Hello,

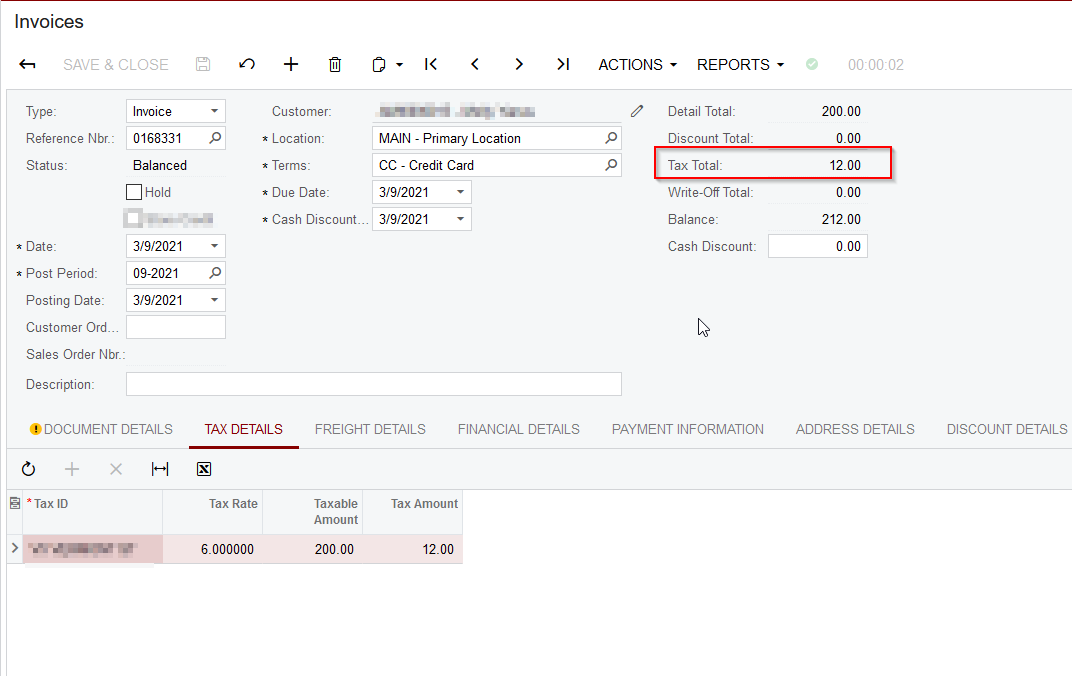

I am writing a report to customers and would like to show the AR line amt and line taxamt.

