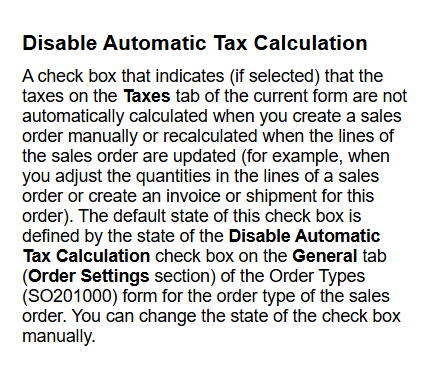

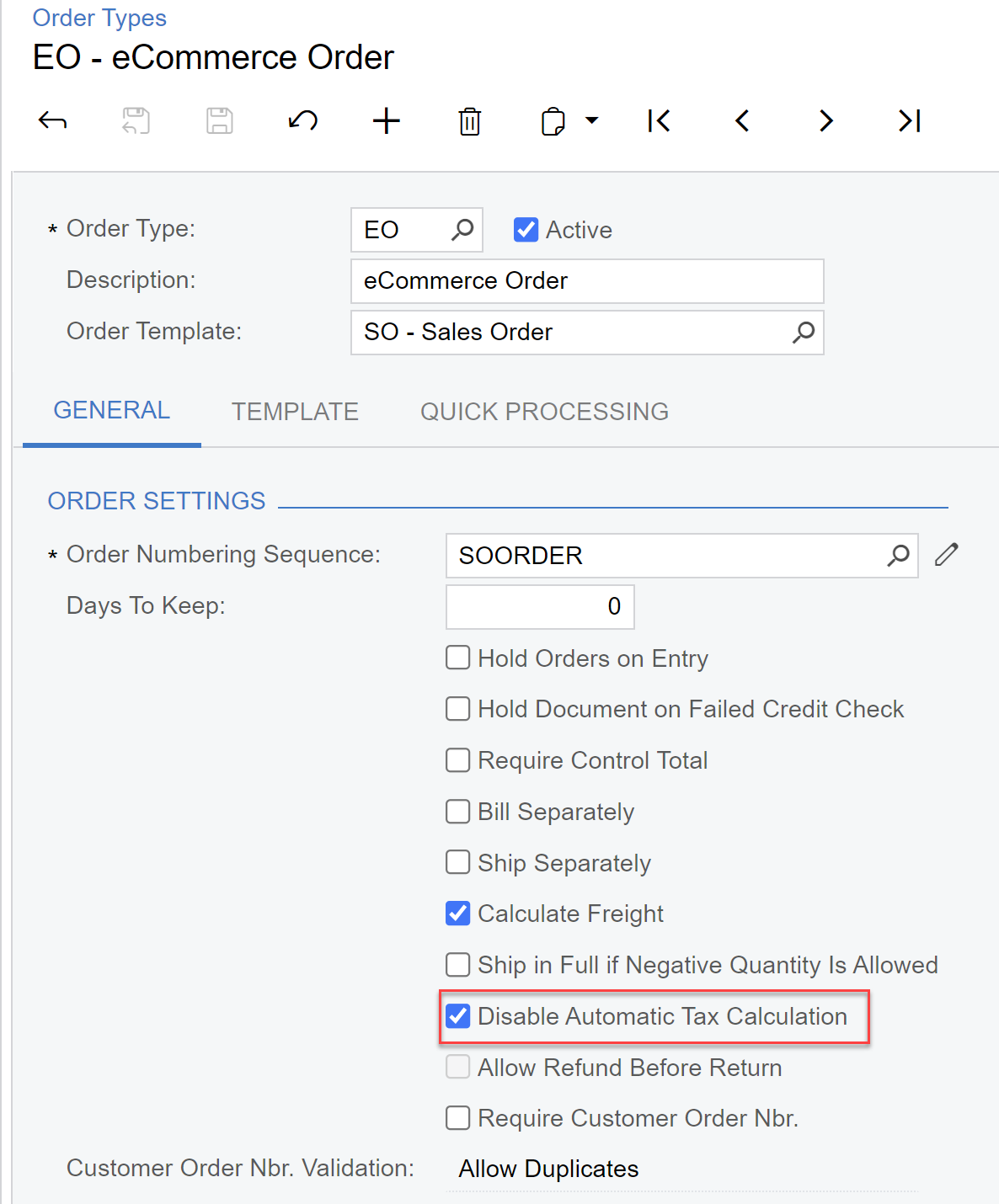

In 2023R1, a new checkbox called “Disable Automatic Tax Calculation” is introduced in the Order Types(SO201000) form. When this checkbox is selected, the system will refrain from recalculating the taxes for the Sales Orders and Invoices.

