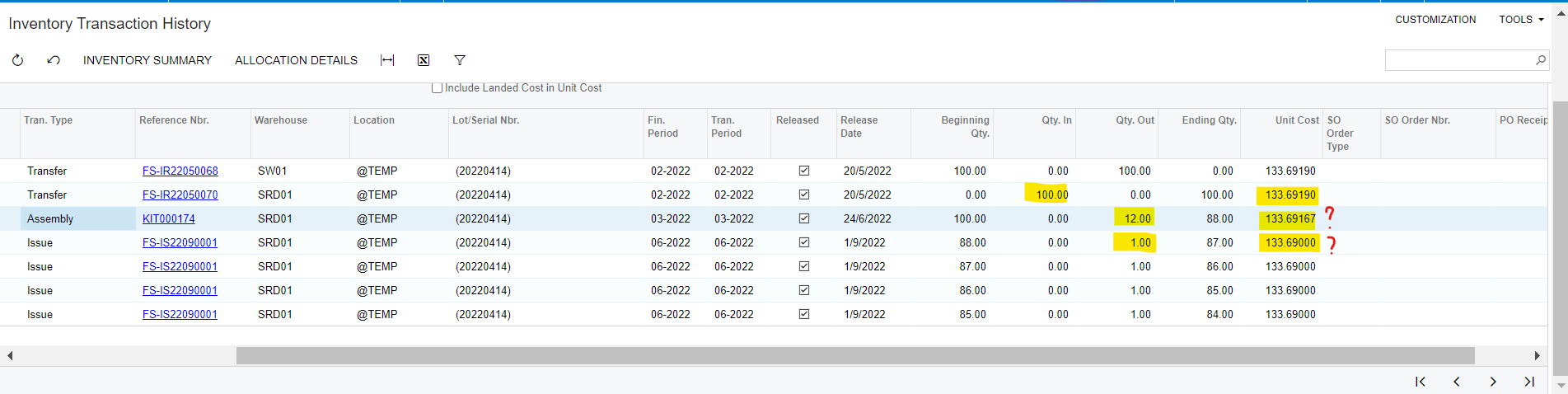

Hi, upon checking the inventory transaction history, I have 100qty in with unit cost 133.69190. However, the next 12qty out becomes 133.69167. And the subsequent issue out unit cost becomes 133.69000. I thought if based on FIFO, the issue out cost should also be 133.69190, but value turns out to be different in the screenshot. Anyone can advise how the system calculates the 133.69167 and 133.69000 if my inventory valuation method is FIFO? Thanks alot!