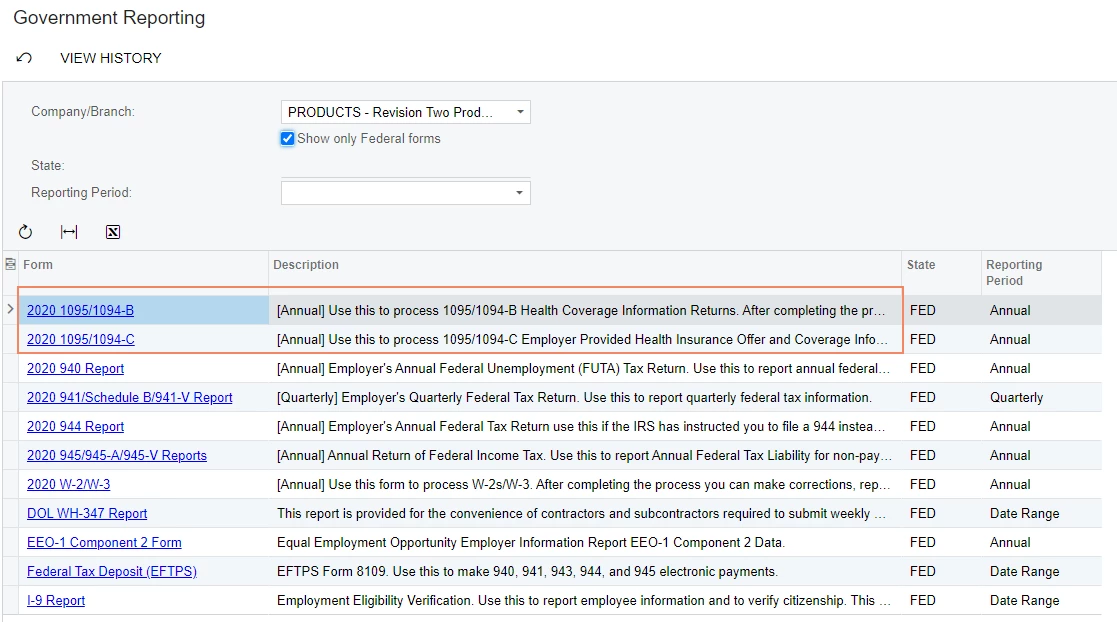

Reports 1095/1094 B and C are now available in the Government Reporting menu.

You may need to Update Taxes in the Tax Maintenance screen.

These are ONLY due for those who were live in 2020 or added a complete year of data to complete filings for 2020.

If you are filing with Aatrix - Review the ACA Package (if you filed W-2s-the package is priced lower). If you need more information on pricing-please contact Aatrix.

Reports are currently due by:

- 1095 Employee Copy Date: Feb 25th 3:00 PM CST

- 1095C & 1095B (ACA) Federal Date: Mar 29th 3:00 PM CST

Be sure to review Known Issues article or contact your Partner for assistance:

for more information on set up and the customization package to use depending on version of software.