Hello,

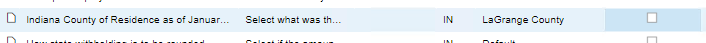

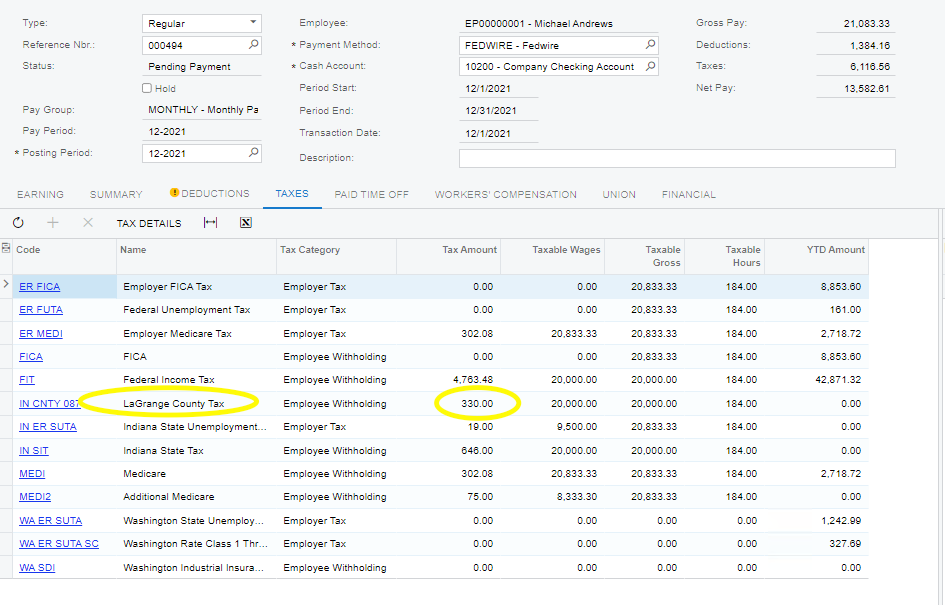

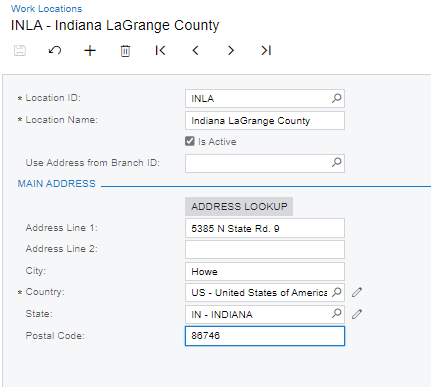

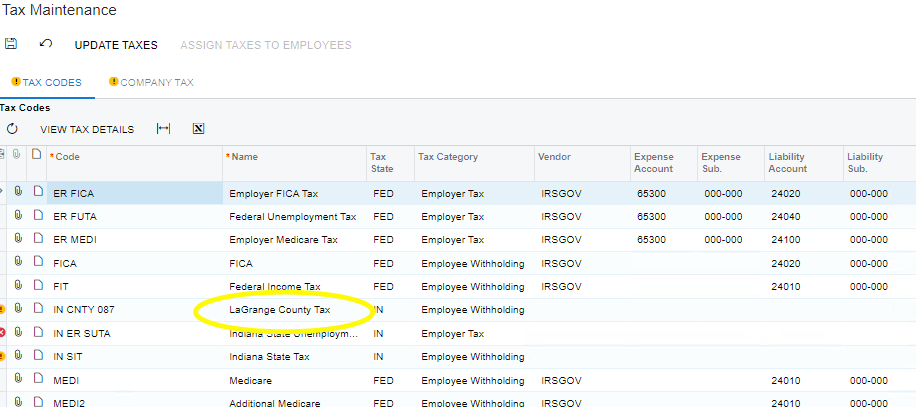

I have to pay payroll in Indiana with LaGrange as the County and my payroll is not calculating the LaGrange tax. I don’t see a place to put county tax rates and Acumatica seems to not be pulling the information. I have no way to input information directly into her “Paychecks and Adjustments” any help will be appreciated!