Can someone provide instructions for entering Taxable Fringe Benefits?

I need to enter personal use of a company vehicle for our owners for 2023.

Can someone provide instructions for entering Taxable Fringe Benefits?

I need to enter personal use of a company vehicle for our owners for 2023.

Best answer by Sonia Echols

Hi Gillian,

You will need to:

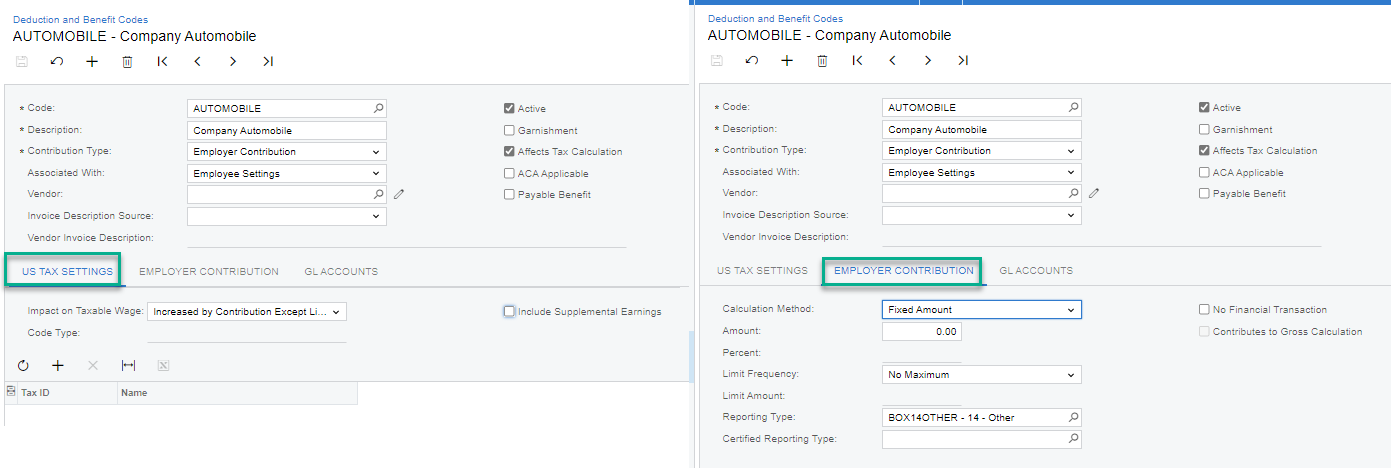

1 - Setup a Deduction and Benefit Codes

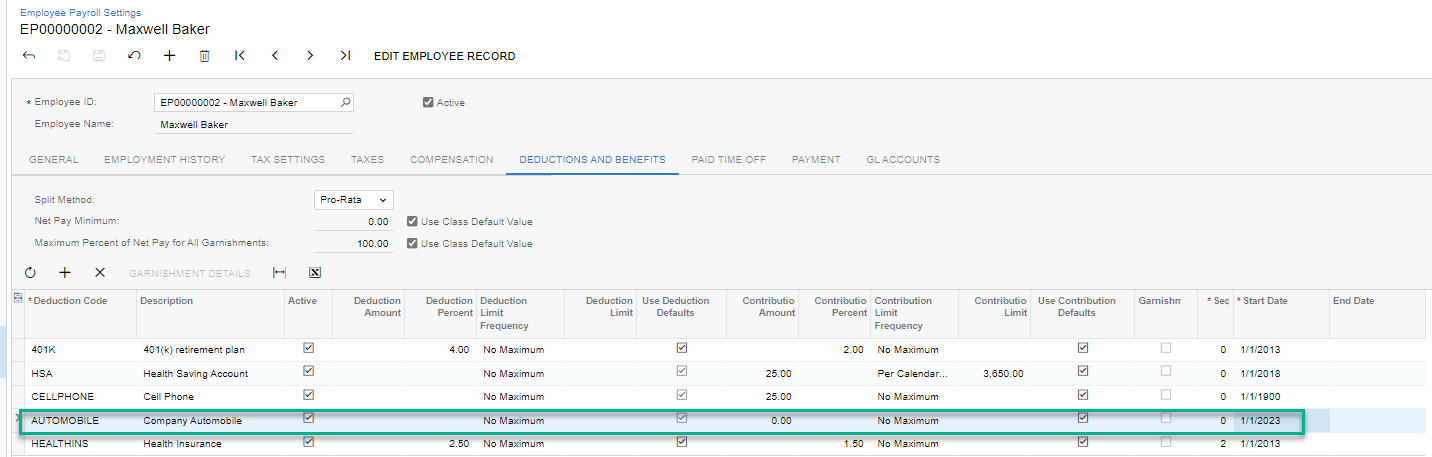

2 - Add to the Employees Deductions and Benefits under Employee Payroll Settings

3 - Create an Adjustment Check

