Gift Certificate/Gift Card:

It is a non taxable non stock item which is associated with a unique code every time the customer buys it. This is maintained at the eCommerce site.

User Flow

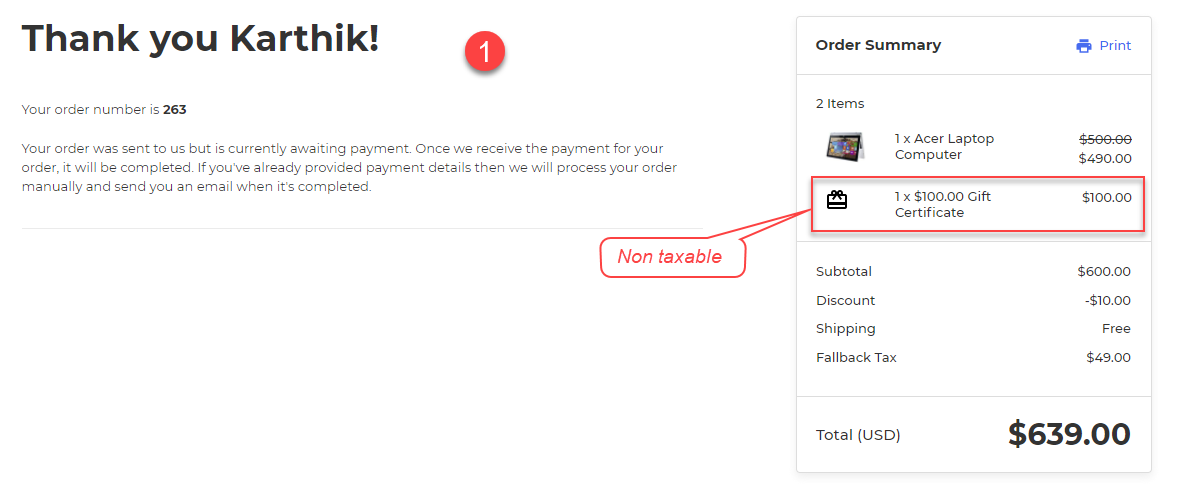

- Customer buys the Gift Certificates in eCommerce site for $100.00 and also a Acer Laptop.

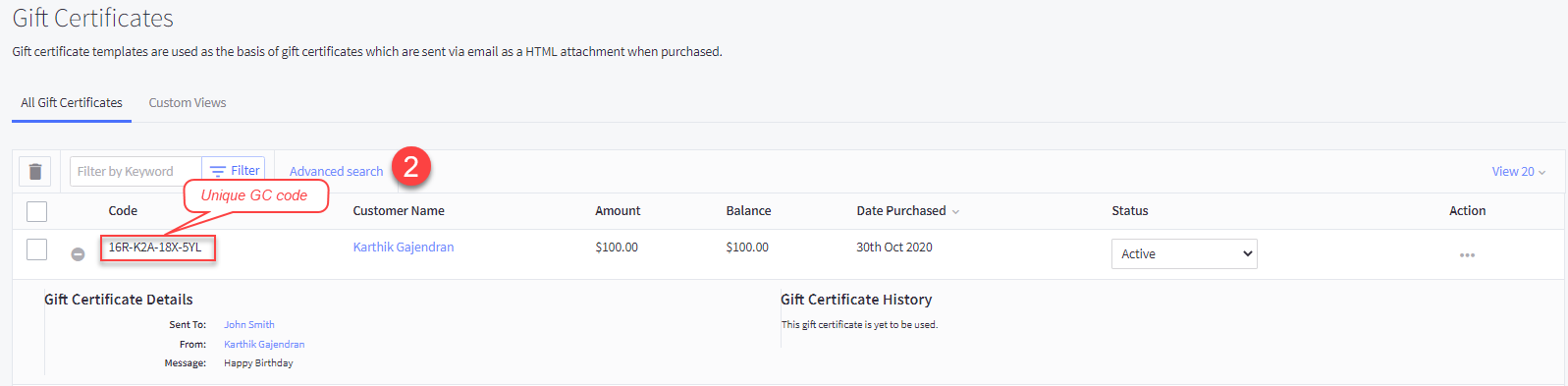

- eCommerce site assigns a unique code to each Gift Certificate. Eg: “16R-K2A-18X-5YL”

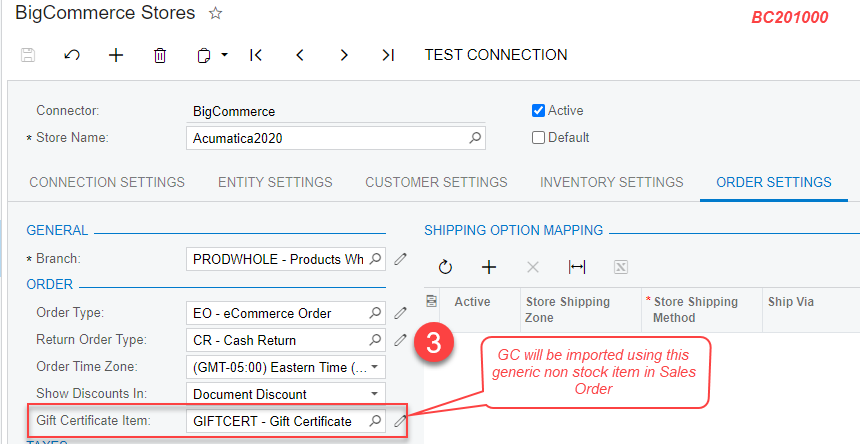

- Gift Certificates/Gift Cards are imported using a Generic Non Stock Item that is provided in the Commerce Connector Store Settings form under the Order Settings tab.

