Has anyone ever had to make mass adjustments to multiple employees taxable wages before?

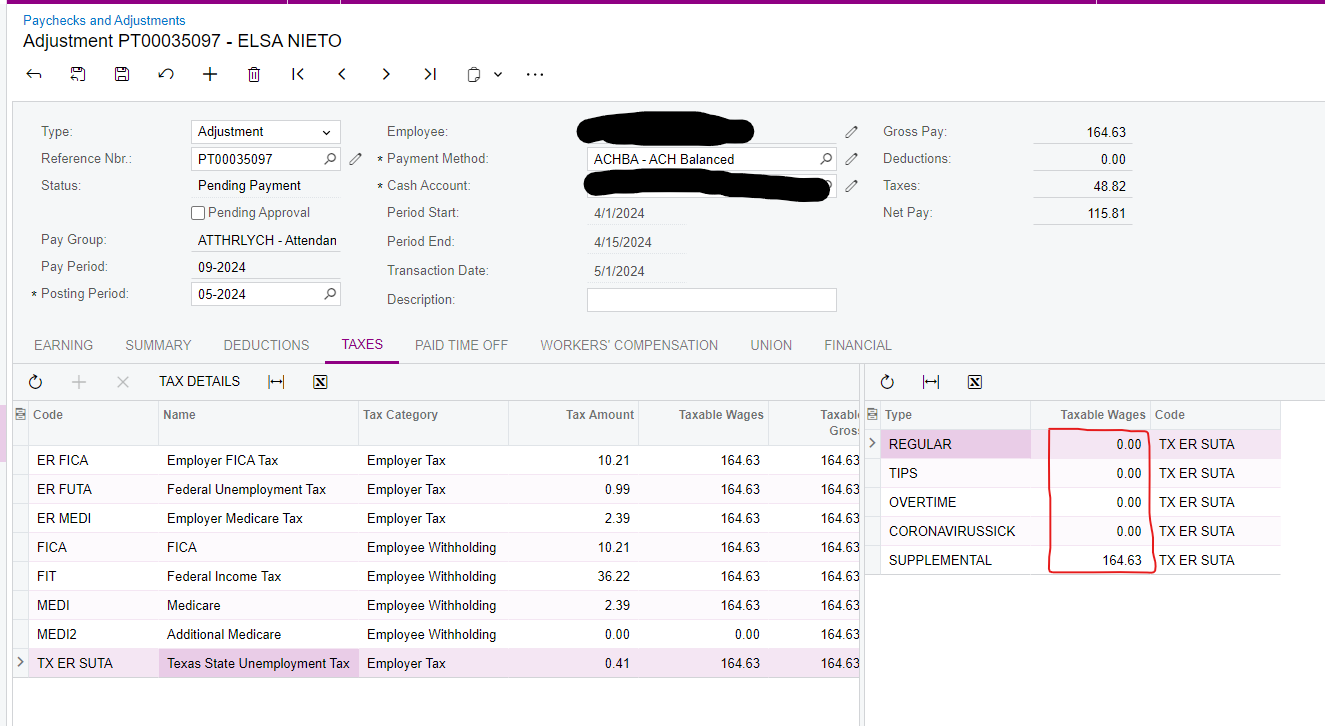

When you go to the Taxes tab on the Paychecks and Adjustments screen, select a tax code you can manually enter taxable wage adjustments in the right hand pane. This is great but if we need to do this to 100-500 employees doing this manually is quite difficult and time consuming for the customer.

Has anyone had any success?

