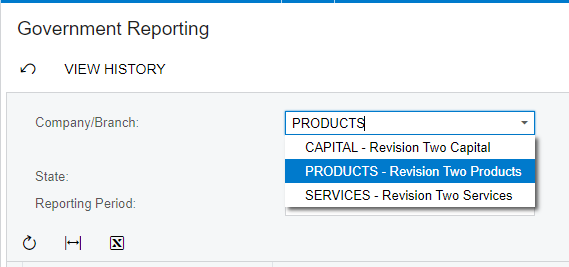

I have multiple companies under one tenant that are all processing payroll under their individual federal tax IDs. Where do I store the individual company’s state withholding and unemployment IDs?

From my understanding, the details are on the Company Setup during the Aatrix processing of reports but where are these details stored to tell Aatrix what to put on these reports?

Solved

Multiple Companies and their State Payroll Tax IDs

Best answer by Denise Johnson

Hi

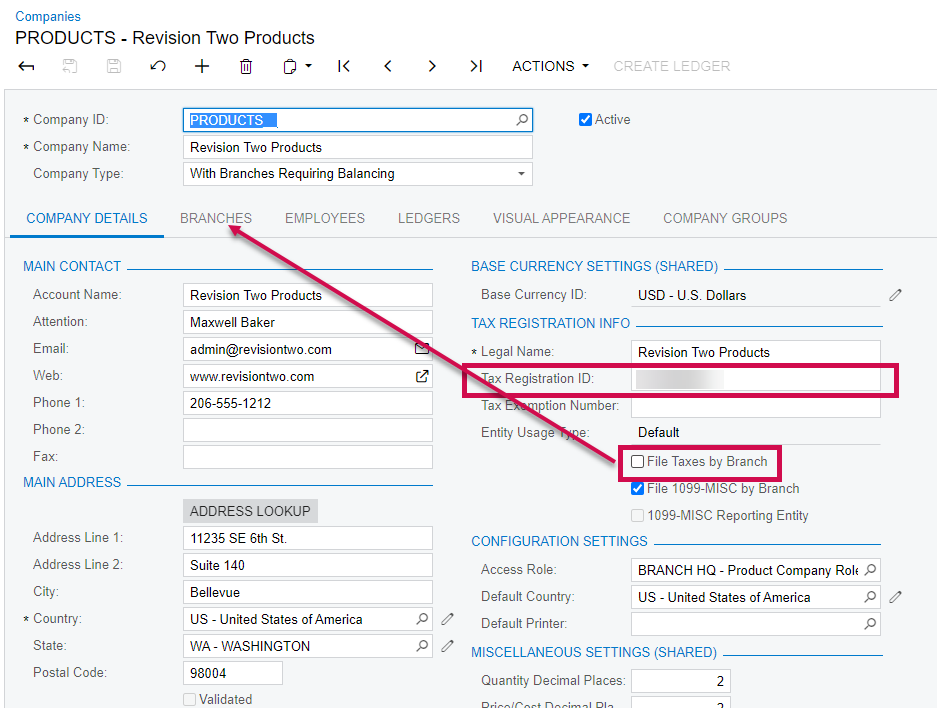

Aatrix pulls tax information by Branch.

Tax ID (EIN) are stored under the Companies form.

Let me know if this helps,

Denise

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.