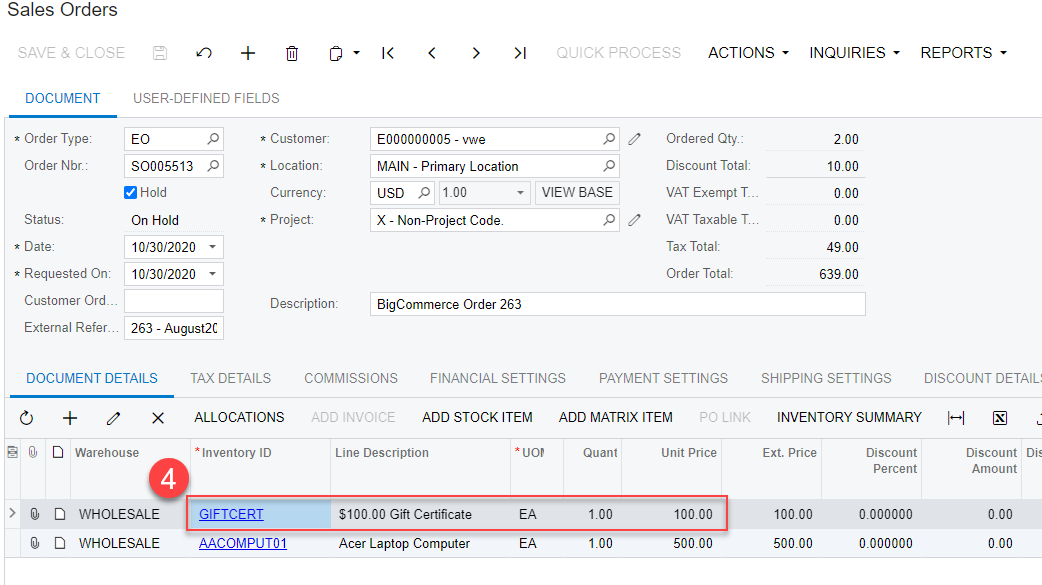

- Sales Order with the Gift Certificate as a item.

Please see the below screenshots. Numbered referencing the above points.

Gift Certificate/ Gift Card Payment:

Once a Gift Certificate is bought by a customer, then the customer can use it to buy products on the eCommerce site as it is created like a Credit Card. The eCommerce site will validate the Gift Certificate unique code when the order is paid using the Gift Certificate.

User Flow

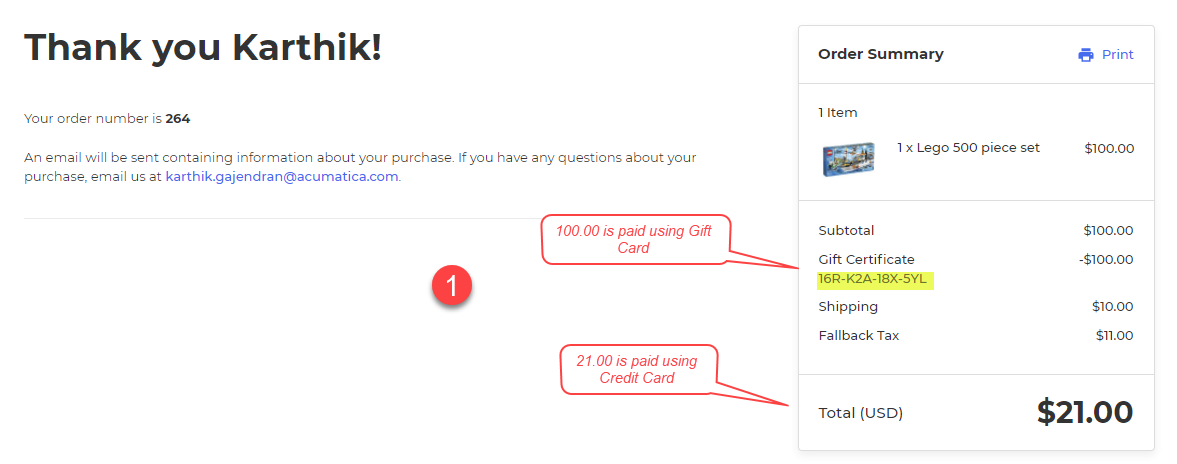

- Customer places the order using the Gift Certificate “16R-K2A-18X-5YL” in eCommerce site, if the code is valid then the system accepts the Gift Certificate as a Payment.

