Hello,

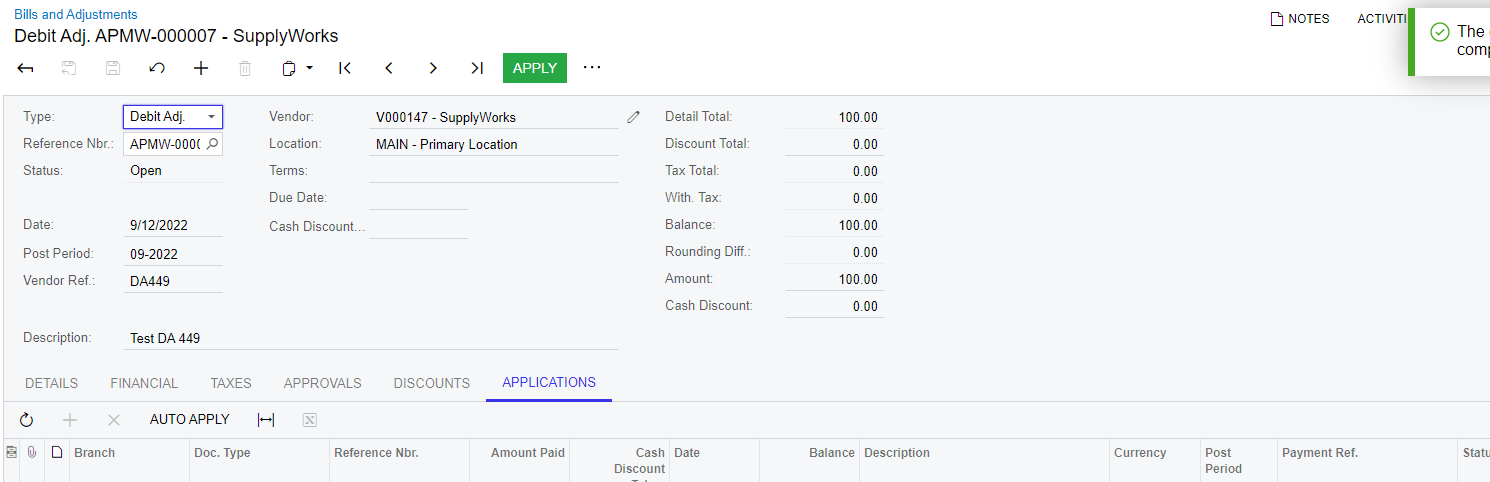

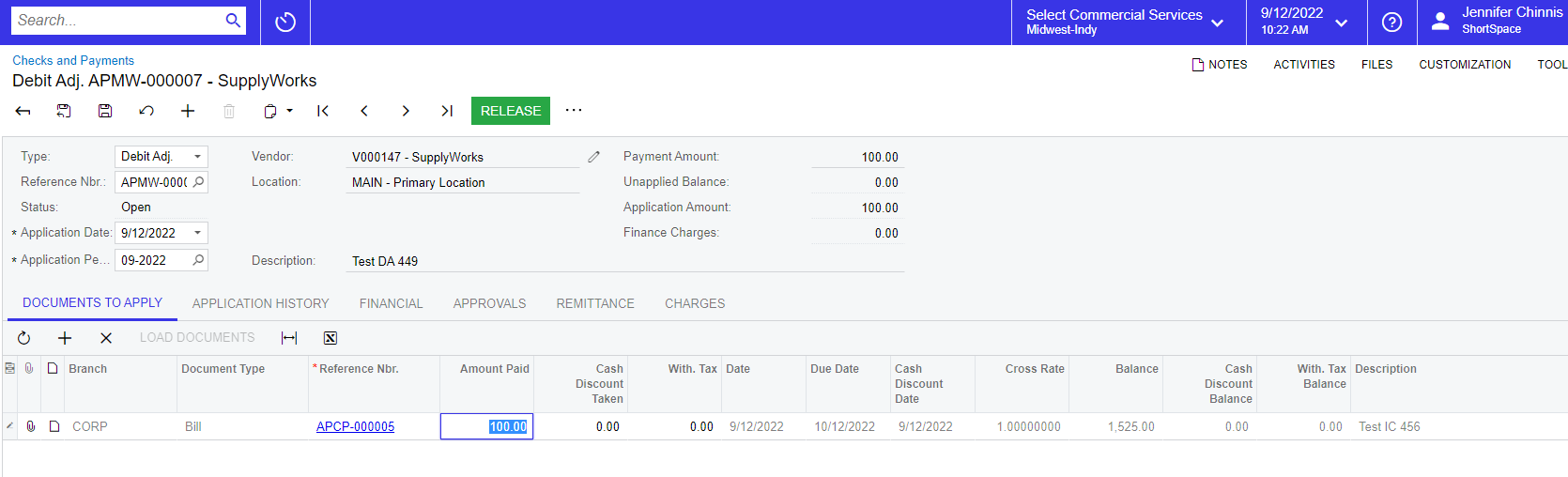

Seems like a simple question, but I’m at a loss on this one. So AP debit adjustments can easily be applied to AP bills….

