Dear All,

The Withholding Tax transaction update the financial year at the time of applied Bill and Payment. Is it the setting which we can adjust somewhere?

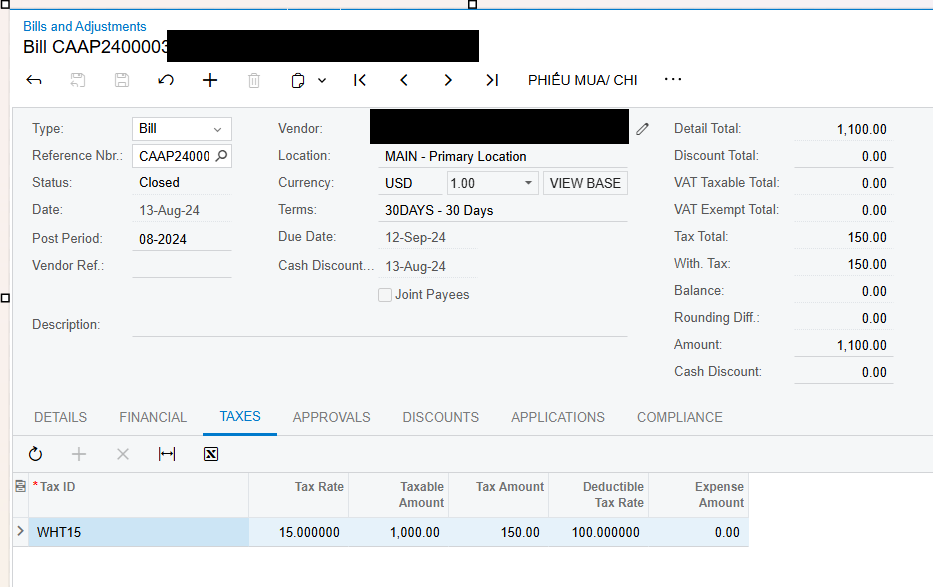

I have a Bill applied Withholding Tax as image. At the time this Bill was released, Withholding Tax doesnt update the financial period yet

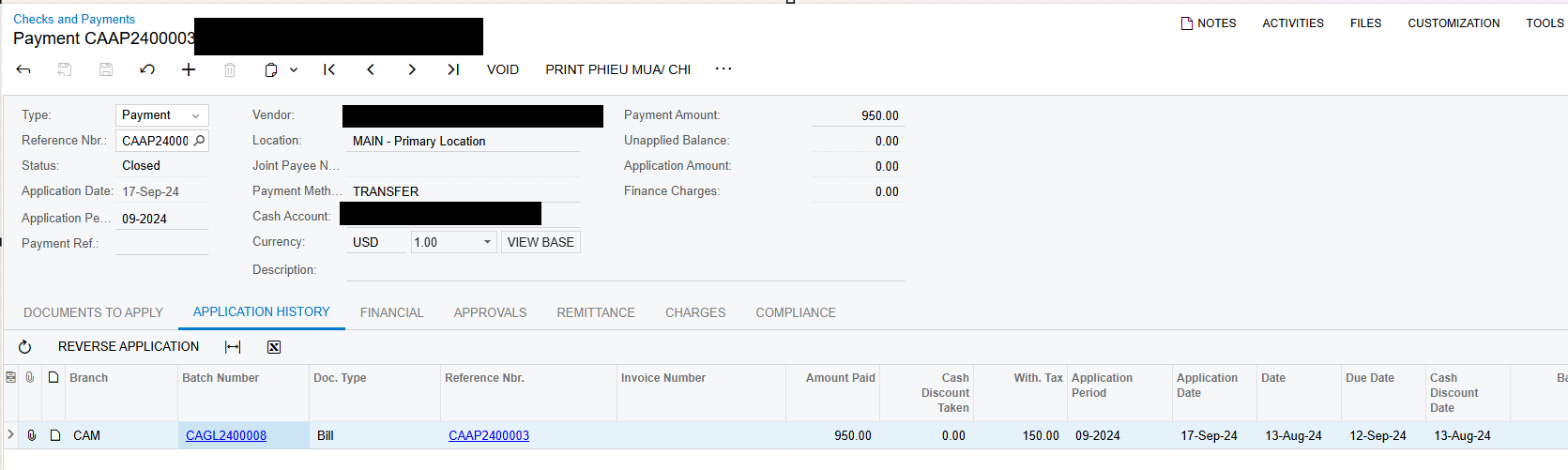

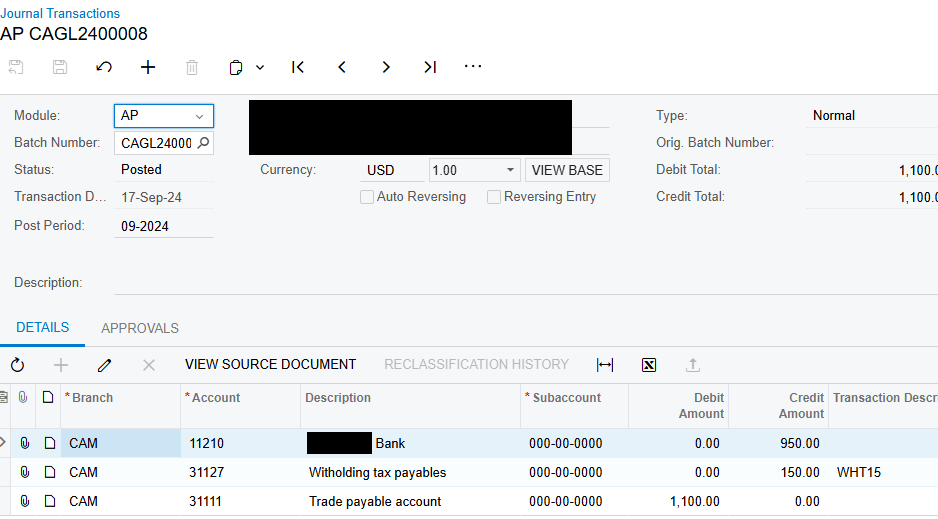

The transaction of Withholding was created at the time of applied to payment.

Due to the law, the Withholding Tax transaction should be record to financial period at the time of the bill, instead of the applied period.

Is it the setting which we can adjust somewhere?

Thanks in advance,

Yên Chi