We start with 60x288 raw sheets of metal and cut them down to 60x248 (just as one example) in high volumes. The 60x248 makes the primary part #, the 60x40 is a usable drop/remnant. I would like to inventory these 60x40 “drops” (by-product) and give them value, because we’ll use them later for plasma cutting small parts.

When creating the BOM for the primary part #, I am consuming the entire 60 x 288 material, and then adding the by-product (60x40) as a negative quantity. This works great for inventory tracking purposes, because the by-product is added to inventory each time we do a Move on the primary part #.

My concern is costing. We use average costing, so do not revalue our inventory (as you would in a standard costing environment). The value of steel fluctuates widely, and therefore the theoretical cost of that 60x40 drop should change relative to the cost of the 60x288 raw sheet. However, in order to accomplish this, I have to manually do calculations for a 60x40 portion of a full sheet and update the cost on the stock item. I can manually calculate theoretical costs of these drops, say quarterly, but the problem is that I have to revalue my drops inventory every time I do that (because Acumatica looks to AVERAGE COST on the stock item the by-product receipt cost). Acumatica cannot take into account that for the last quarter I was adding drops into inventory at $100/ea, and now I want to add them into inventory at $150/ea over the next quarter… I actually have to revalue my entire existing inventory of the drop to be $150/ea, so that the average cost gets updated (which will then make sure drops going forward will be added into inventory at $150/ea).

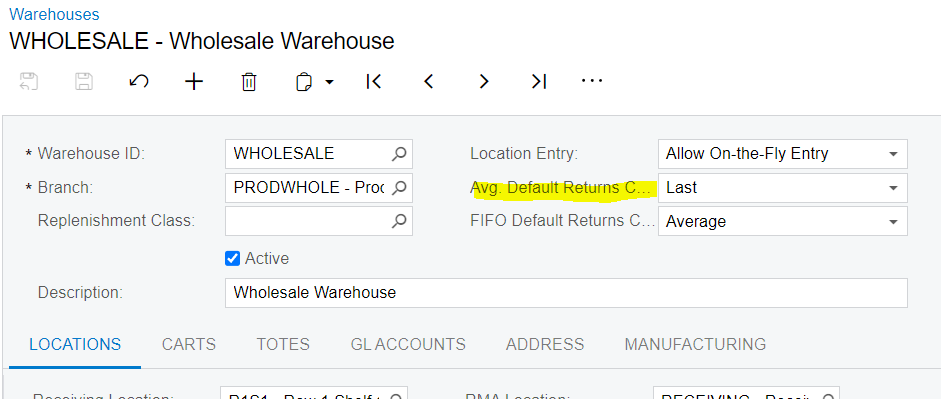

- Is there any way for Acumatica to look to LAST COST instead of AVERAGE cost when installing by-products into inventory? This would then behave exactly like purchase/production receipts under average costing because you would continually introduce receipt costs different from existing inventory, but the system would continually average your new on hand inventory. This is assuming I periodically evaluate what the “standard” cost should be of all of our by-product Stock Items.

- Even better, is there a way to specify somehow that a 60x40 by-product is 13.89% of the raw sheet, and will take 13.89% of the cost of the Materials transaction for the primary part # and put it into the by-product? This would eliminate the need to periodically calculate what the “standard” cost should be of all of our by-product Stock Items.