We utilize several unions with our payroll, but have one that uses a multiplier on each of its deductions and fringes (each of which are based on hours). We have tested the deduction and benefit using regular only, regular and OT, and total earnings, which are all the options. These all treat all hours at the same rate. Does anyone else use multipliers for overtime and double time hours for unions? And if so, how are you making that calculate correctly?

Local Union Calculations

Best answer by pbellefeuille

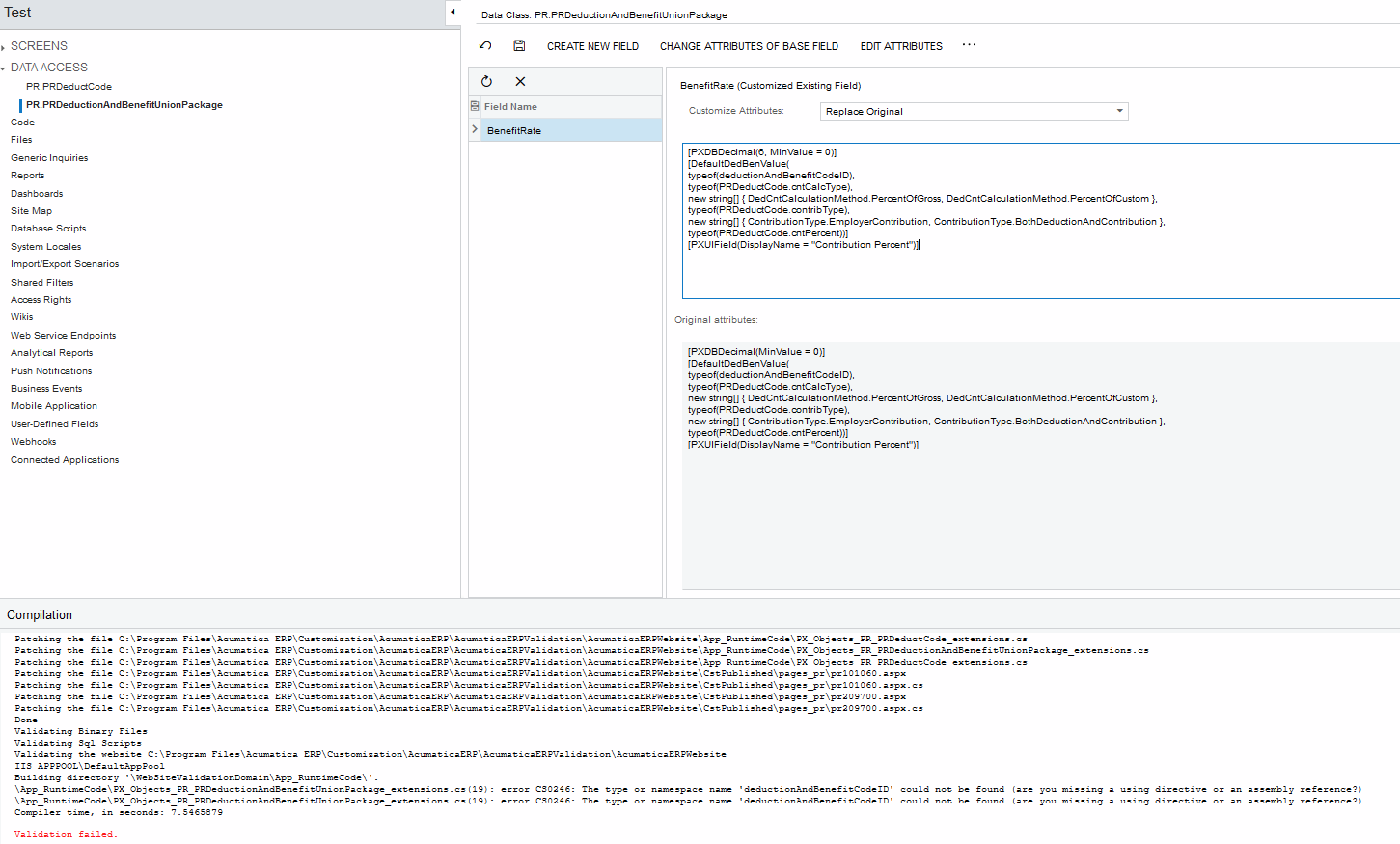

We do not currently have a weighted amount per hour, that would take the overtime multiplier of the earning type for calculation of the deductions & benefits. However, you should be able to achieve your requirement by using percent of gross and calculating what is the percentage from your amount per hour.

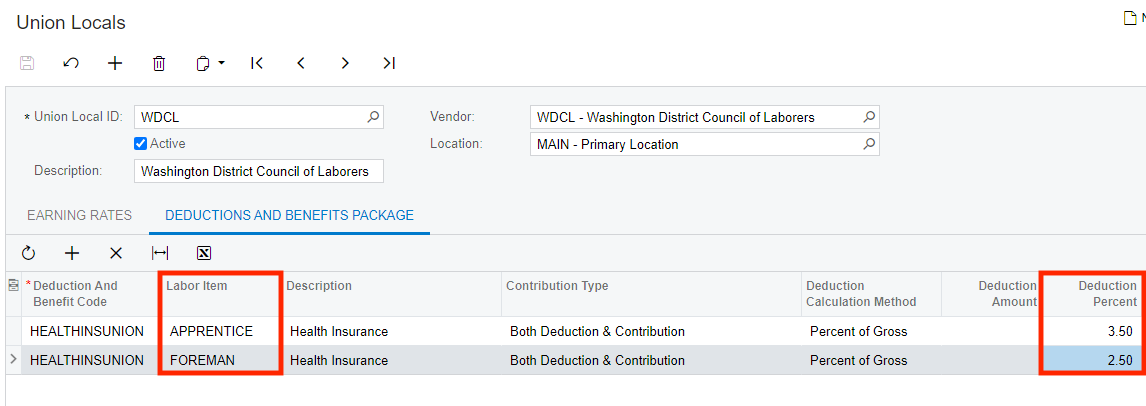

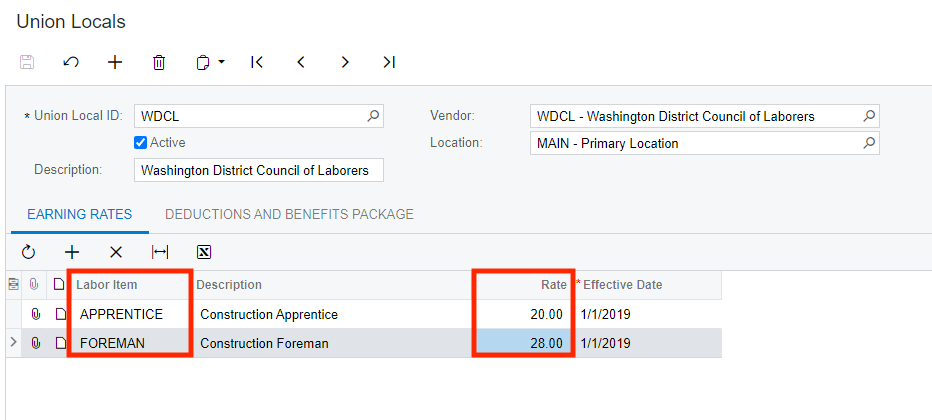

E.I. if the benefit is 0.70$/h and the pay rate is 20$/h, it will be 3.5% (0.7/20). If the benefit rate at 0.70$/h but the pay rate of a different labor item is 28$/h, the benefit rate will now be 2.5% (0.70 / 28). Because union wages are standardized by labor item, you should be able to configure the right rate for each labor item.

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.