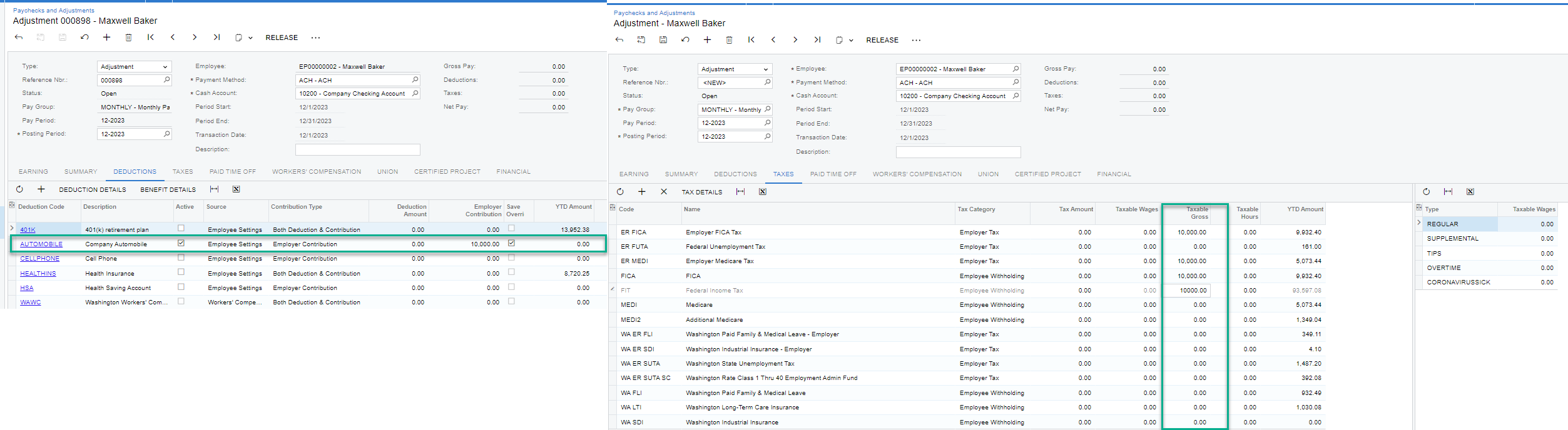

Adjustment Check

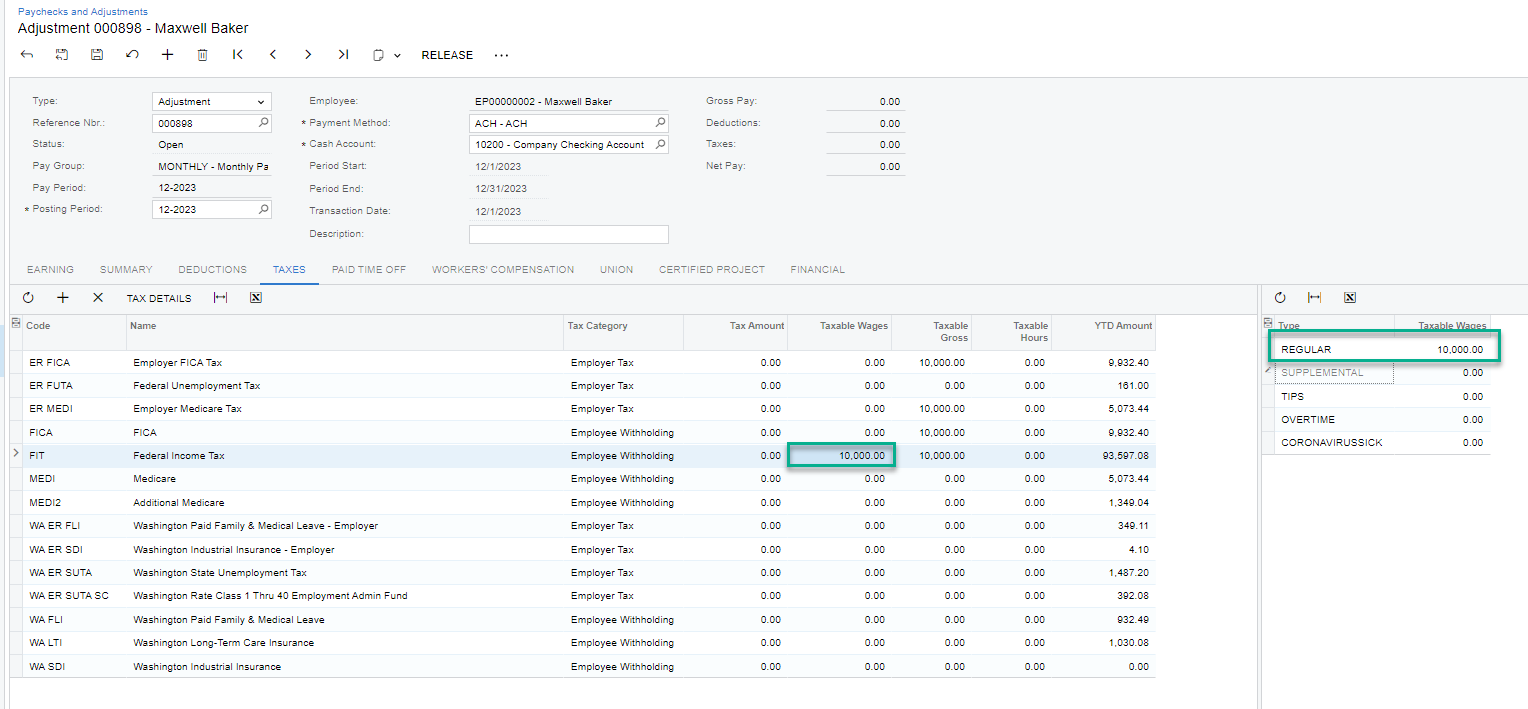

4- Run the Taxes by Paycheck Report for the Calendar year for the Employee (do not include Unreleased) Look at totals page.

5-Edit report and include Unreleased. Verify that the amounts are as you expect.

6 - Release the adjustment.

NOTE: You can find instruction on how to calculate the Fringe benefit in Publication 15-B (2023), Employer's Tax Guide to Fringe Benefits | Internal Revenue Service (irs.gov) and Publication 5137, (Rev. 10-2022) (irs.gov)

Sonia Echols

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.