Hi guys,

Consider this case below.

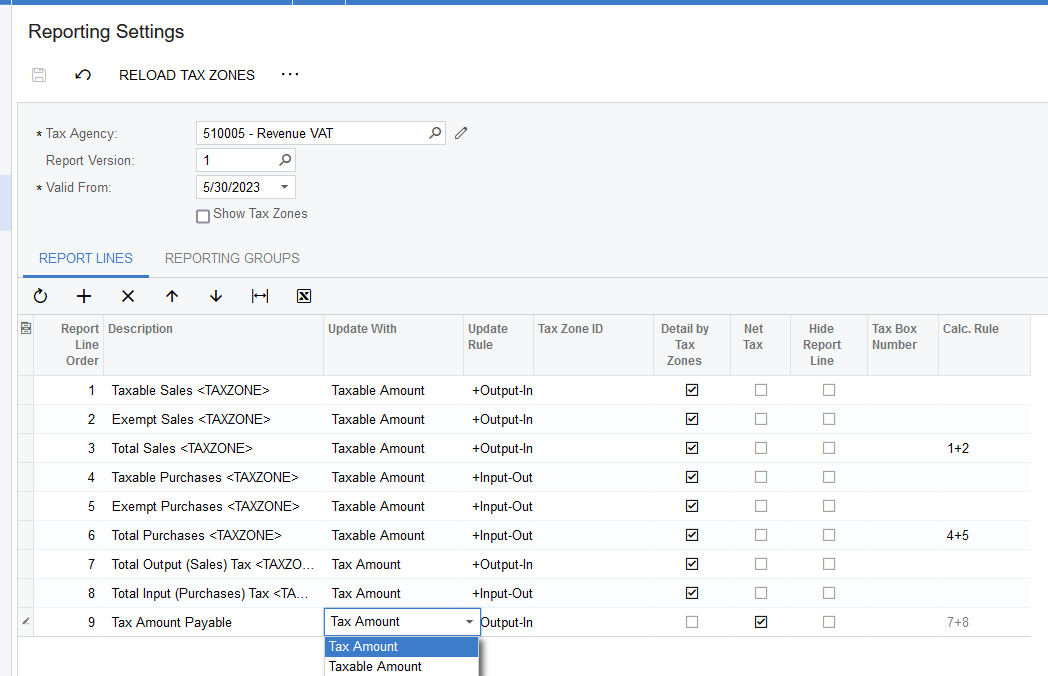

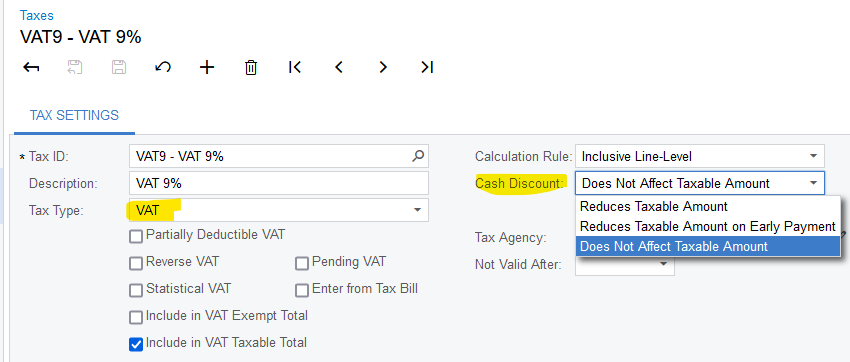

If the credit terms for customers is “3% discount in 10 days, net in 30 days”, and we made a sale to a customer of $100, with a VAT rate of 10%. The customer paid within 10 days, and I’m trying to generate a tax report looks like this:

Total sales: $100

Cash discount: $3 (-$3 is also ok)

