Hi Everyone,

Quick Question:

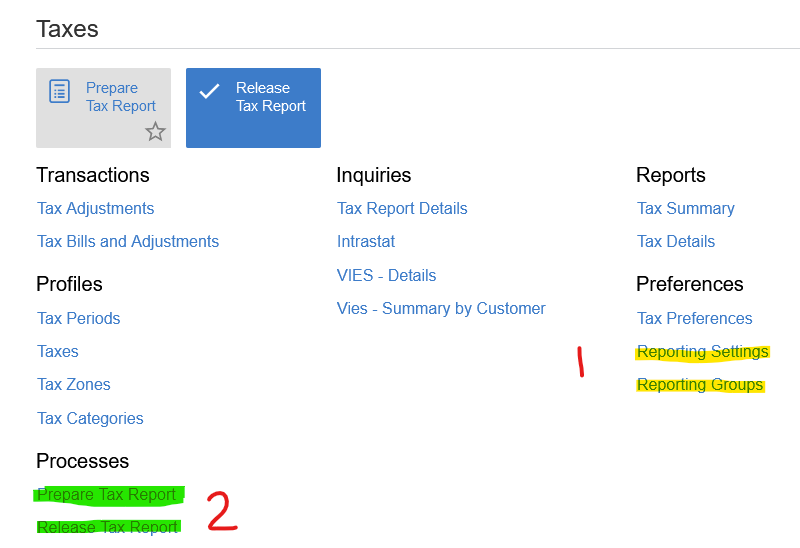

At a high level, what are the transaction requirements to have the “Tax Summary” Report generate with data?

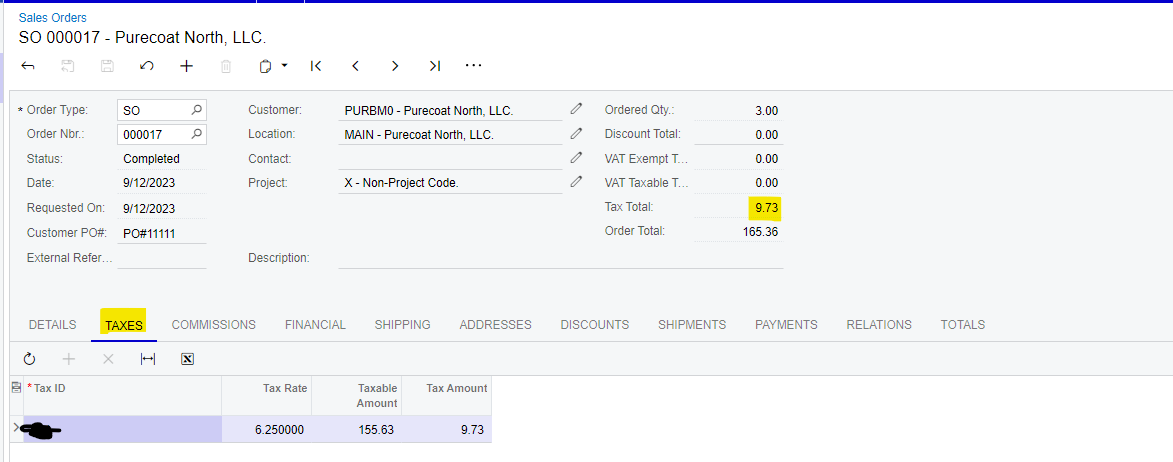

Essentially, We are looking for a report to summarize all sales taxes charged to customers on Sales Orders based on either Tax ID and/or Tax agency on a monthly basis.

We have the Company, branch, tax agency, and periods set up. We also have Sales Orders completed and invoiced.

If the “Tax Summary” report would not be the best method to summarize and view this data, what would be the best approach?

open to any ideas, suggestions.

Thanks.