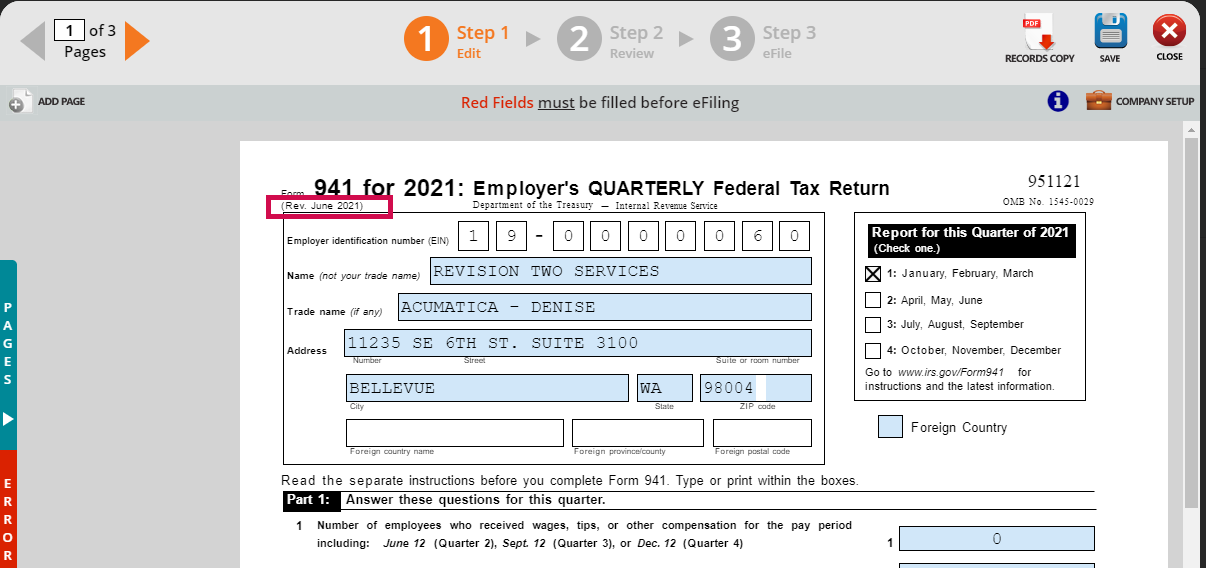

The 2021 941/Schedule B/941-V Report has been updated as of June 2021 and is now available in Government Reporting.

For the latest information about developments related to Form 941 and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form941.

For instructions for Form 941 (06/2021), go to https://www.irs.gov/instructions/i941

The IRS released: a revised 2021 Form 941, Employer’s Quarterly Federal Tax Return, and its instructions; instructions for Schedule B, Report of Tax Liability for Semiweekly Schedule Depositors; and Schedule R, Allocation Schedule for Aggregate Form 941 Filers, and its instructions.

The revised forms and instructions address how to treat revisions to the COVID-19 tax credits and the new COBRA premium assistance credit, created by the American Rescue Plan Act (ARPA).

What’s New

The Form 941 instructions now include five worksheets to calculate the credits. Many lines have been added to Form 941 to account for changes made by the ARPA and to calculate the COBRA premium assessment credit.