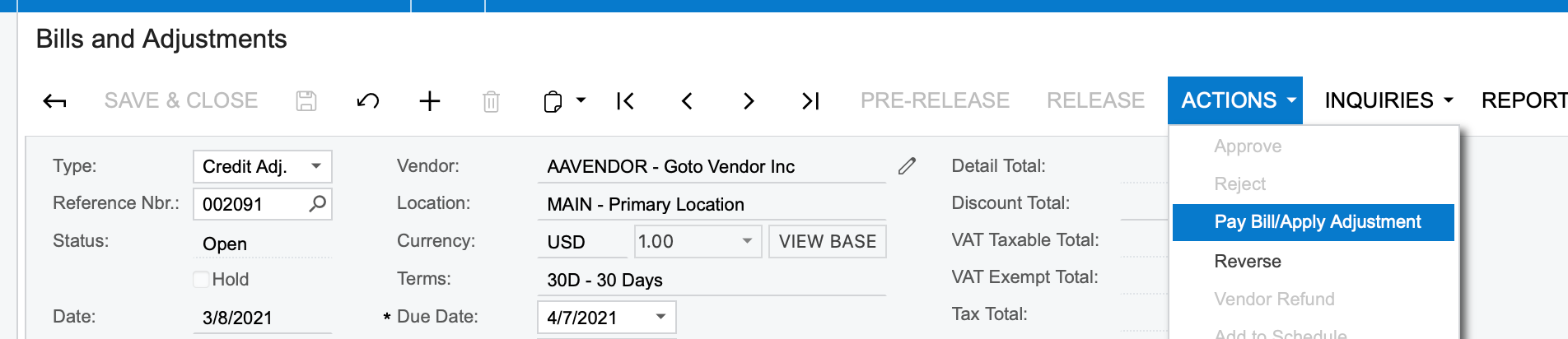

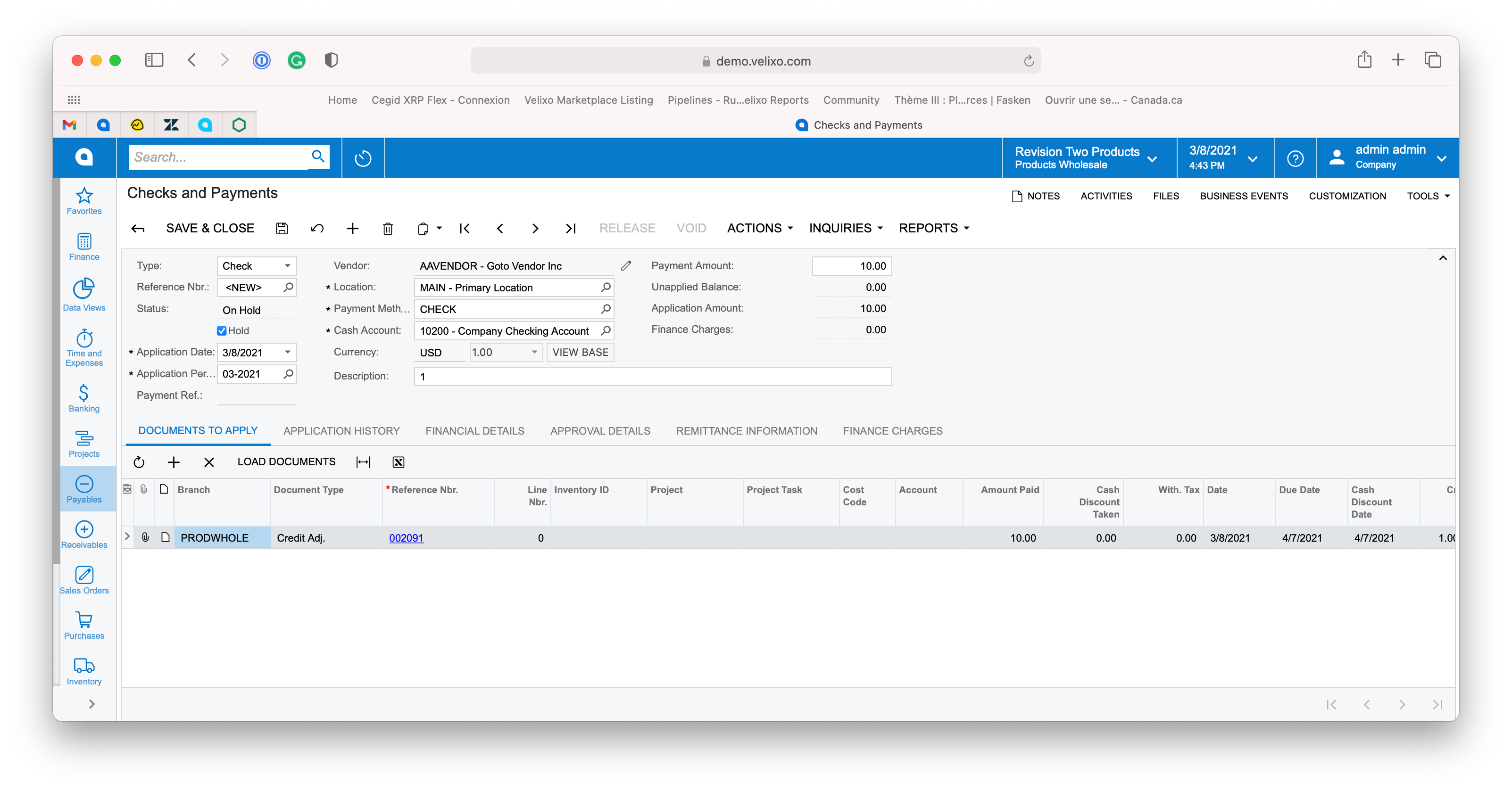

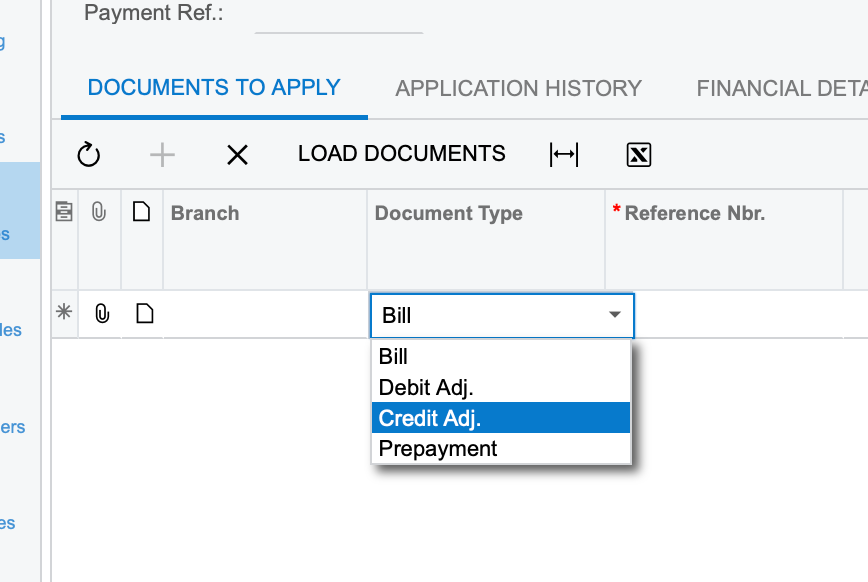

However I can not find a way to have a simple vendor credit adjustment applied to an invoice. There appears to be no similar process there credit adjustments can be applied to AP Bills. Can anyone assist?

Thanks,

Bob