We are new to the platform. We are experiencing difficulties when trying to sync returns from Shopify. We are getting the error message:

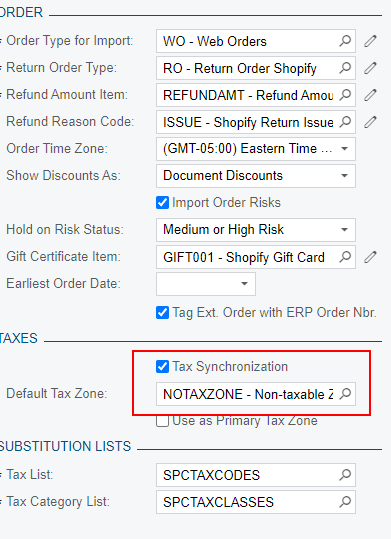

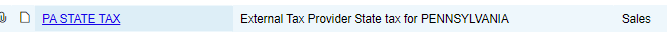

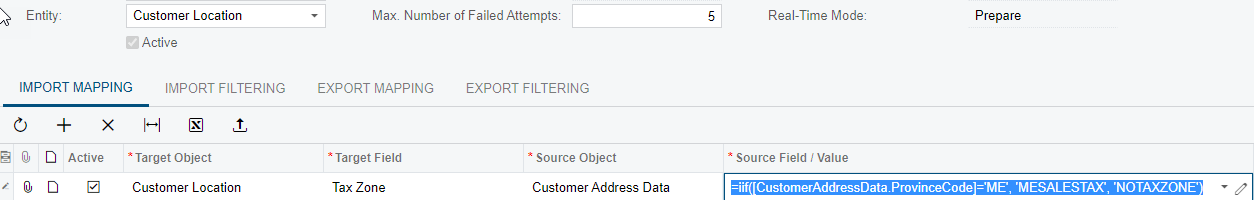

The following tax identifiers from the external system could not be matched: PA STATE TAX. The ERP has failed to save the tax ID or the tax amount differs from the one that has been expected. Make sure that taxes are configured for the tax zone and tax categories. Also, make sure that taxes either have the same identifiers in the ERP and external system or are mapped on the Substitution Lists (SM206026) form.

Has anyone experienced this issue and how do we correct the issue? We are currently manually entering all returns into Acumatica at this point.

We do not experience this problem with a normal order or with a POS return.