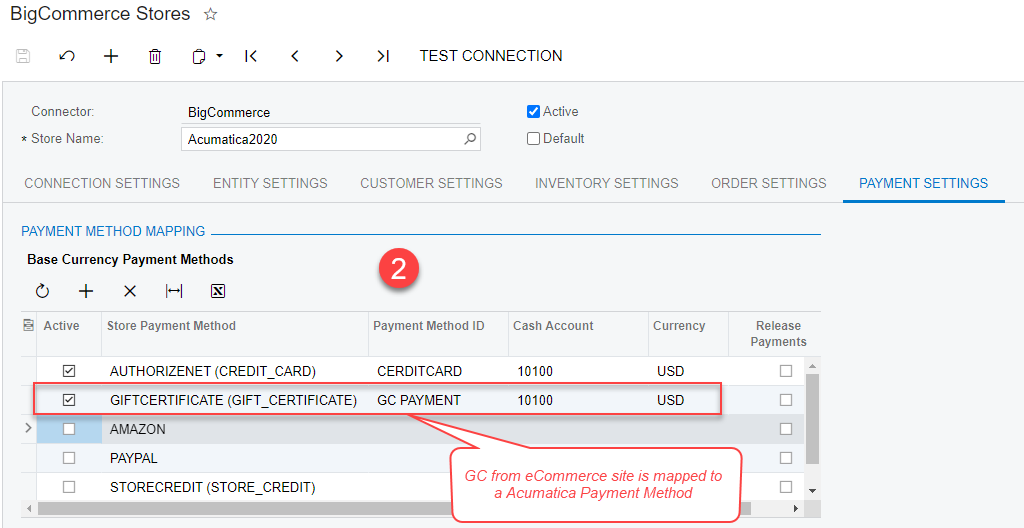

- In Acumatica, Gift Certificates Payment from eCommerce site is mapped to a Acumatica Payment method in the Commerce Connector Store Settings form under the Payment Settings.

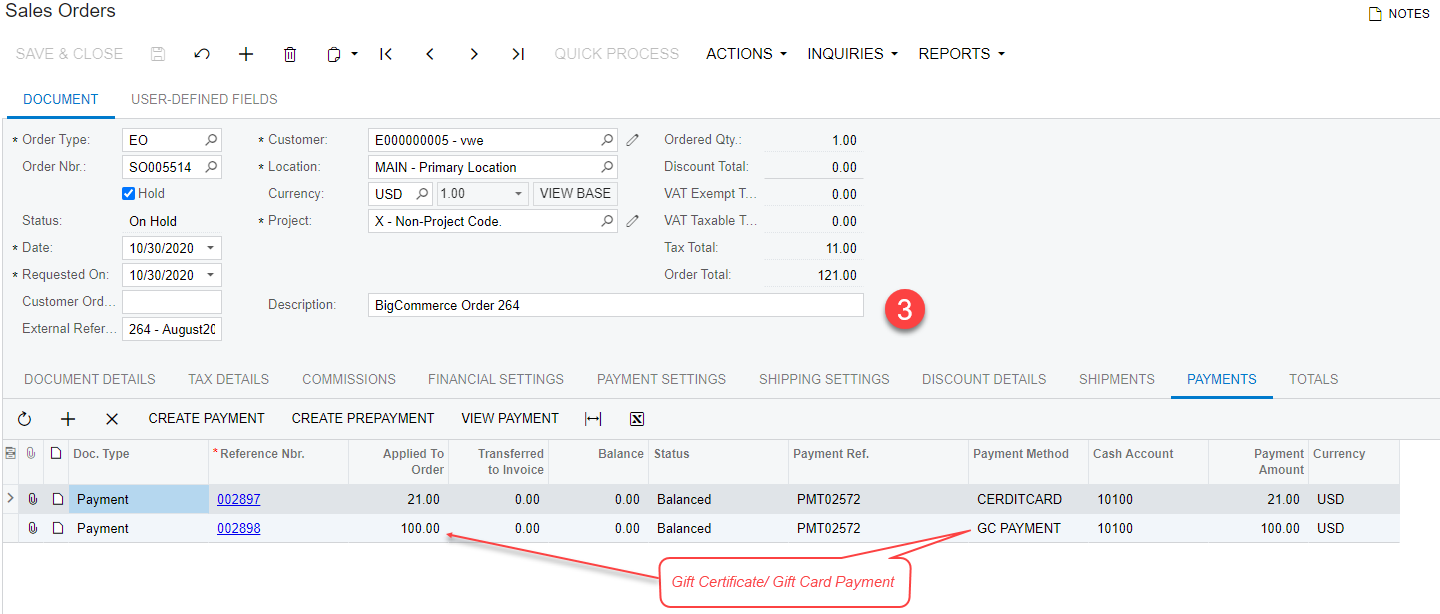

- Sales Order is created with the Gift Certificate Payment.

Please see the below screenshots. Numbered referencing the above points.

To know more about How-To accrue Gift Certificate revenue in Acumatica Commerce Edition please check this article.