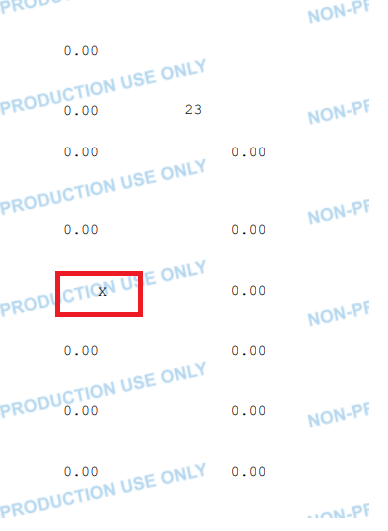

Acumatica has as a 1099 Box selection - MISC 07/NEC 02 - Direct Sales. Is there any documentation on this or does someone know how / where this box should be used ? I have found that using this Box on AP bills does not print on either 1099 form. Is this a big?

IRS says… You may either file Form 1099-MISC (box 7) or Form 1099-NEC (box 2) to report sales totaling $5,000 or more of consumer products to a person on a buy-sell, a deposit-commission, or other commission basis for resale.