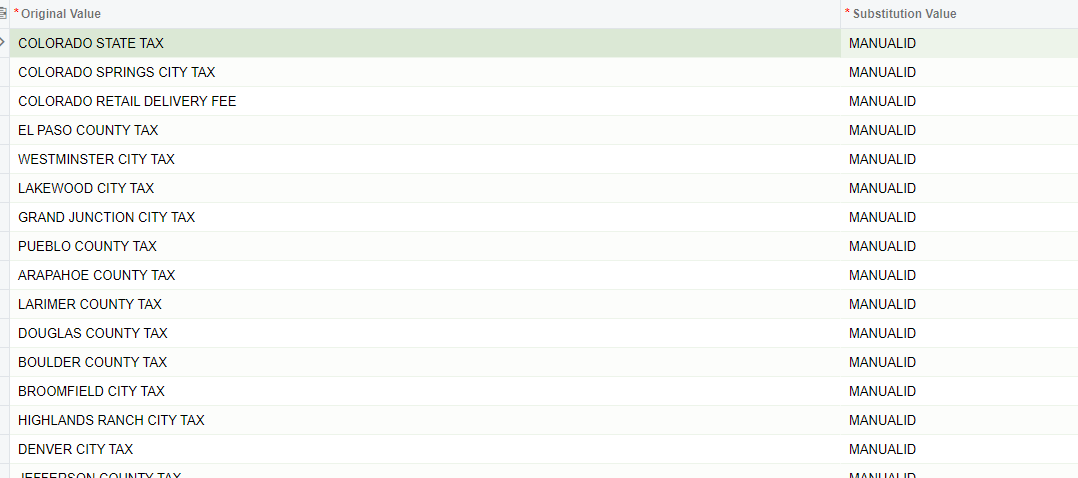

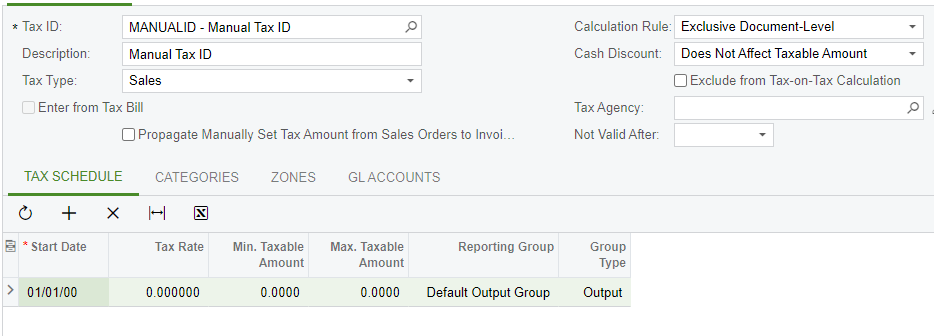

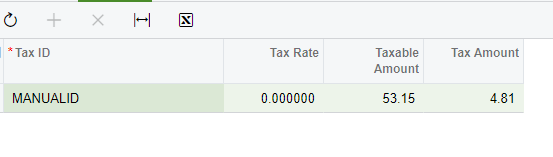

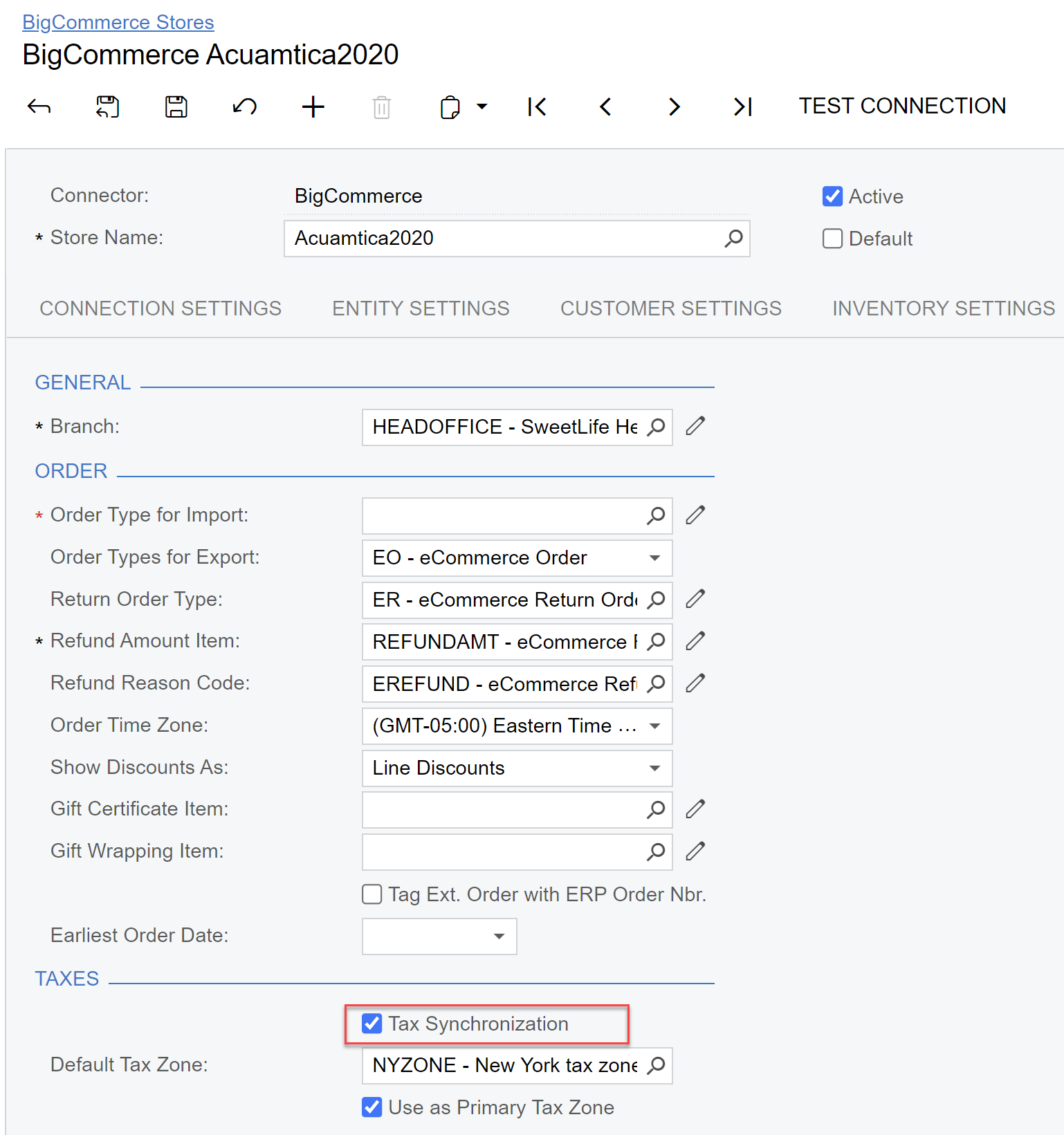

The Commerce connector will import the Taxes from external systems such as BigCommerce, Shopify, Amazon etc., if the “Tax Synchronization” checkbox is selected in the Stores form.