however,

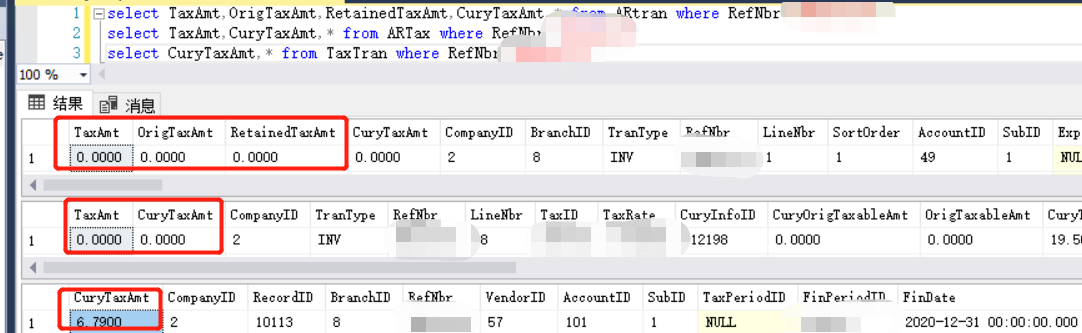

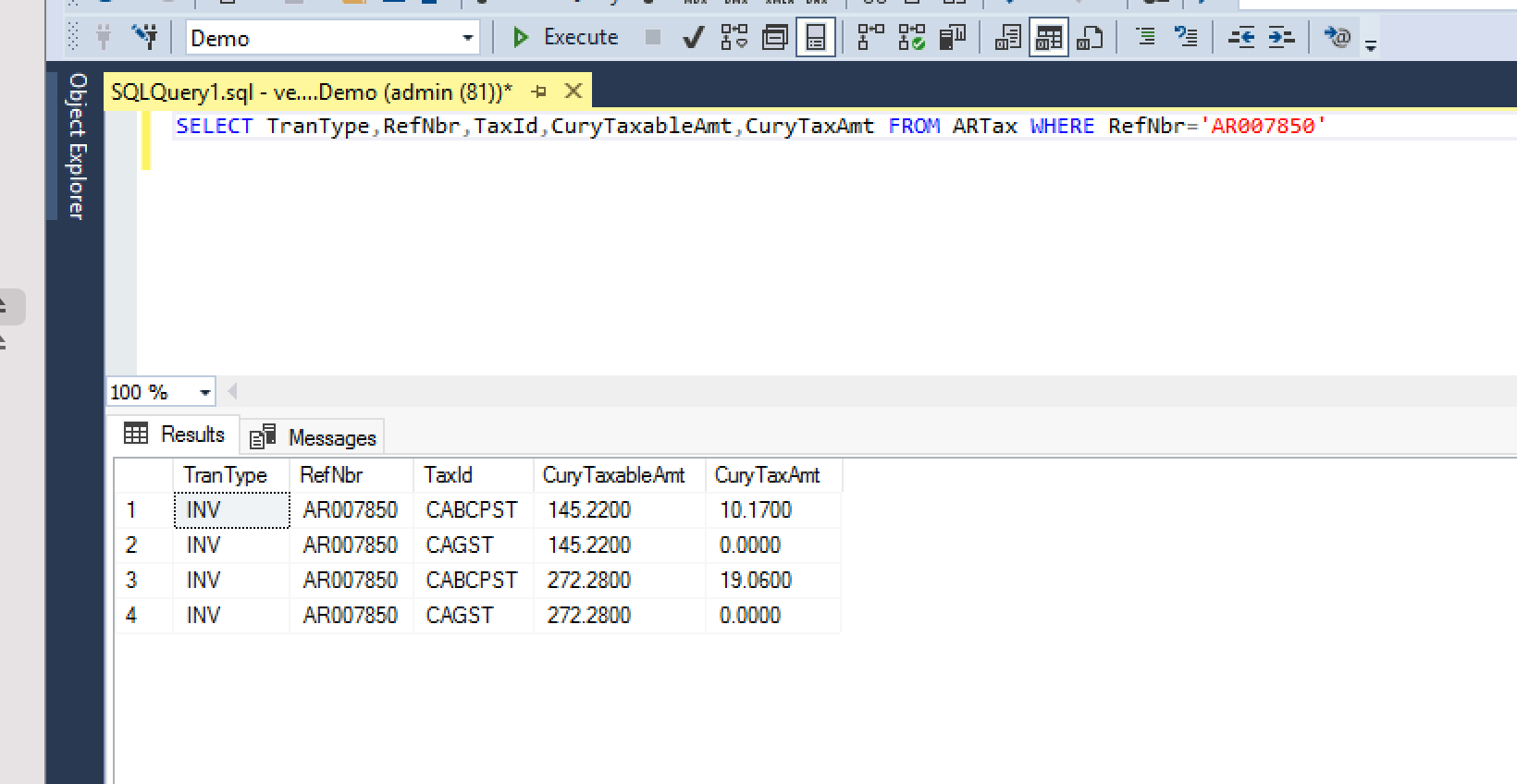

The ARTran.TaxAmt is empty, and also the ARTax.TaxAmt is empty.

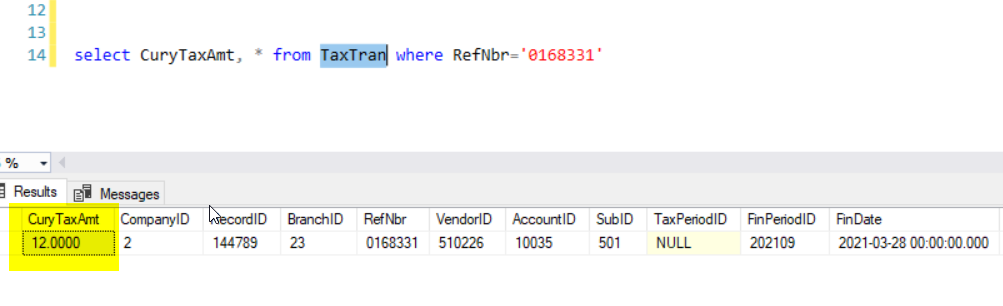

We do have TaxAmt on TaxTran, but is is not single line, it is the whole AR document.

Can somebody tell me where I can get the line TaxAmt directly?

Or I have to calculate it by myself?