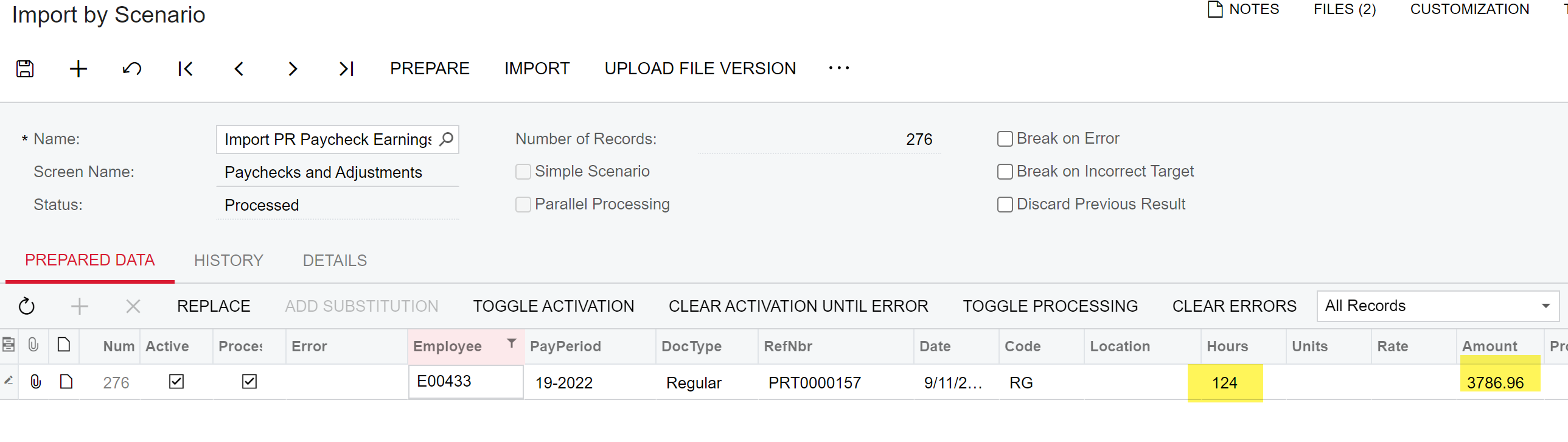

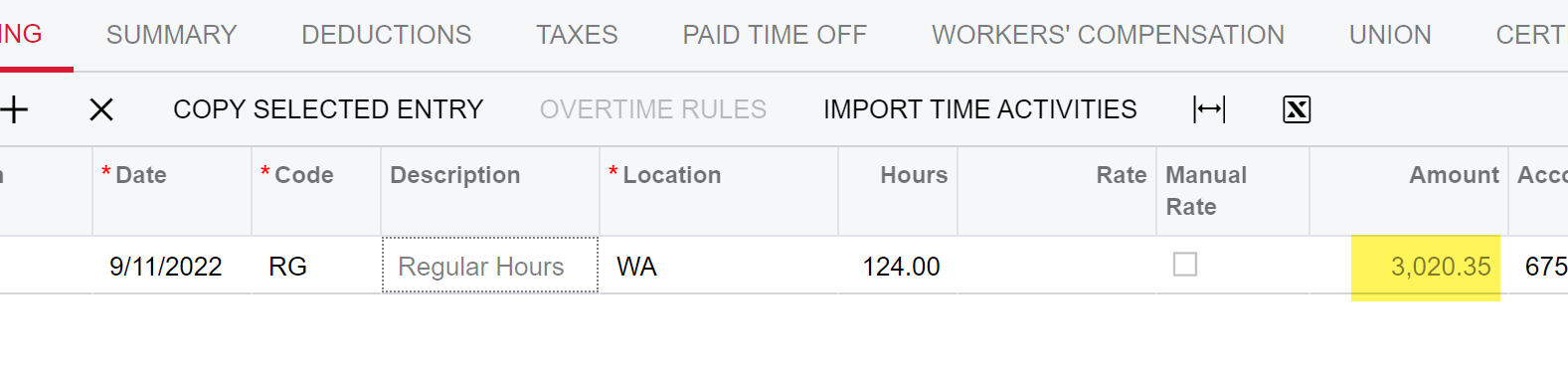

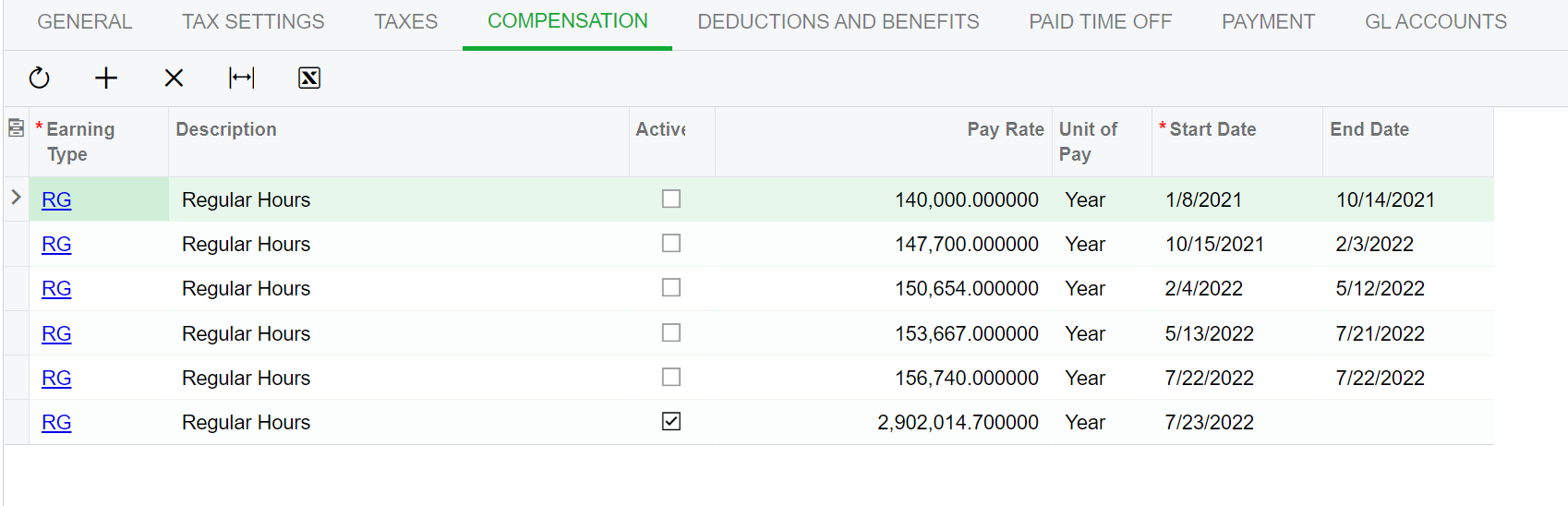

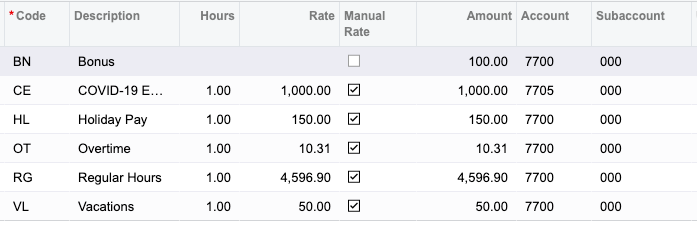

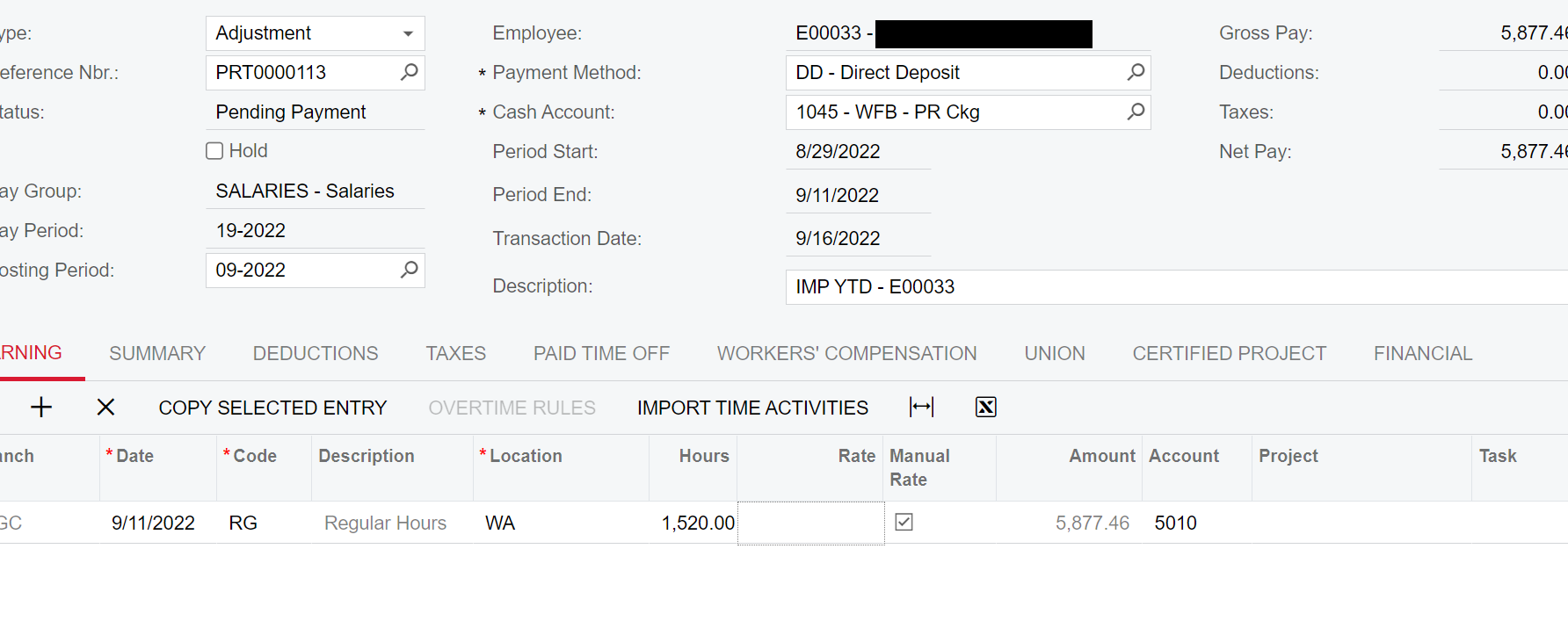

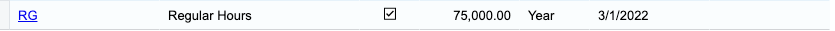

Trying to Import paychecks for a salaried , when using the “Import PR Paycheck Earnings” Import scenario we are trying to set the Amount to $3786.96. However the amount field is not being imported. The Hours field imports no problem. The amount field is being set automatically to the Employees current biweekly salary amount $3020.35. Is there anyway to force the amount to be $3786.96 so as to match the legacy system?