Hello,

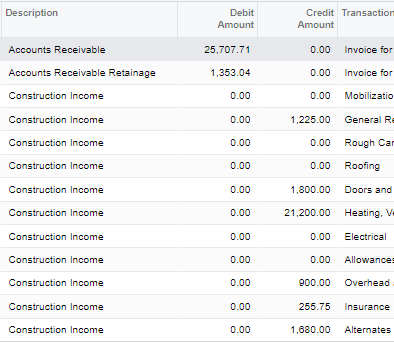

I am noticing that by default if an AR invoice has retainage specified, then this will go directly into Income upon release of the original document. Shouldn’t this be handled differently? I would assume that Retainage Income wouldn’t be recognized until the release of the AR Retainage? Let me know if you have any ideas or can better explain. Thank you!