Good morning Acumatica users!

Are you aware of a quarterly 941 summary produced by Acumatica?

Here is an email thread from our employee that processes payroll to our VAR (it’s easiest to start at the bottom - and screenshot from our VAR is attached.)..and Thanks to anyone who reads this! :) :

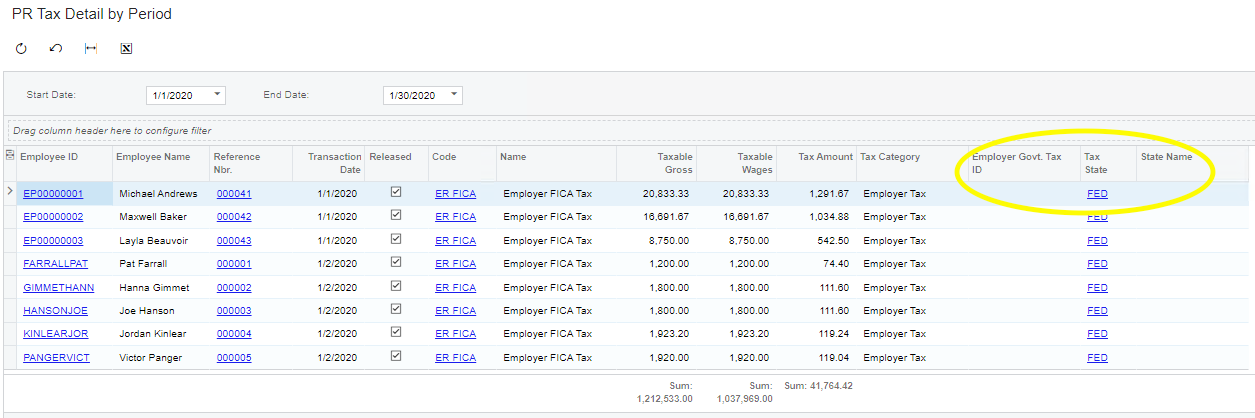

They would have to combine three different reports just for the 941 returns. Seems like it should be way easier than this.

Thanks,

Candace Moore

Hi Candace,

Have you ran any of the Annual Reports or any of the “Employee” Inquiries? The Annual Reports are grouped by the quarter, but do not show grand totals. The Inquires are also grouped by the quarter and they also have grand totals.

Please let me know if you have any additional questions or if you would like to setup a meeting to discuss in more detail.

Tammy,

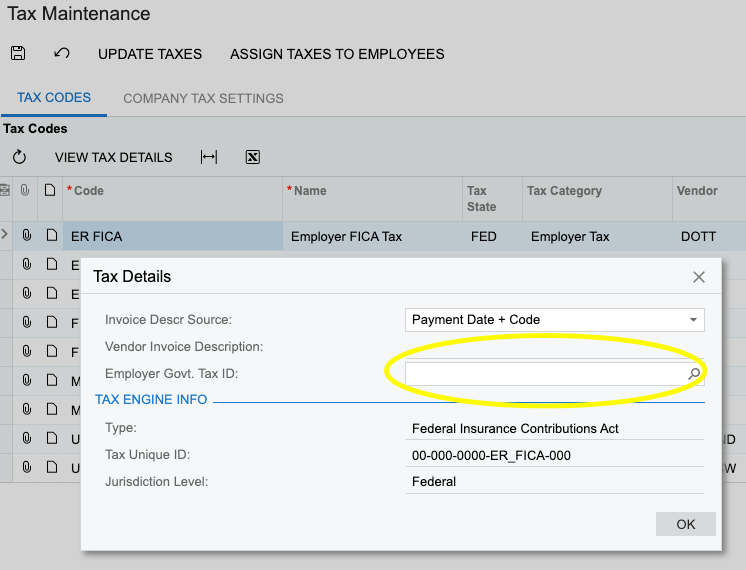

I’m looking for what Acumatica is, I guess you’d say, telling Aatrix what should be done for taxes on the employer end. For instance, what pulls into AP when I pull in the weekly 941 deposits. Where is a report from Acumatica that says this is what it pulled for the quarter? If I go into Aatrix I have to login and get a code and act like I’m paying it just for a report. We need one that shows what Acumatica says was sent to Aatrix.

Candace Moore

Accounting Dept.

Stockmeister Plaza

700 E Main Street

Jackson, Ohio 45640

Office 740.286.8000

Hi Tammy,

Can you tell me if there is a way to add employer reports? All I am seeing are employee reports in payroll. For example….if I want to see what our 941’s were for a quarter. I’m not seeing an option to print those. Do employer reports exist or is that something that has to be created?

Thanks,

Candace Moore

Accounting Dept.

Stockmeister Plaza

700 E Main Street

Jackson, Ohio 45640

Office 740.286.8000