This question is a bit different from a prior question regarding how to reverse an inventory receipt. In our case, we did an Issue out of inventory that reduced our Inventory account and went to our inventory shrinkage account. We have to make some changes to the sku accounting methods, so we transferred it all out in order to make the change, then will move it all back in.

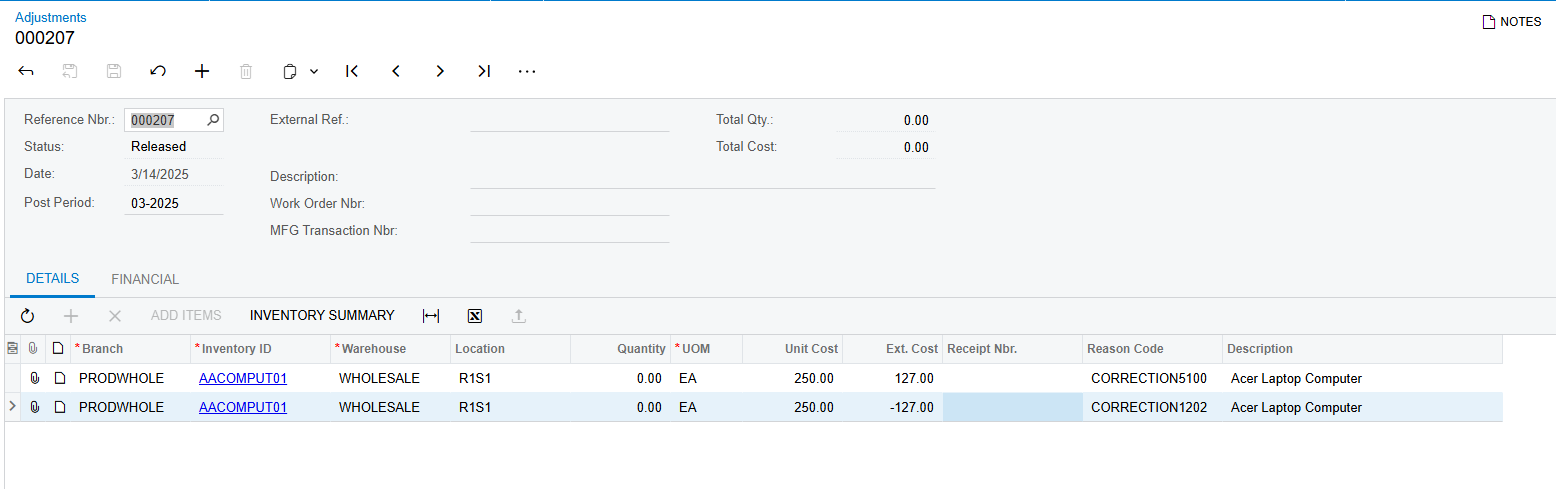

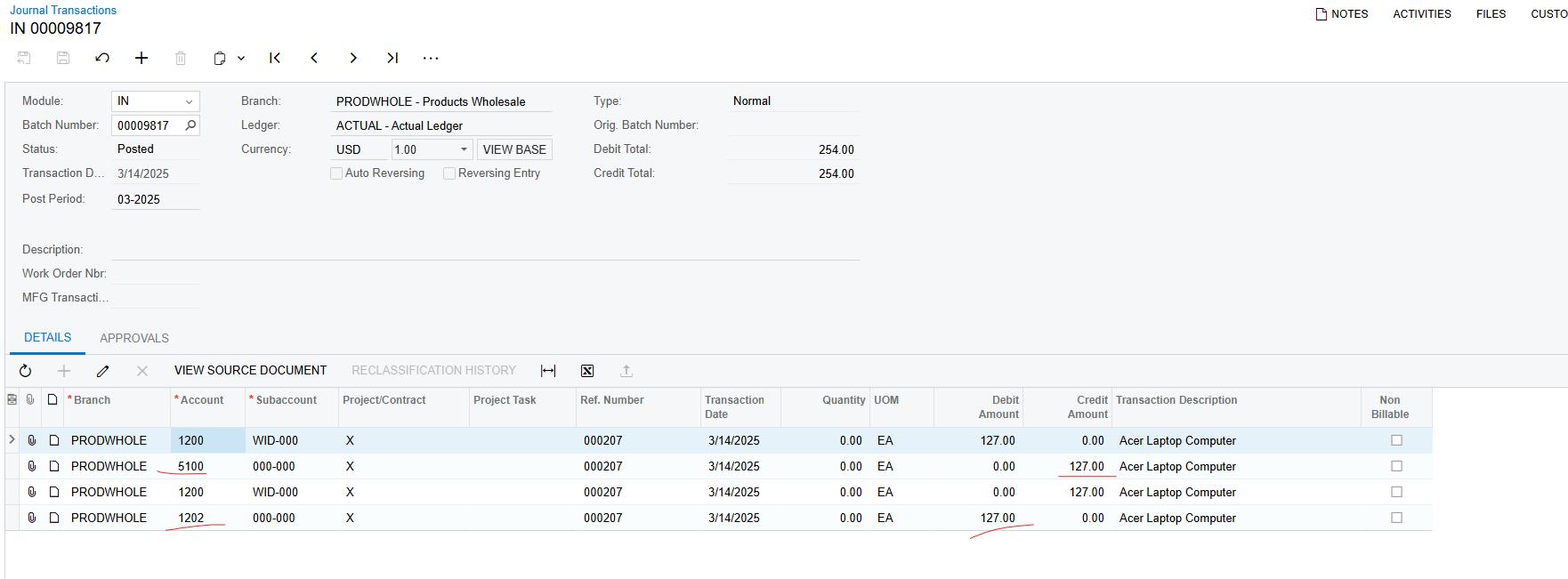

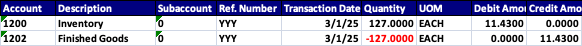

After we issued it out, however, we received in via the Receipts transaction rather than do a corresponding inventory adjustment in. It correctly increased the inventory, but the other side of the transaction hit their finished goods control account rather than shrinkage. Now we have an imbalance and we can’t determine how to reverse the purchase receipt so we can adjust the inventory in properly and make it all balance.

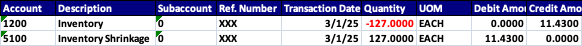

The Issue out:

The Receipt:

Since accounts 1200 and 1202 are control accounts in our case, we can’t just reverse the batch for the receipt.

Does anyone know how we can do a reversal of the Receipt such that it simply reverses the above receipt transaction and then we can do a proper Adjustment in which will offset the Initial issue out?

Thank you

Patrick