Hello Everyone,

I am looking to see if there are any other options for a minor issue I am facing. On older versions of the payroll modules, like 2020R2, the system calculated salaried employees’ paychecks by the amount of hours times their salary rate (divided by the amount of pay periods).

For instance if a salaried employee was paid $1000 per pay period for 80 hours, then for 40 hours they would be paid $500. In newer versions this changes to $1000 regardless of the amount of hours they have. This makes sense to me but I am wondering if there is any setting I can change to turn this back?

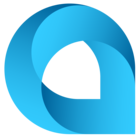

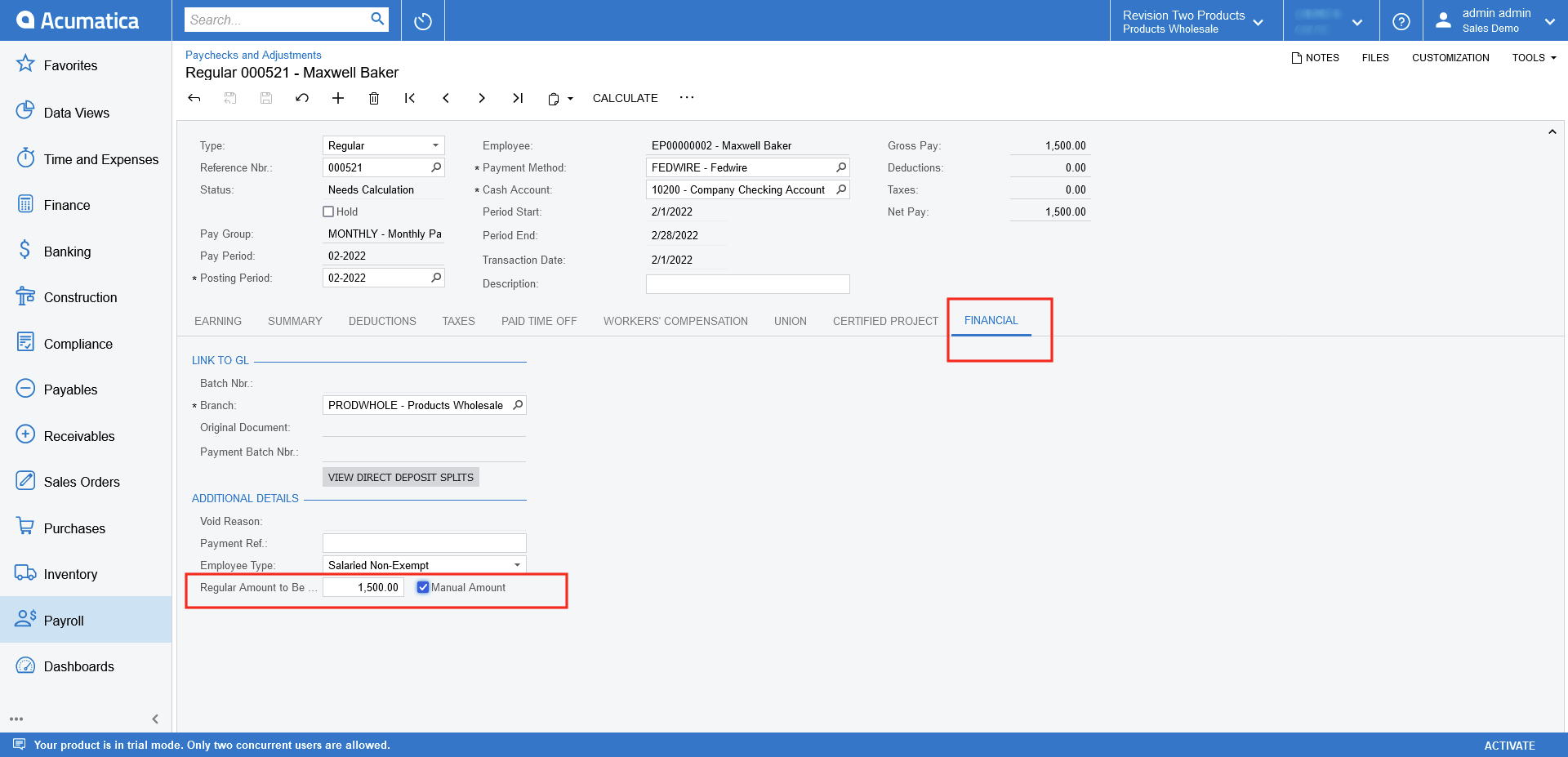

I know one option is to make those salaried employees “hourly”. Another option is to change their type, on the paycheck, to “hourly”.

