Hello,

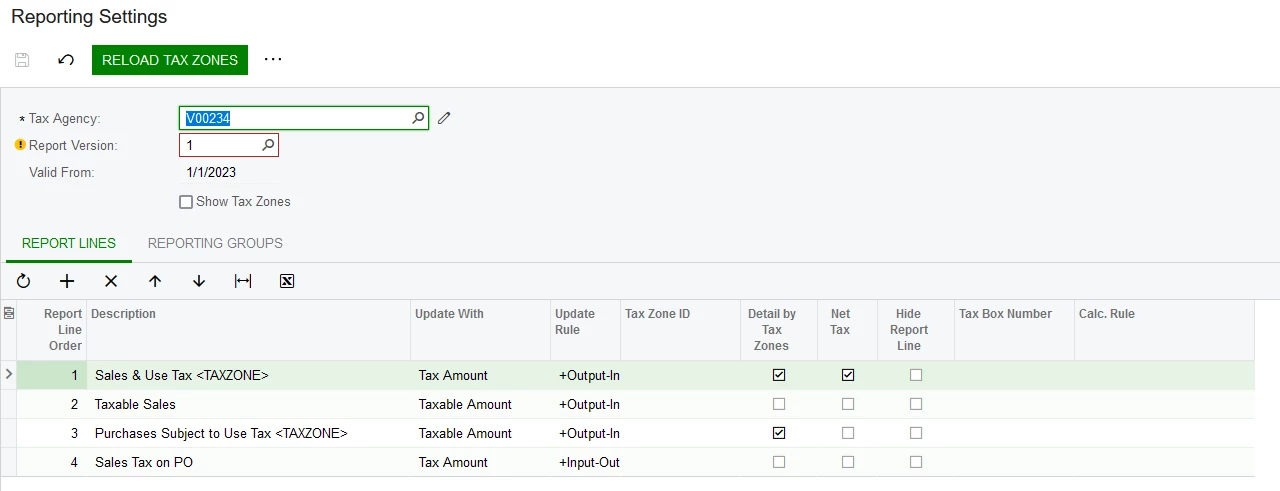

I am working on my first sales tax report and i can’t get the report the way I need it. We are on 2022R2 with fast track implementation.