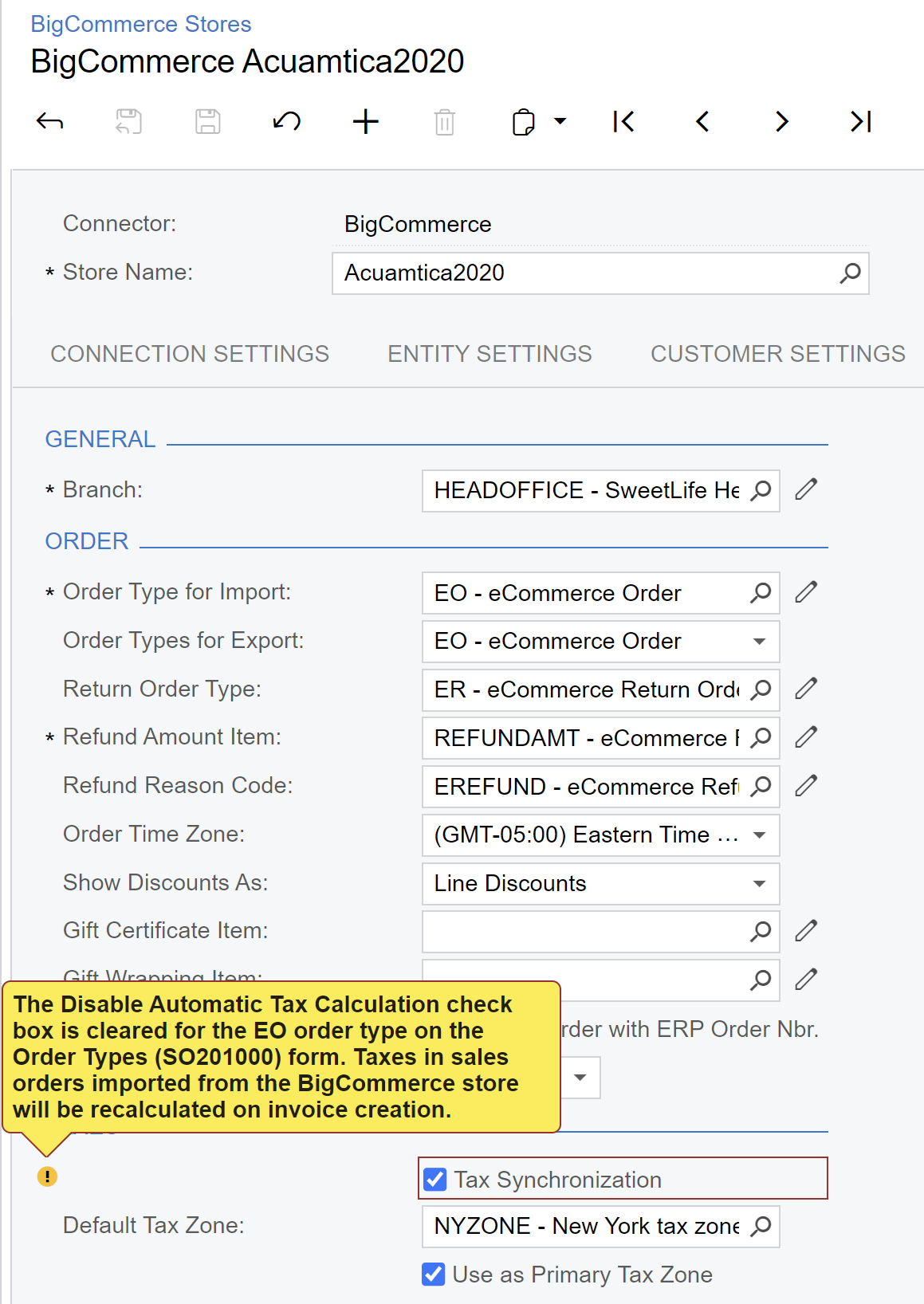

If the “Tax Synchronization” checkbox is selected in the Stores form and if the selected Order Type in Order Type for Import selector has “Disable Automatic Tax Calculation” unchecked then a warning is shown to the user as “ The Disable Automatic Tax Calculation check box is cleared for the EO order type on the Order Types (SO201000) form. Taxes in sales orders imported from the BigCommerce store will be recalculated on invoice creation.”

Once these taxes are imported, then it stays as the same even if the Sales Order or Invoice is modified.