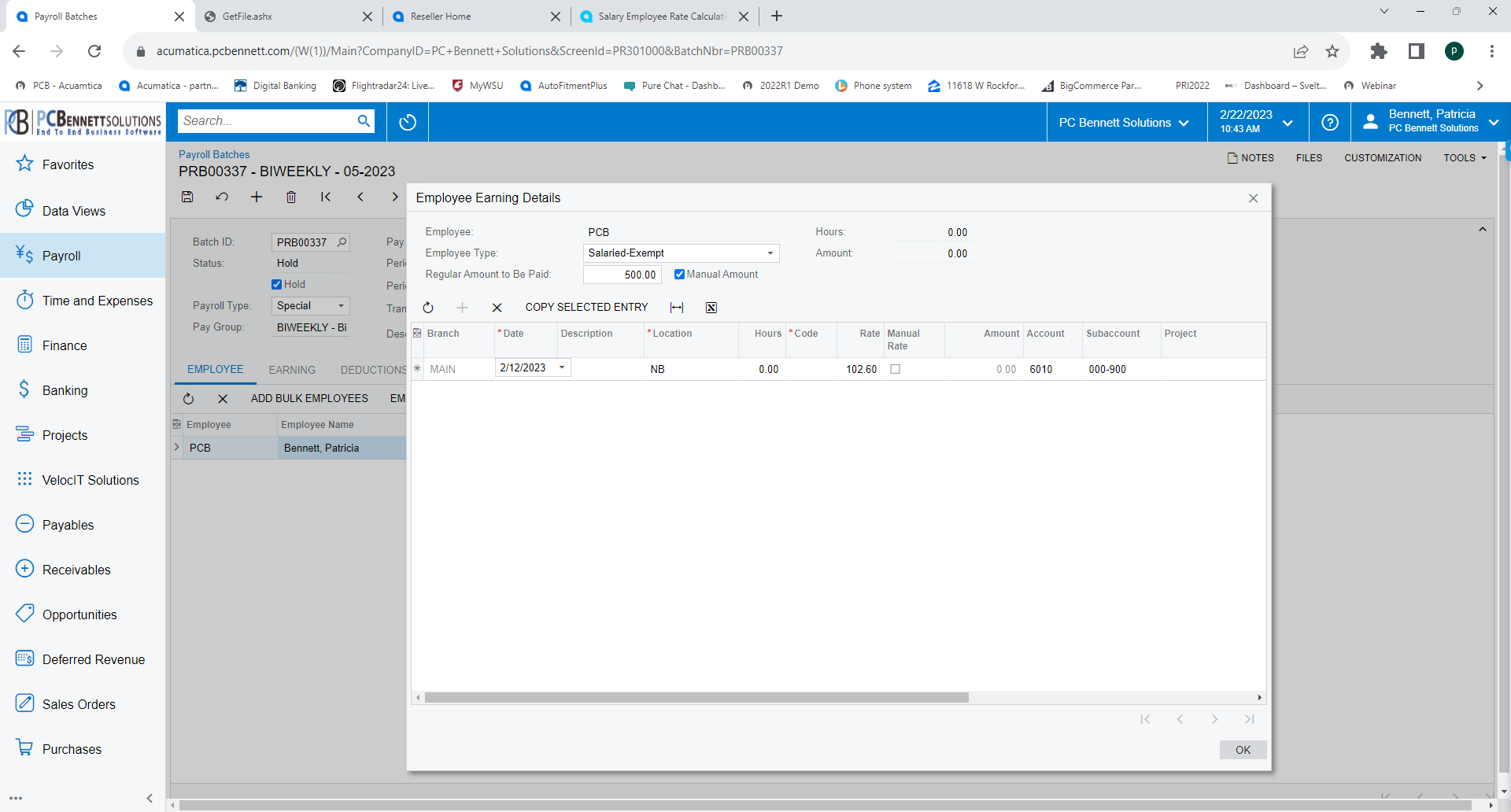

In the meantime I have created an inquiry that I use to show salary employees hours that we run after a payroll import to see if we need to do any manual changes (we are working with 300 employees, about 100 are salaried). If someone is under 80 hours we go ahead and manually change those like in the screenshot above.

If anyone has any other ideas please let me know.

Thanks