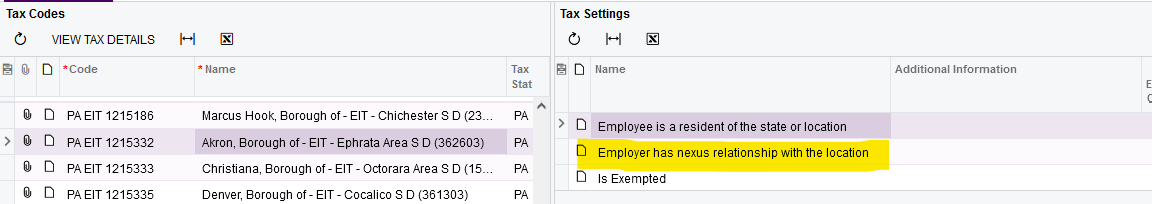

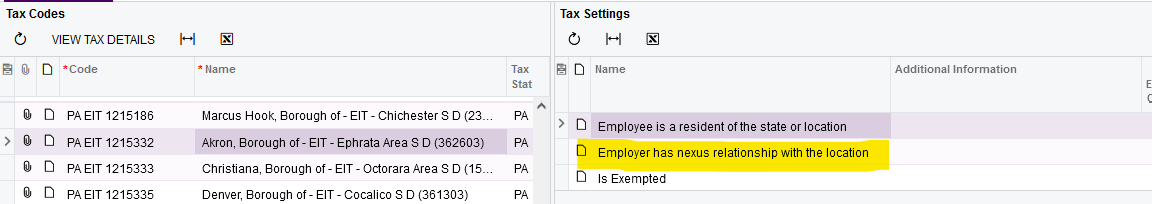

In the Pennsylvania local tax settings, what is the explanation for the use of the “Employer has nexus relationship with the location” setting? There is no additional information in the tax settings column to define this.

In the Pennsylvania local tax settings, what is the explanation for the use of the “Employer has nexus relationship with the location” setting? There is no additional information in the tax settings column to define this.

Best answer by mpeck12

I believe that this comes from the way PA determines whether nexus exists for Local Earned Income Tax liability.

If you live in a locality with no Local EIT BUT work in another locality that does, you are liable for W/H due to the Employer’s nexus.

If you live in a locality with a Local EIT AND work in another locality that also does, you are liable for w/h due to the Employee’s nexus.

Finally, the typical EIT Rate in PA (other than the biggest cities) was 1%, so if you live in a locality with a .5% rate, and work in a different locality you are liable for .5% rate at most, even if the local rate there is 1%. You only pay up to a combined 1%. This is based on Employee’s Nexus first, then Employer’s Nexus for the amount up to the maximum.

This is based on my experience, which is almost a decade out of date. The percentages may be different currently, but I would guess the operation is the same.

There may be some exceptions, such as Philadelphia, where I believe you pay the full 3.93% no matter where you are resident.

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.