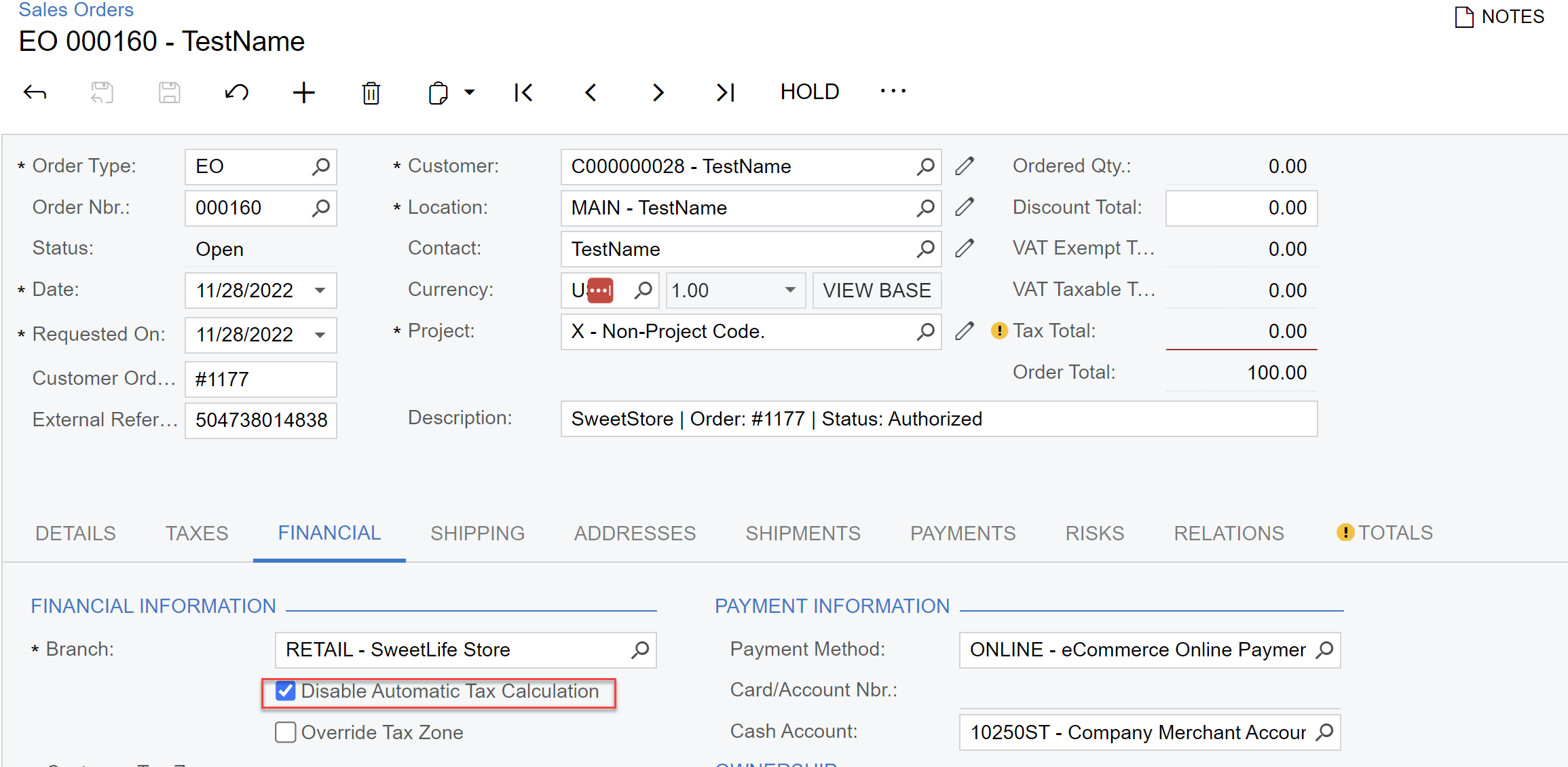

This “Disable Automatic Tax Calculation” is also found in the Financial tab of the Sales Order(SO301000) form. This inherits the value from the Order Types form. If for some reason, the user would like to recalculate the taxes in Sales Order or Invoice, then the user could simply uncheck the “Disable Automatic Tax Calculation” checkbox.

Limitations:

- Currently, the Disable Automatic Tax Calculation check box will not work with

- Inclusive taxes.

- If the Net/Gross Entry Mode feature is enabled, with the Gross mode.

- Currently, for the partial invoices, the taxes are posted to the first invoice. But this will be enhanced in the upcoming releases.