I am looking for a 401k report by payperiod for upload to the 401k provider (or Generic Inquiry). What is the best report to start with for customization that includes deduction by payperiod and YTD total earnings and hours?

Thanks

Sharon

I am looking for a 401k report by payperiod for upload to the 401k provider (or Generic Inquiry). What is the best report to start with for customization that includes deduction by payperiod and YTD total earnings and hours?

Thanks

Sharon

Best answer by mikedavidson07

Hi Sharon,

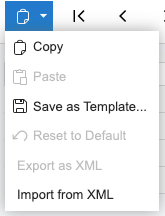

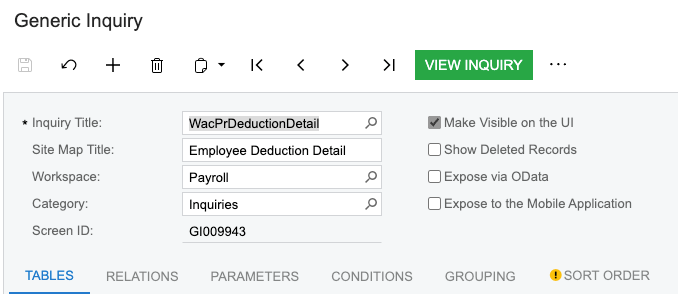

Here is a simple Generic Inquiry for deductions by date range that may get you going.

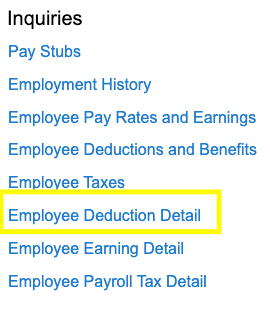

Now back in Payroll you should have the new item under the Inquiries section “Employee Deduction Details”.

Once you run inquire by the dates desired, you can filter by your 401K deduction code and export to Excel.

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.