Hello,

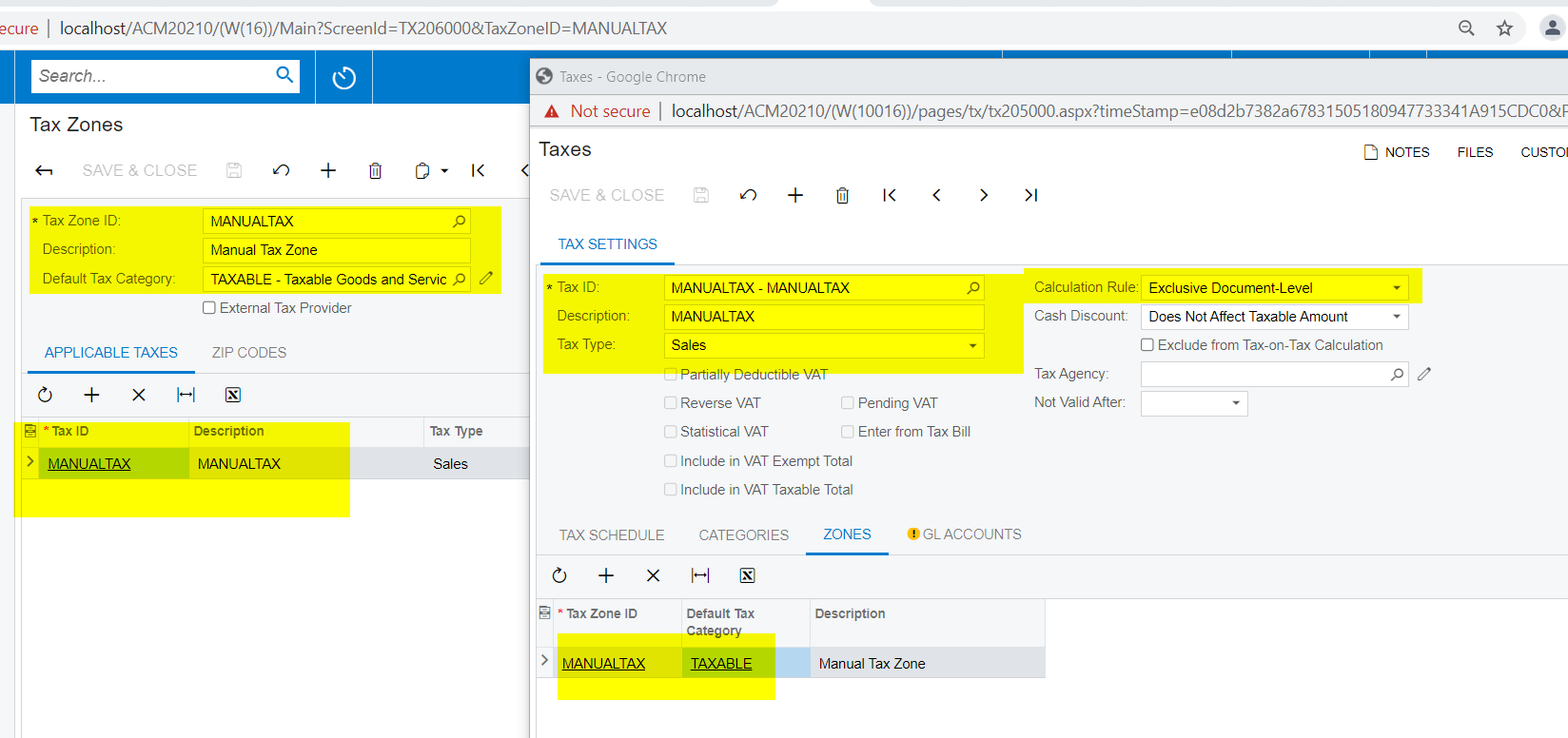

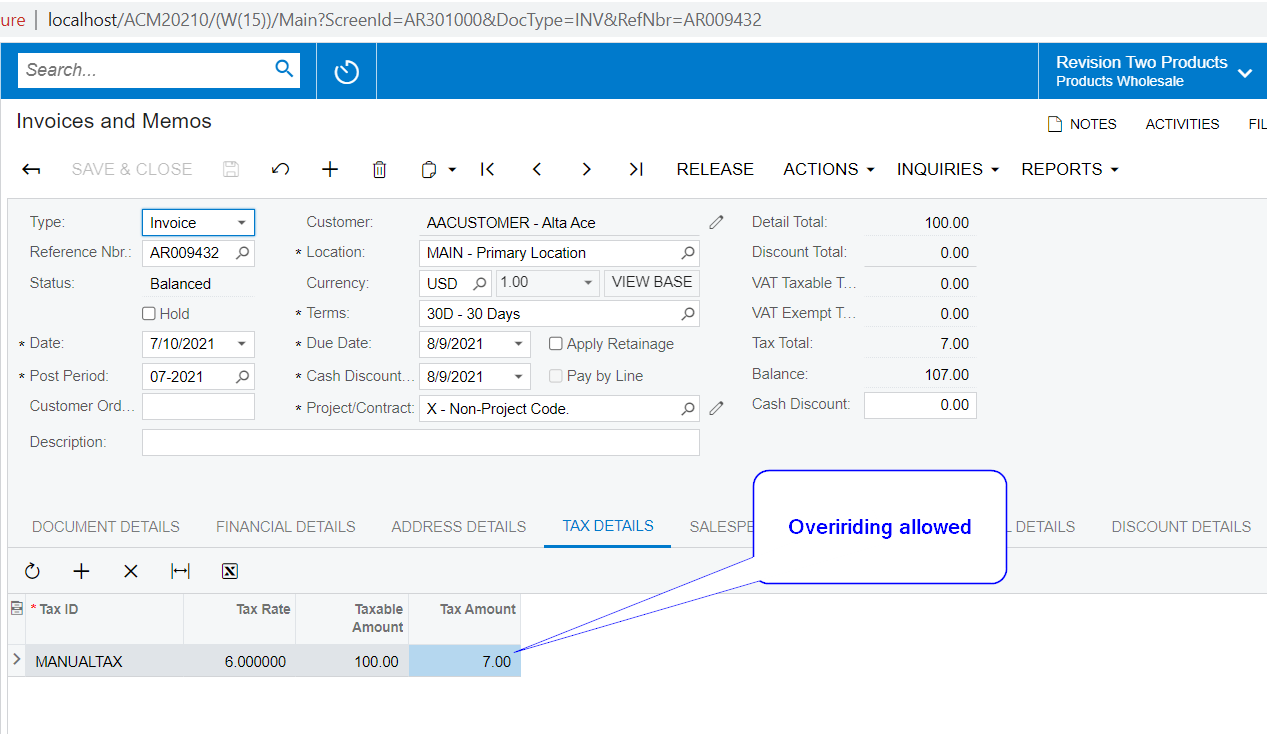

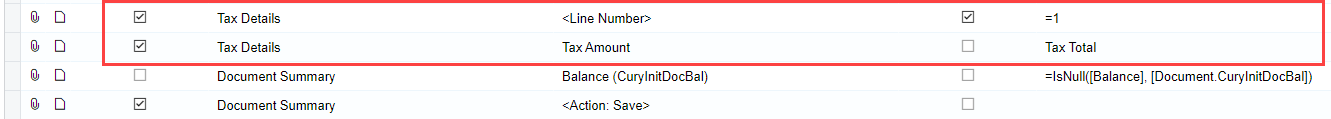

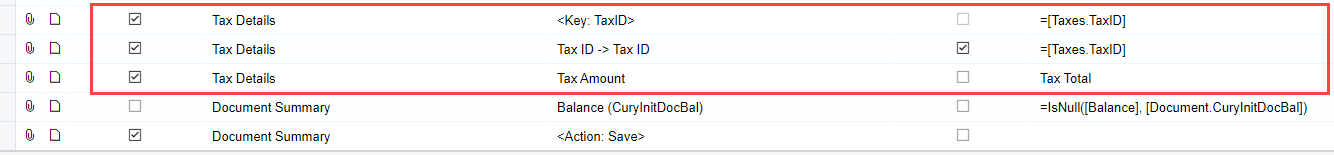

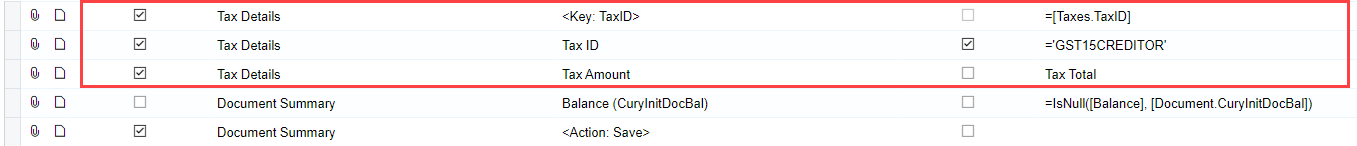

I am trying to import historical invoices into Acumatica using the out-of-the-box ACU Import AR Invoices import scenario. My file has a column for total tax which I tried to map to the tax total field on the invoice header. After running the import scenario, the invoices are created but the tax total remains 0.

I suspect this is because the field is greyed out/disabled on the invoice entry screen. I tried to enable the field using both the ASPX editor and by setting the Enabled property of the PXUIField attribute in code. Neither of these worked, the field is still disabled.

Does anyone know how to enable the tax total field, or have had success importing tax amounts for historical invoices?