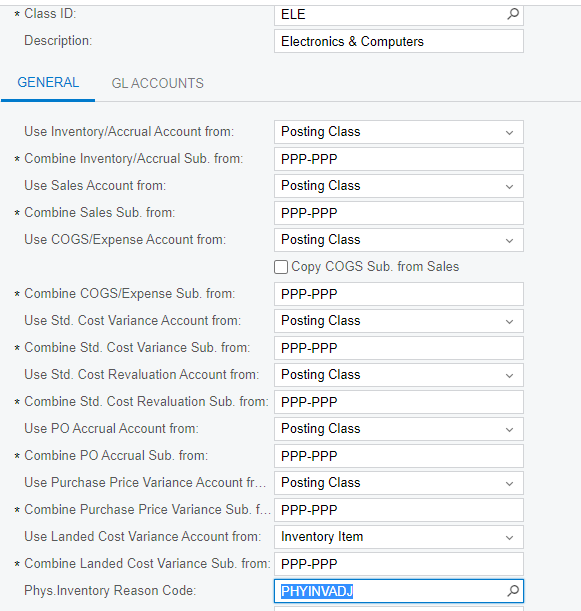

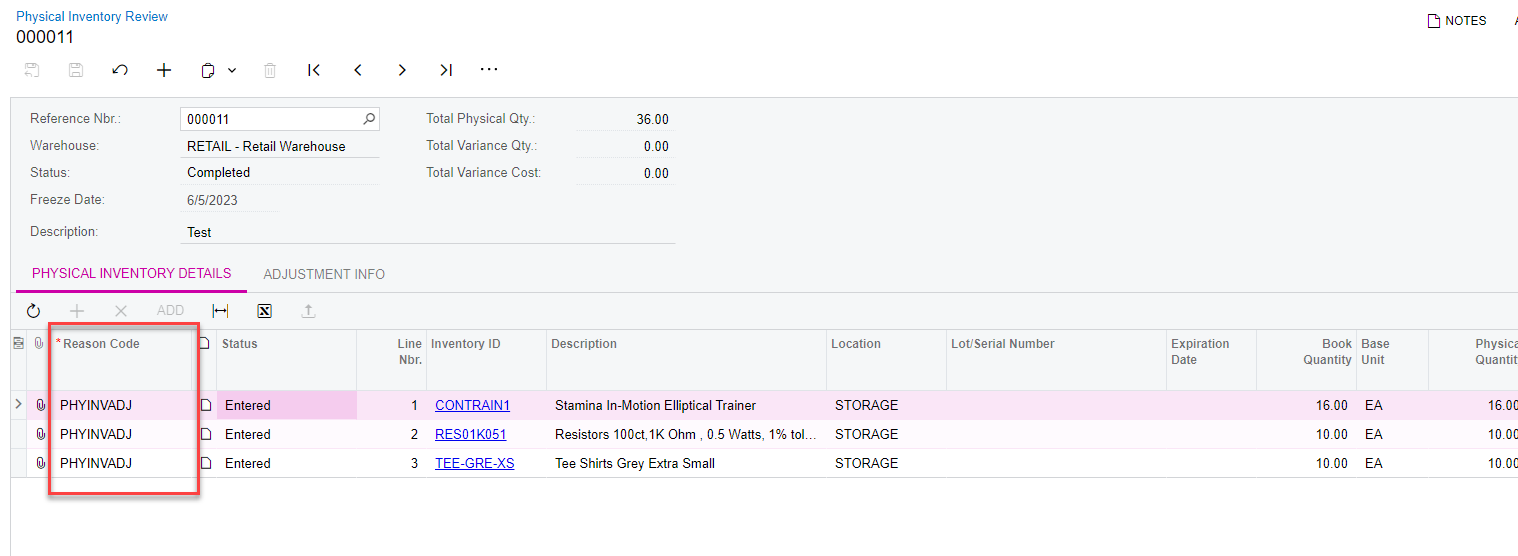

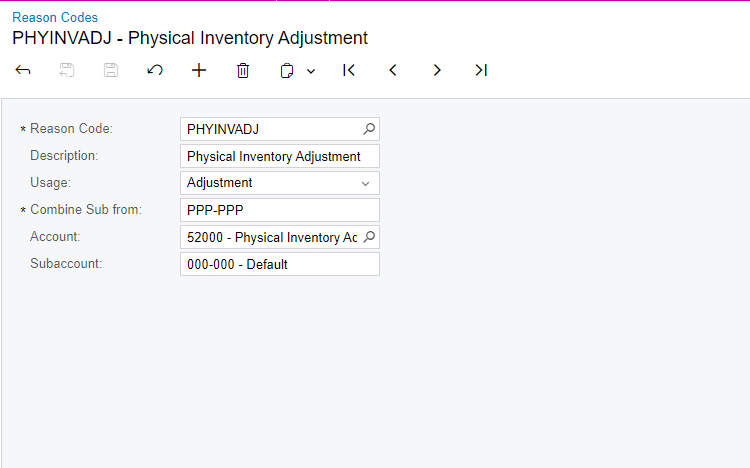

When we do an inventory count, the adjustment hits 66102 - Physical Inventory Adjustments which we have specified as a COGS account.

However, there are certain items (such as packaging), which, when adjusted should flow through a different account (the one specified on the stock item screen).

Is there a way to set up inventory counts that post adjustments directly to the related stock item expense account rather than the physical inventory adjustment account?