Including non-GST items on tax reports is essential for maintaining accurate and comprehensive financial records. While GST (Goods and Services Tax) is a significant component of tax reporting in many countries, it is not the only aspect that needs to be considered. Non-GST items, such as exempt supplies, zero-rated supplies, and non-taxable supplies, also play a crucial role in the overall tax calculations.

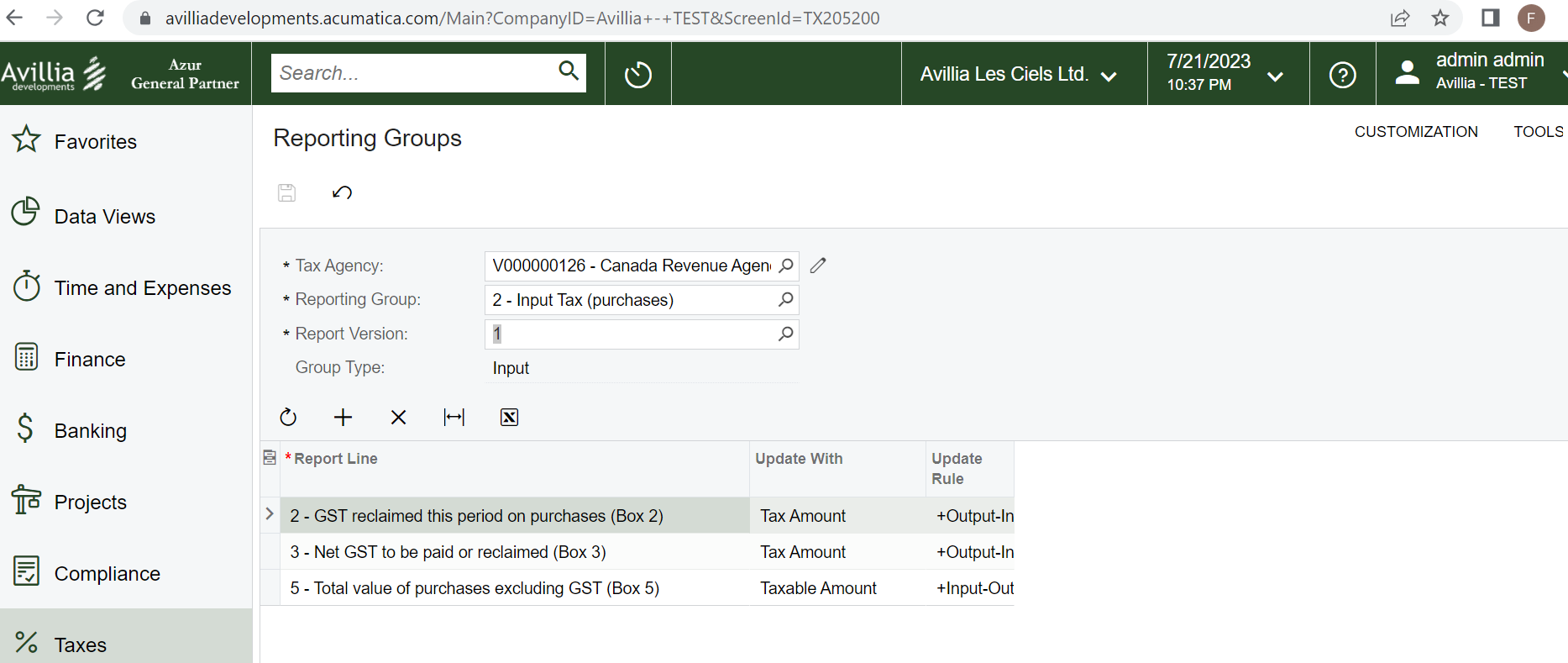

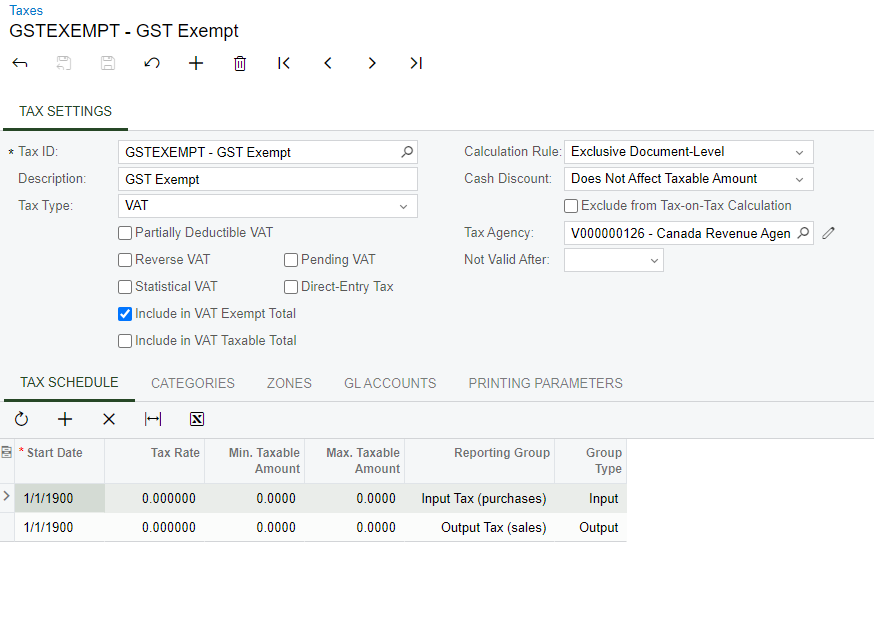

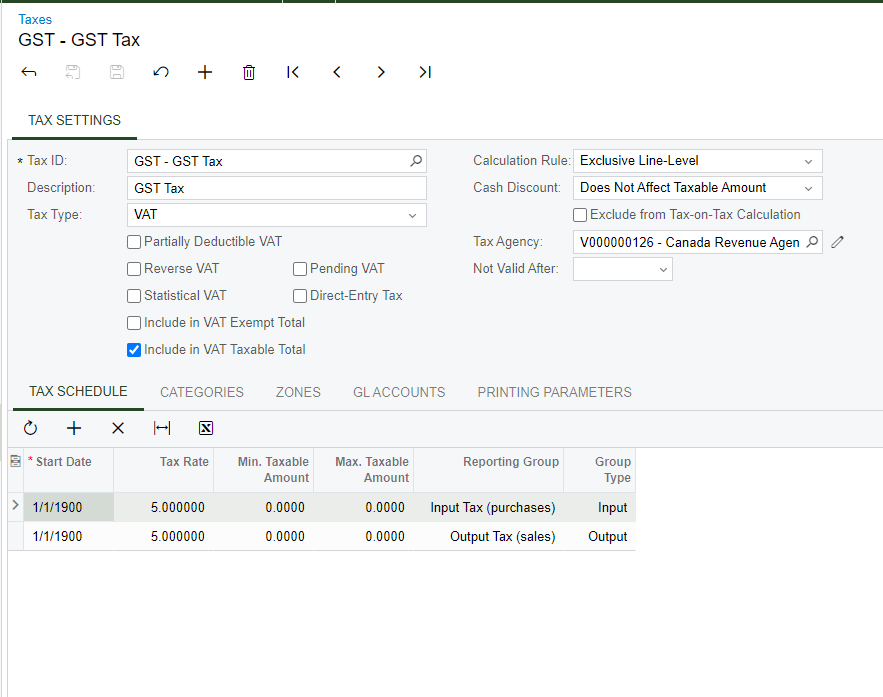

By including non-GST items on tax reports, businesses can provide a complete picture of their financial transactions and comply with tax regulations. Exempt supplies, for example, are sales that are not subject to GST, but businesses must still report them separately for compliance purposes. Zero-rated supplies, on the other hand, are subject to GST at a 0% rate, meaning the tax is effectively not charged, but these transactions need to be recorded accurately.

Properly accounting for non-GST items ensures that businesses can claim input tax credits correctly and meet their tax obligations accurately. Additionally, it enables tax authorities to verify the accuracy of the tax reports and minimizes the risk of potential audits or penalties.

In conclusion, including non-GST items on tax reports is vital for maintaining transparency, complying with tax regulations, and accurately reflecting a business's financial position and tax liability. Businesses should work closely with their accountants or financial advisors to ensure all aspects of tax reporting, including non-GST items, are properly accounted for.