Total taxable amount: $97

Total tax amount: $9.7

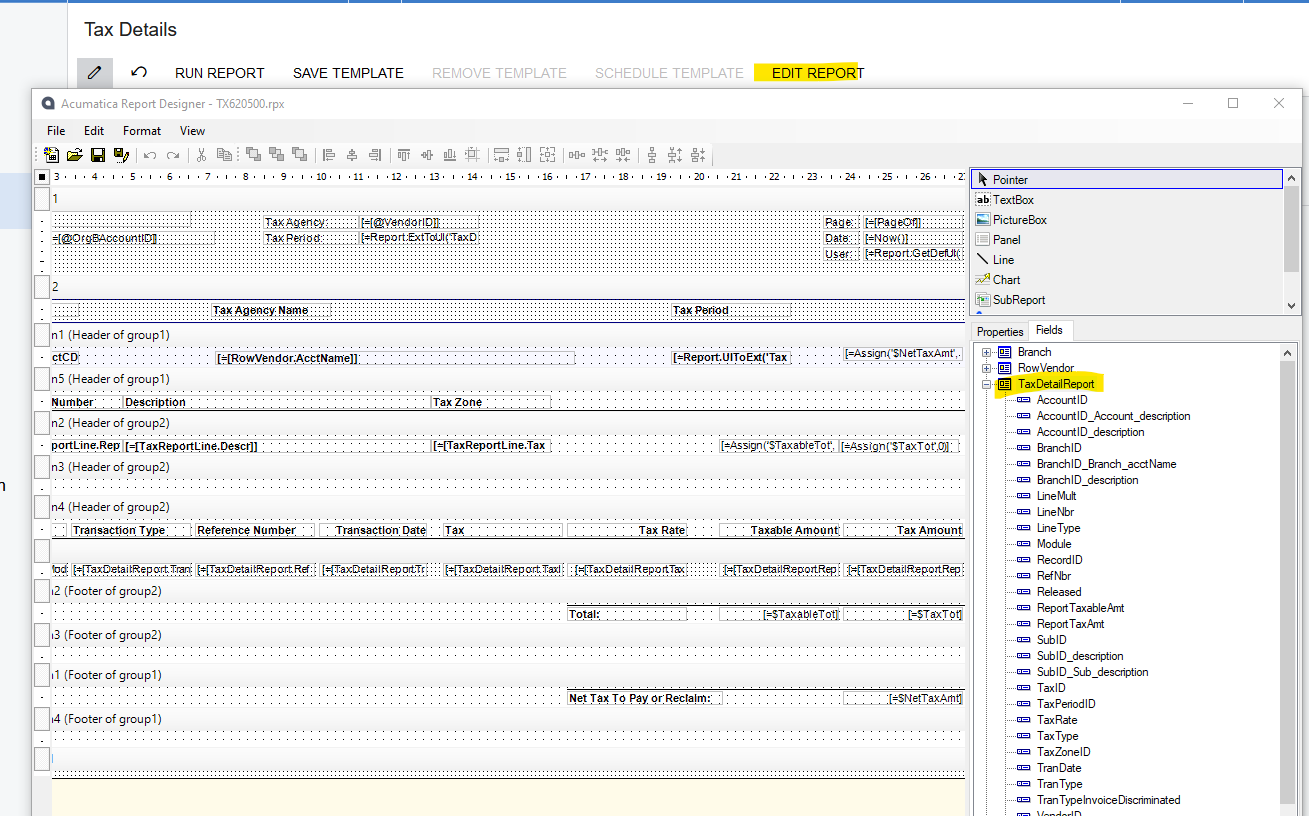

But according to what I have tested on Acumatica, it seems like the above couldn’t be achieved. I tried to use the cash discount feature, and the outcome looks like this:

Total sales: $100

Total taxable amount: $100

Total tax amount: $10

The total tax amount here isn’t even correct (should be $9.7).

I also thought of recording the cash discount in a separate line in the invoice, but we wouldn’t know whether the customer takes the cash discount or not while recording the invoice. And once the invoice is released, I assume there’s no other way to add a line for cash discount.

So any better ideas on this case? Thanks in advance.