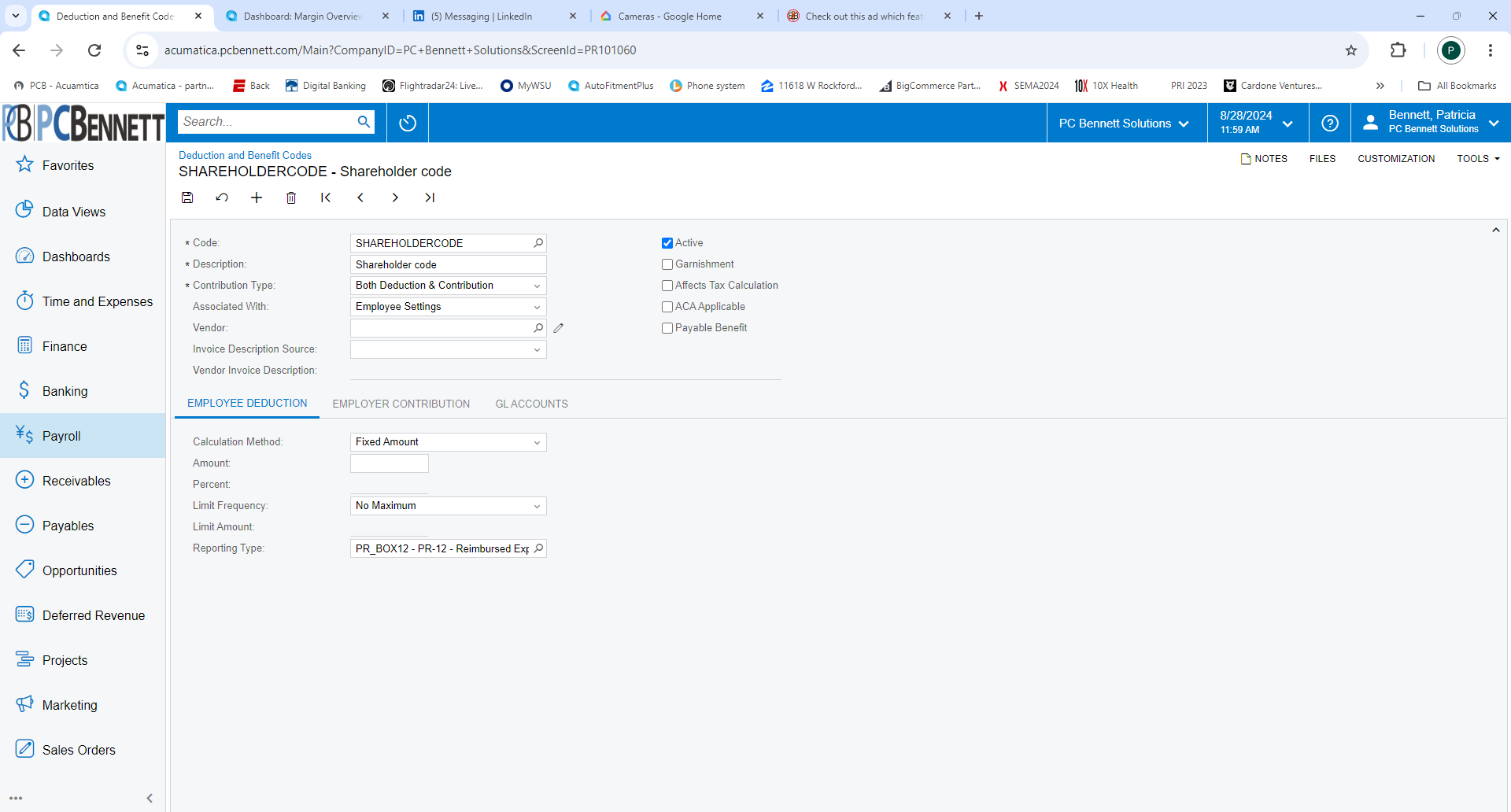

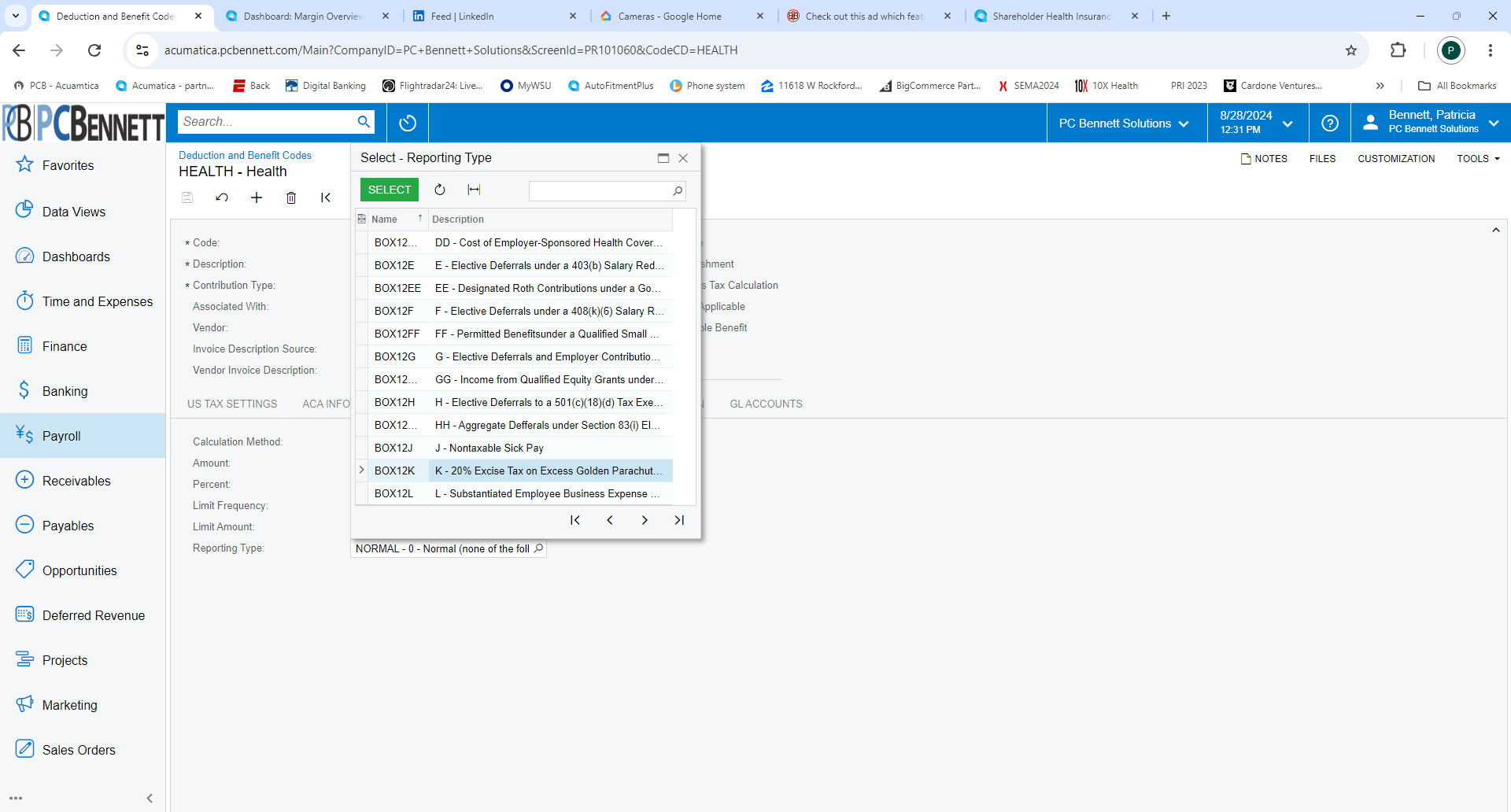

How do you set up the deduction/benefit code to add Shareholder Health Insurance to owner’s W2 and report in Box 12 DD?

Solved

Shareholder Health Insurance W2

Best answer by pbennett

if the code is incorrect the are other options on the setup screen.

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.