Hello

We are newly implemented and working through our first certified projects.

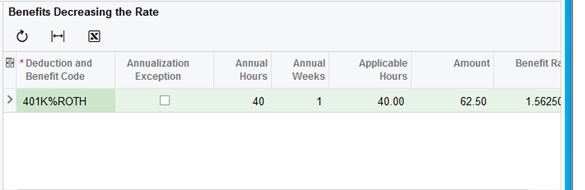

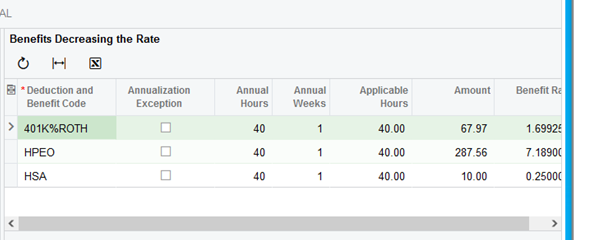

For our employees that we offer health insurance and 401k, the certified calculation isn’t quite right.

You can annualize or not the benefits.This changes the way the calculation works for benefits reducing the rate.

When you annualize health insurance it works more accurate as the cost is divided out over the anticipated hours per year.

401k, if you annualize the rate, it divides those dollars over anticipated hours per year. Which can under report contribution and require us to over pay the employee.

if you don’t annualize it, it over reports and under pays the employee.

For example. We match 4% of hourly rate for the 401k. If an employee works 10 hours on a certified job and 30hrs on regular job. It takes the 4% match on all 40hrs and divides by the 10. We want the 4% of 10hrs divided by the 10hrs.

So we are either over paying or under paying the prevailing wage job. The other issue, we work non-consistent hours. We can work 10-60hrs a week depending on weather and a mixture of certified vs non-certified jobs.

Let me know if you have any suggestions.

Thanks,

Jeremy