Hello Everyone,

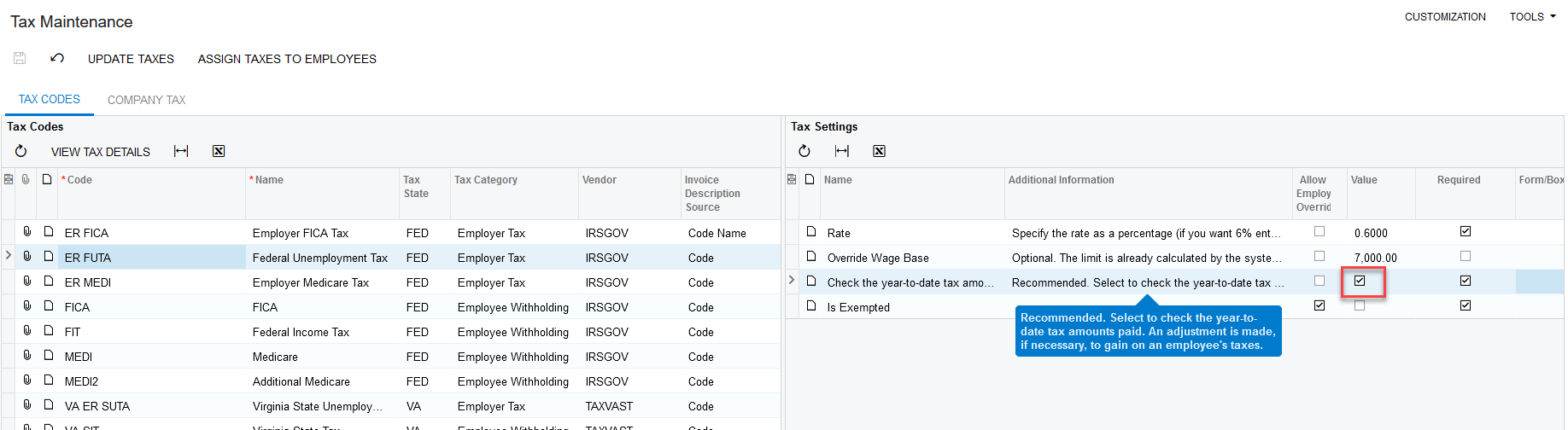

I was wondering how the payroll module pulls taxable wage amounts. Let’s talk about the California SUTA wage base amount. Say an employee has gross wages of $10,000. The taxable wages for the California SUTA will stop at $7,000 (unless overriden of course). Does it stop at $7,000 because Acumatica is pulling this limit from the tax symmetry engine?

I am just trying to get confirmation on how this works.

Thanks