Hi Sir

Due to vendor profile- tax zone was not set correctly so the AP reflected the tax 26 as below.

Not sure what is the correct way to offset or write off this tax amount 26 from the AP bill?

Hope to hear from you soon.

Thank you

Hi Sir

Due to vendor profile- tax zone was not set correctly so the AP reflected the tax 26 as below.

Not sure what is the correct way to offset or write off this tax amount 26 from the AP bill?

Hope to hear from you soon.

Thank you

Best answer by vkumar

Hi

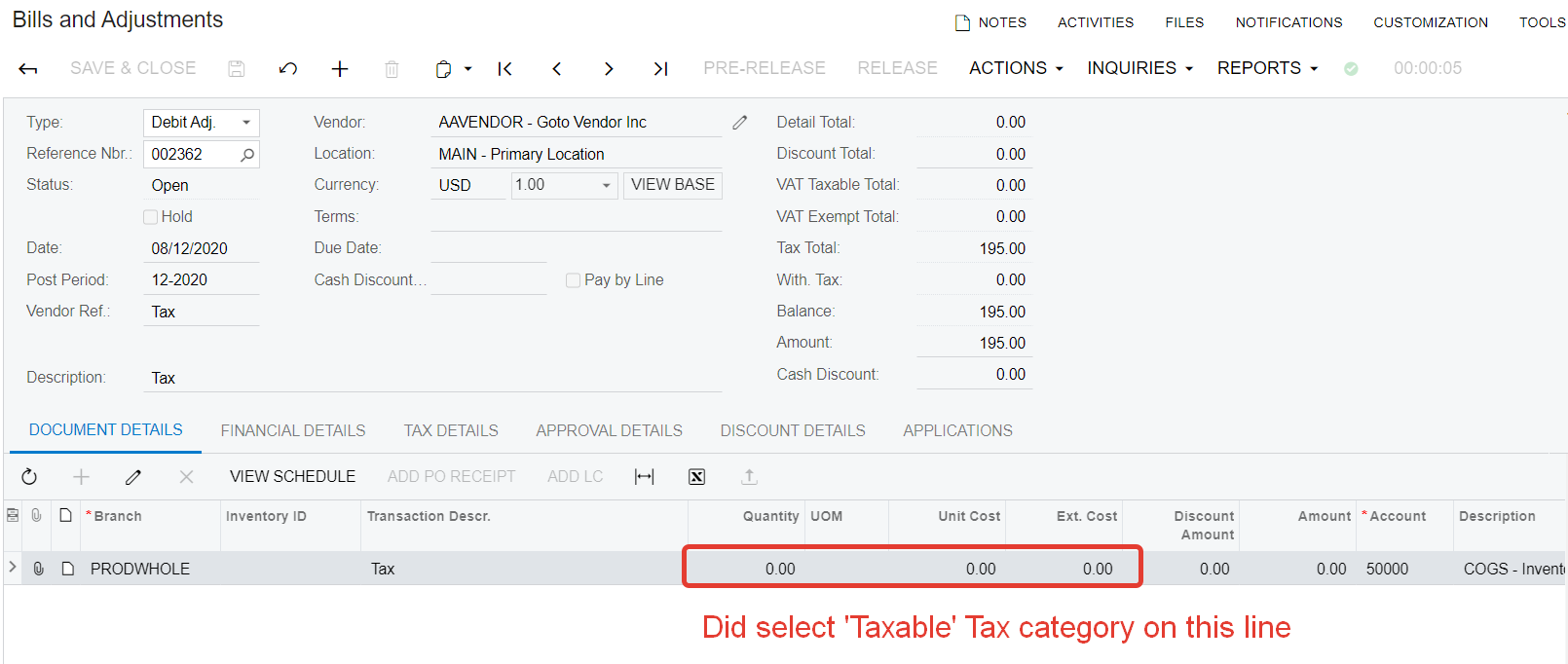

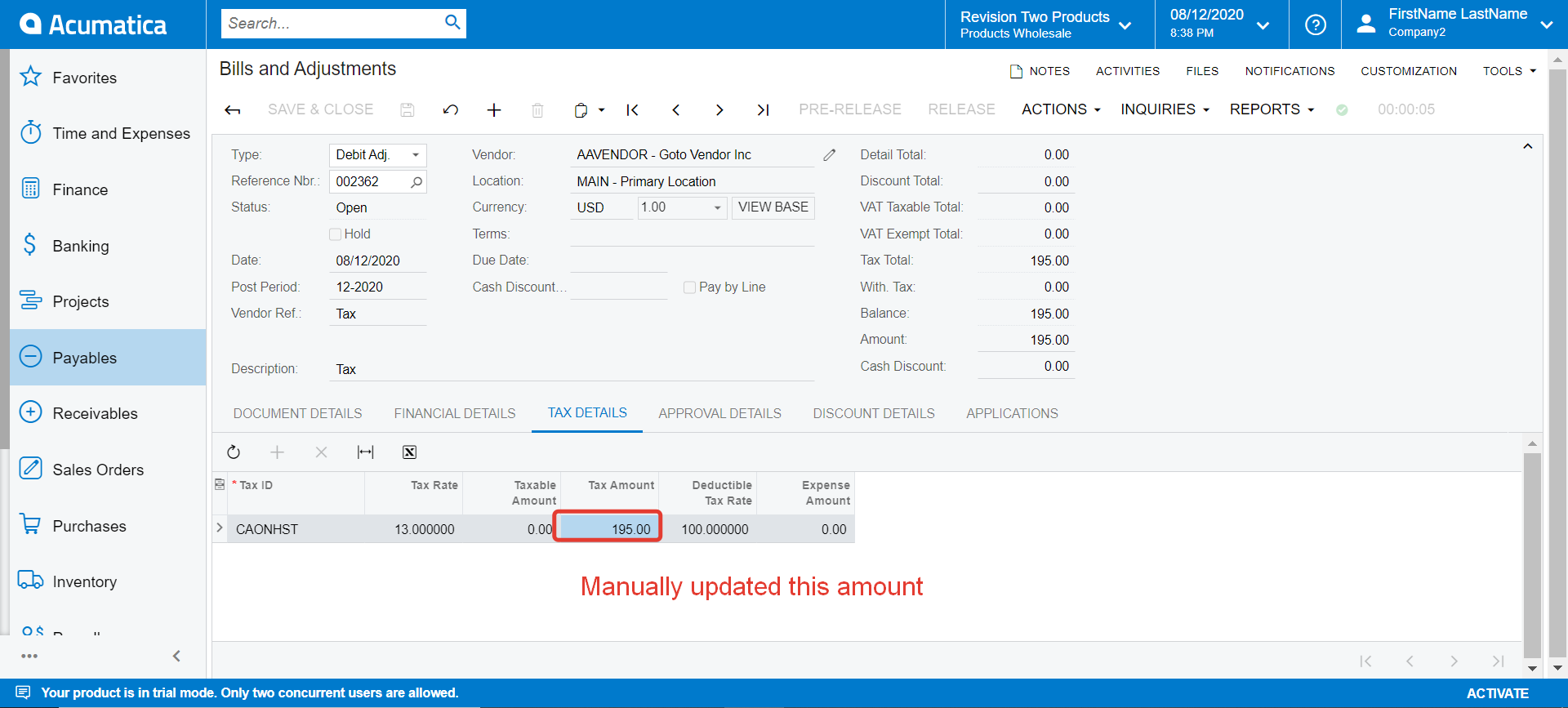

I could not see any attachment. I guess you wanted to reverse the tax component on an AP Bill. Here is the option you can explore, you can create a debit adjustment to reverse only Tax component. Here are the steps:

Refer to the screenshots below:

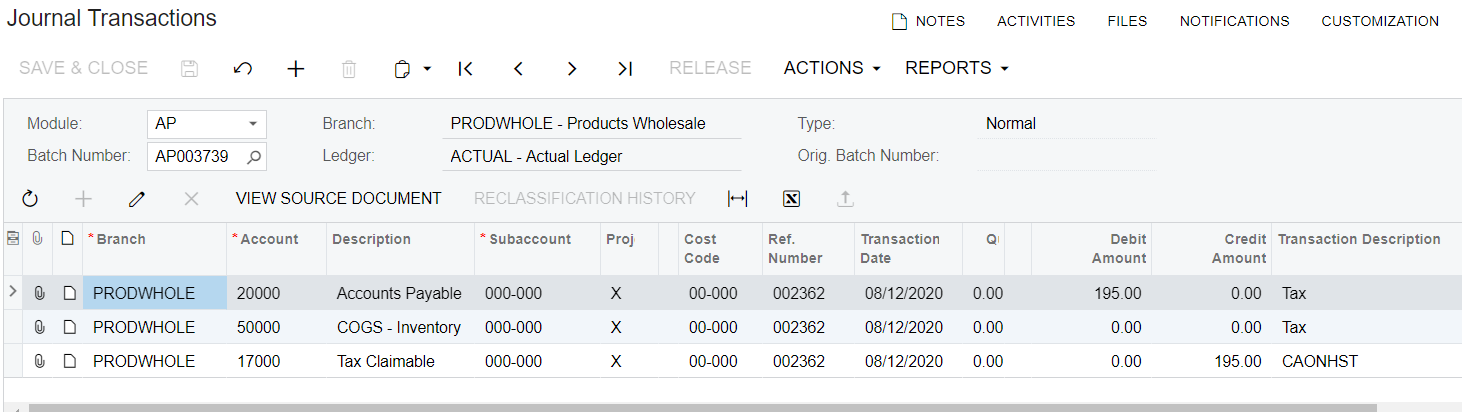

GL Transactions generated on release of debit adjustment

Hope this helps,

Regards,

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.