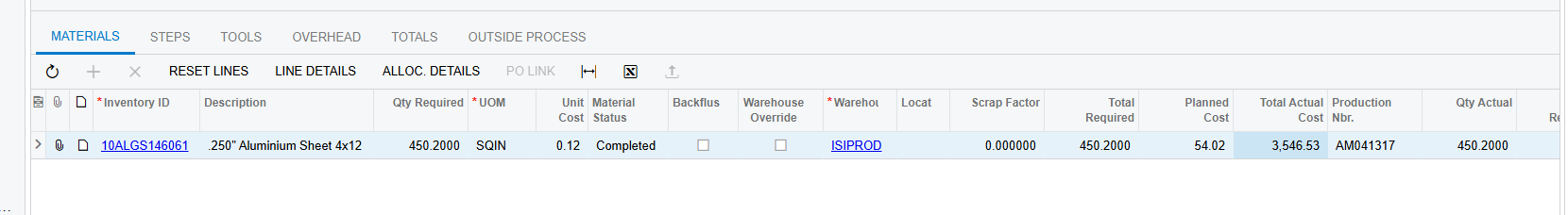

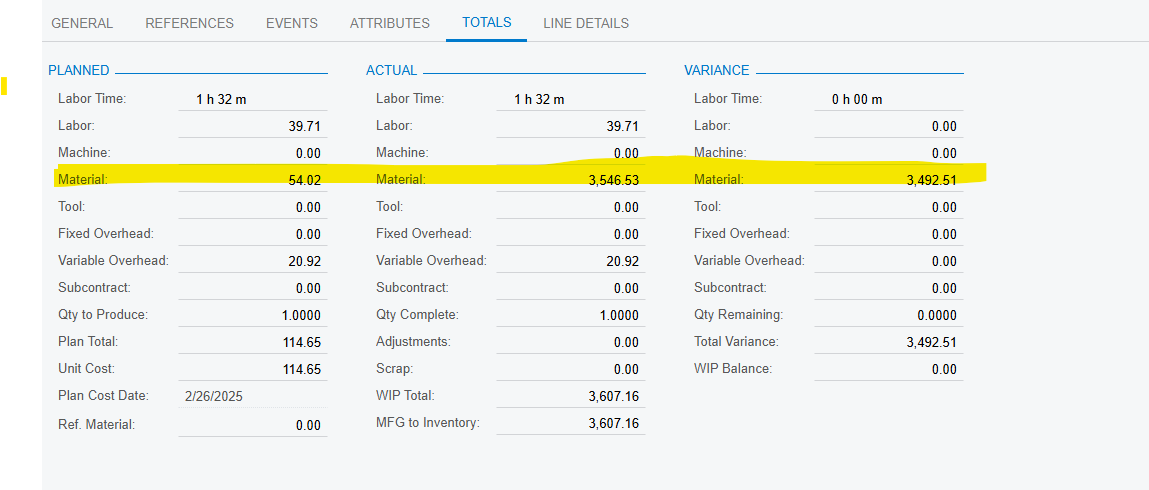

@grillevan - I would assume at this point the production order is complete, or is it still in WIP.

I’m not one for trying to go back in time try to adjust inventory, as this can be tricky and lead to undesired results. Others may disagree, but given the nature of how inventory costs behave, it’s always best to make the adjustments based on the current status of your inventory and not retrospectively.

With that said, how you fix it is based on facts and circumstances.

You could do a dissassembly production order as a first step to effiectively put the aluminum “back” into your Raw Materials inventory at the cost reflected in your material issue, while also reducing your finished goods quantity. Then make an appropriate inventory adjustment for your Aluminum per the instructions below. Once you’re able to get your cost metrics dialed in, redo the production order.

If you’re using an average cost method, I would simply take your current inventory quantity (after the disassembly) and do your best to estlmate what your extended costs should be, based on your expected average current cost per unit. Then subtract expected value from the current extended cost of your Aluminum to arrive at an adjustment amount. Then record an Inventory Cost Adjustment (leaving the quantity set to “0.00” units), and simply enter only the cost difference (I presume it’ll be a negative number to adjust the cost downward).

If you’re using FIFO for your raw materials, the steps are the same, except you should focus your adjustment only for the impacted cost layer(s) and not on the entire inventory balance.

Alternatively, you could choose NOT to run a dissassembly order, and simply record two cost adjustments; one for the RM inventory and one for the Finished Goods.

Of course there’s more to consider here, such as the root causes of the costing error. We know that it’s resulted in an overvaluation of your inventory, but was it due to a UOM conversion error, a purchase price variance, or both? All will have potentially impacted your financials, so you might want to get with the appropriate folks to identify how the debits and credits should flow.

Hope that helps and best of luck.