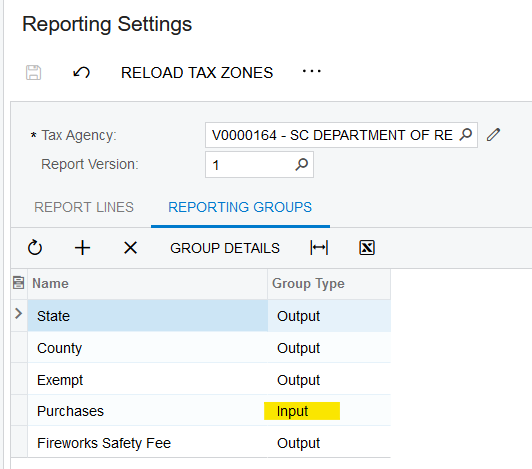

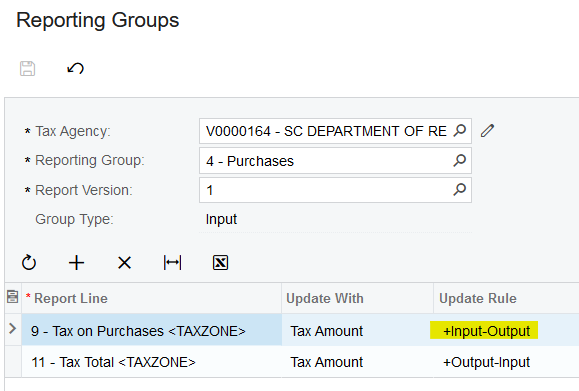

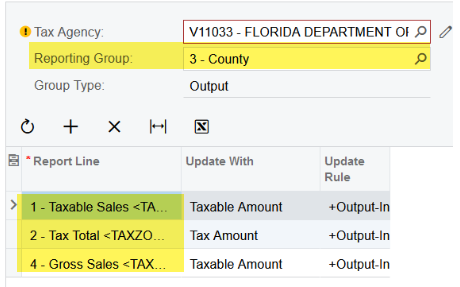

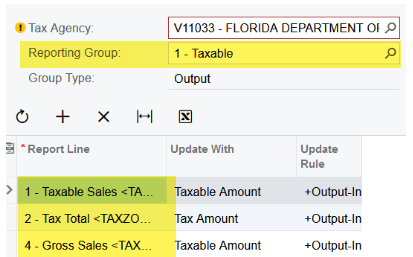

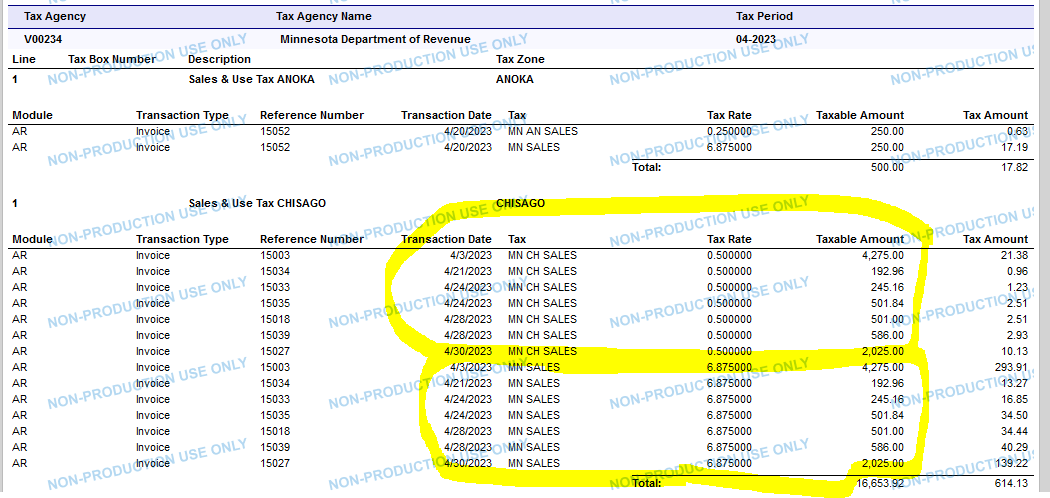

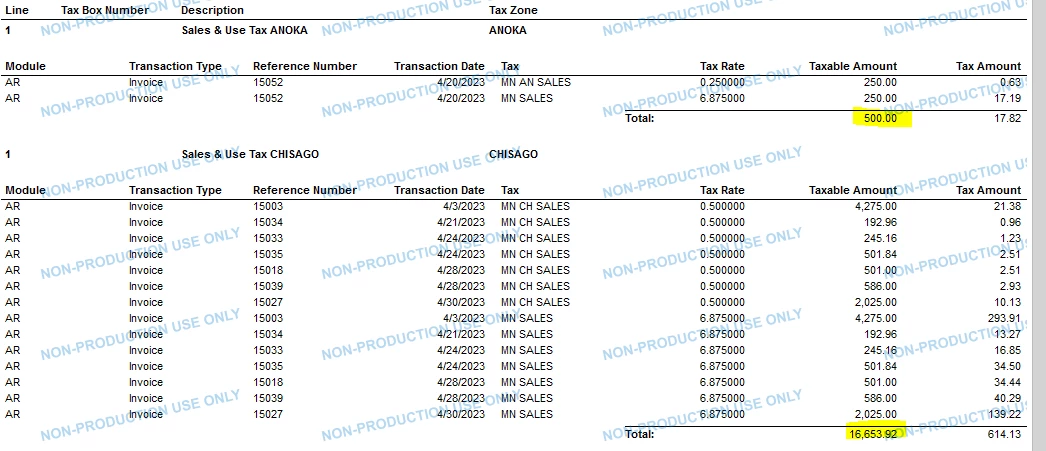

We are setup to have zones that pay multiple rates. Base MN 6.875 plus county of .25%. On the report the tax amount due is correct, but the taxable amount is doubled up and broke into multiple groups.. I need to report the taxable amount for each group. 8k to state @6.87% and 8k@.25% to the counties. and the state website calculates the tax amount due (which it should match)

I have tried multiple settings and groups, but can’t get the settings quite right.

Thanks,

Jeremy