Screen:

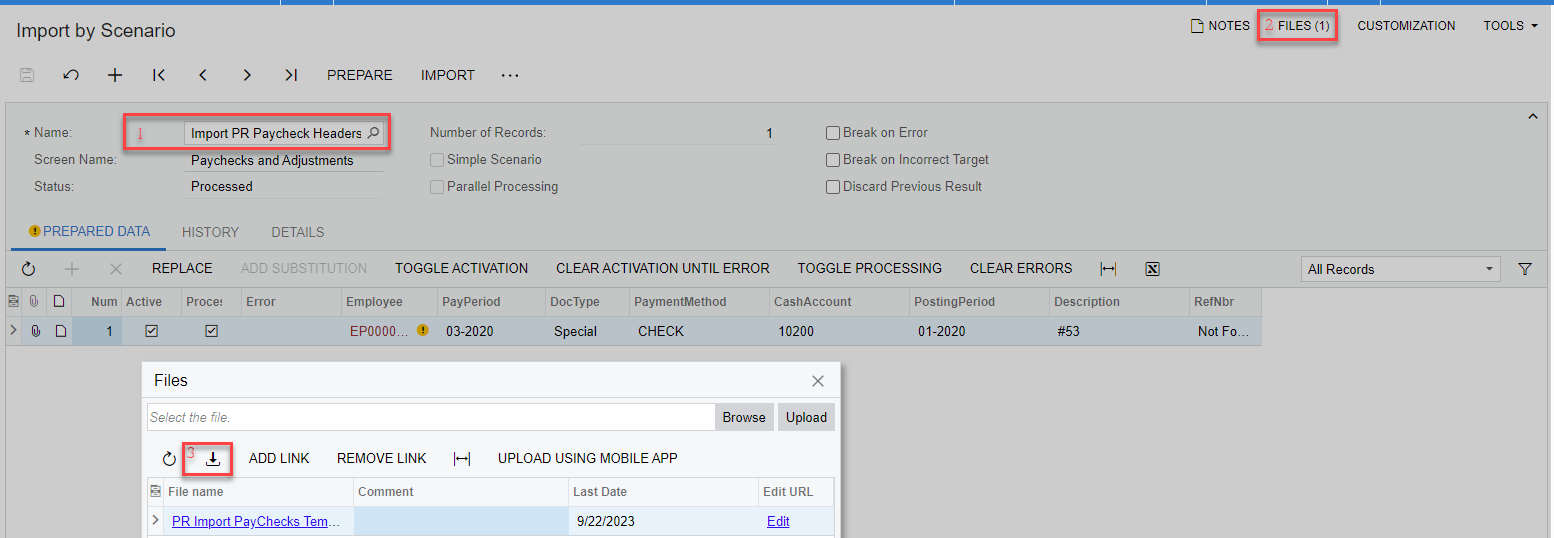

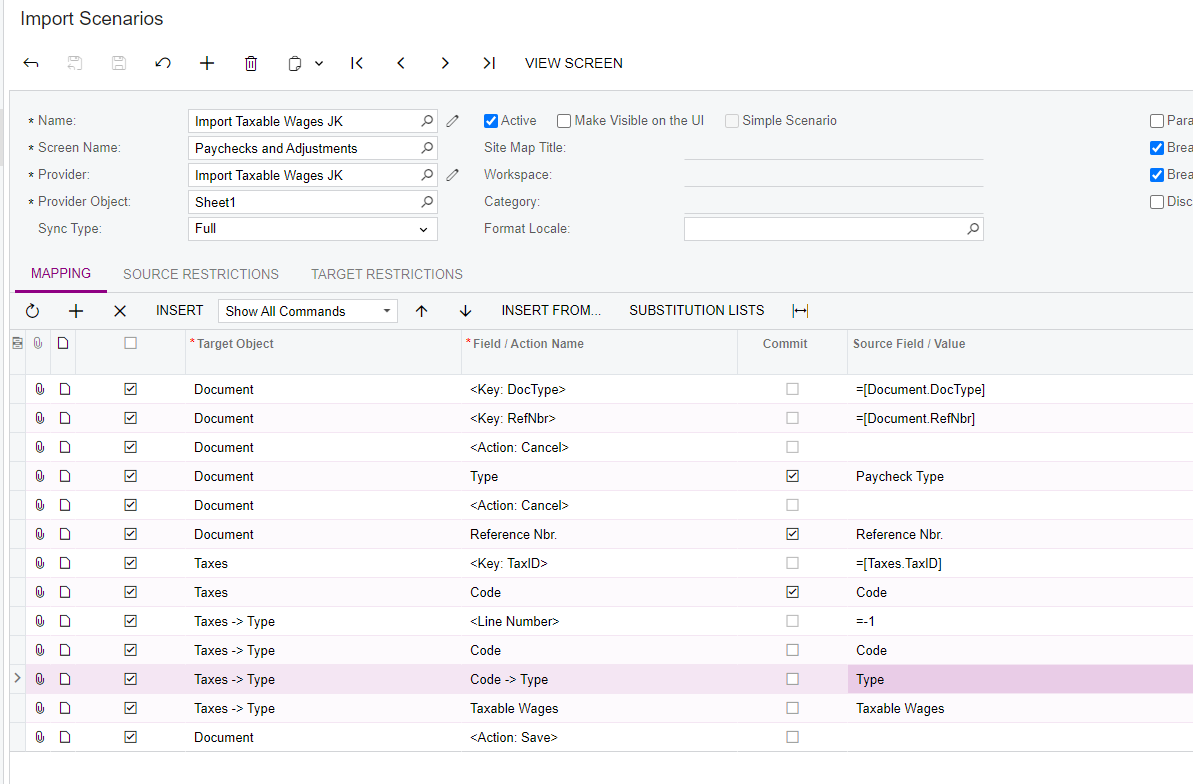

One of the import scenario’s I have tried:

