Hello,

Would anyone have a clue to why Acumatica (Symmetry Tax Engine) Taxes are not capping? I cant find a way to adjust any setting to correct this.

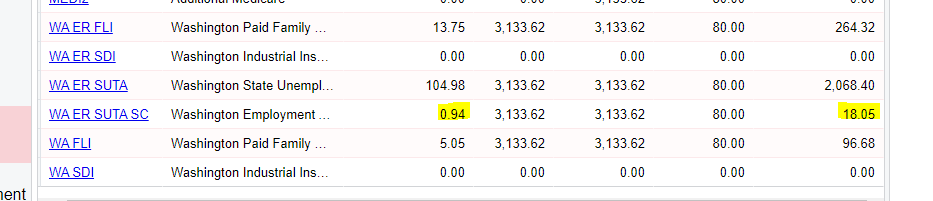

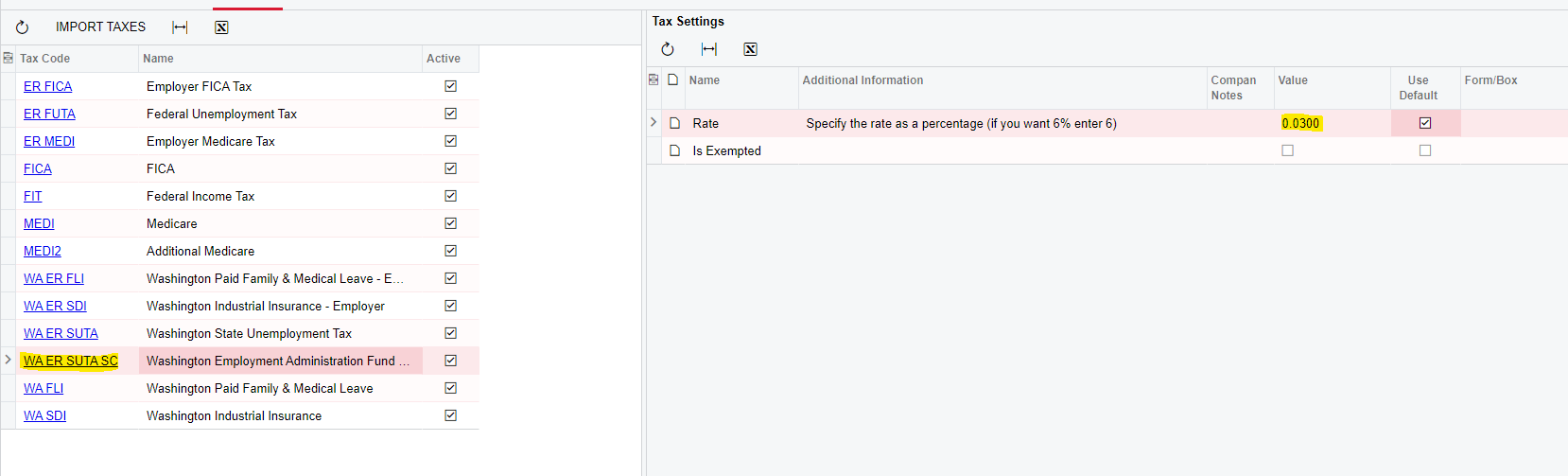

In Washington, Employer Admin fund is 0.03% of gross wages with an assessable wage cap of $62500, making a contribution cap of $18.75. Acumatica is not taking this into consideration and continues to withhold after the $18.75 is reached. This is happening for the SUI too.

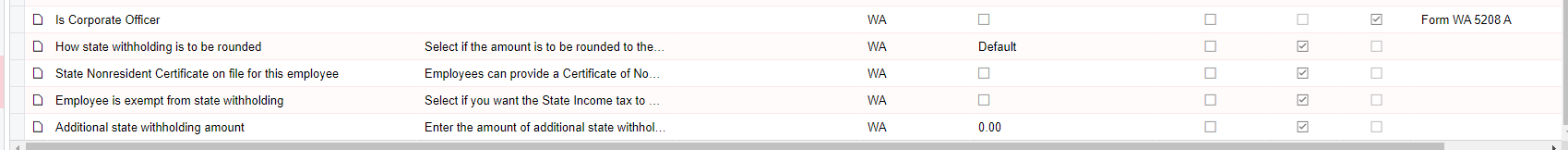

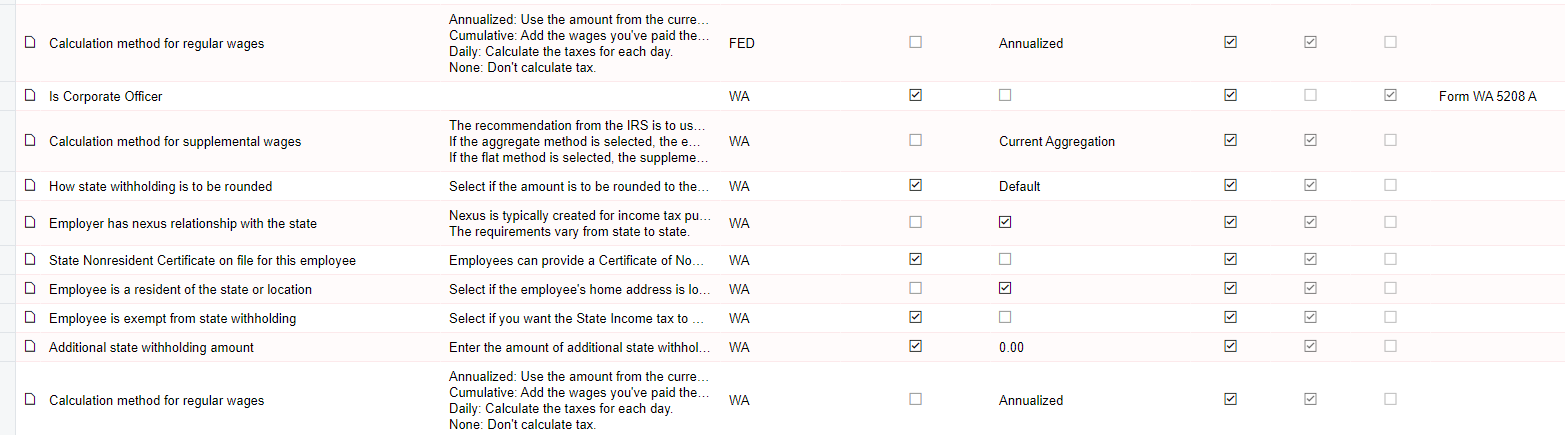

I have checked the Tax Maintenance and the cap is configured correctly. We made sure that the payroll employee payroll settings have not been overridden for the specific individual.

The above amount of 0.94 cent should be 0.70 to take the accrued 18.05 into consideration.

Any help, thoughts, insights would be greatly appreciated!

Thanks!