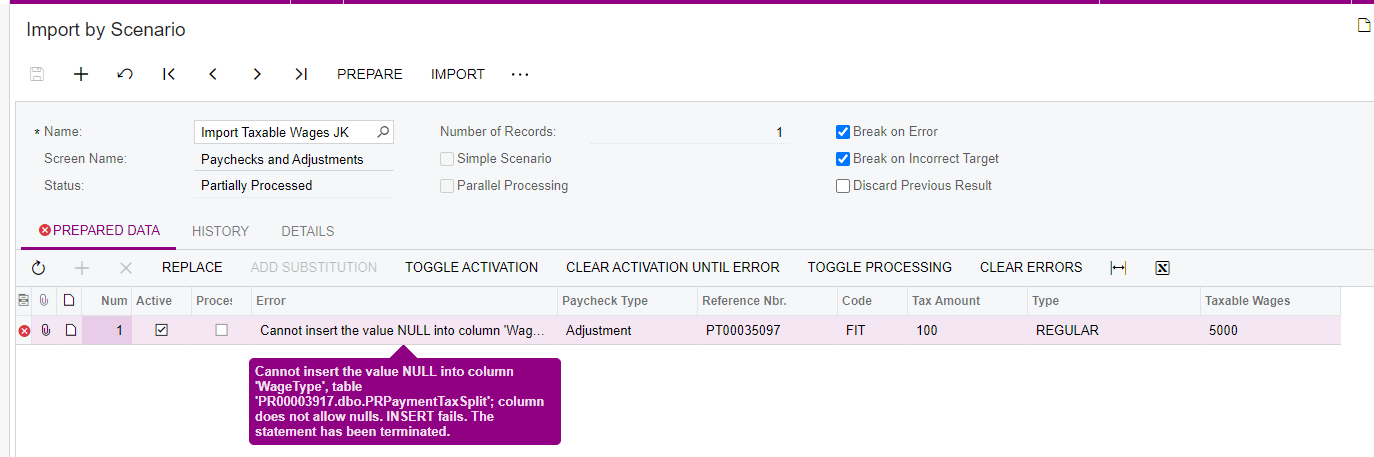

Import By Scenario with Error:

There is clearly a Wage Type