Hello All,

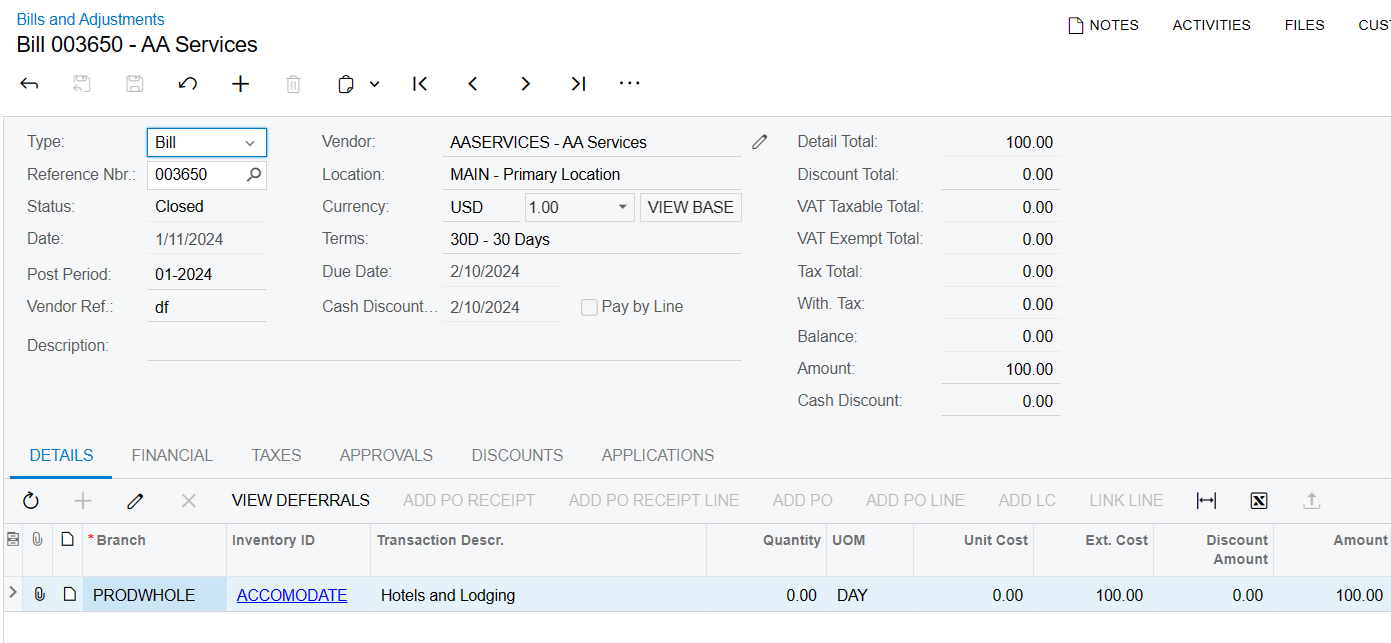

I have a case where I must record withholding tax and submit it to the government.

Ex: Bill from Vendor is 100$ (does not include any taxes), withholding tax is 15%.

As document F335 - Value Added Taxes. there are 2 ways to record withholding taxes.

Option 1: Enter directly to GL through Journal Transaction, the entry included:

| Debit | Credit | |

| Payable Account | 100 | |

| Withholding Tax | 15 | |

| Expense Account | 115 |

Disadvantage: The system doesn't calculate tax amount. The user needs to manually calculate and input it.

Option 2: Create Bill and apply Bill with Payment → Tax Amount will be automatically calculated and booked to GL after Payment is released.

Entries on Bill

| Debit | Credit | |

| Payable Account | 100 | |

| Expense Account | 100 |

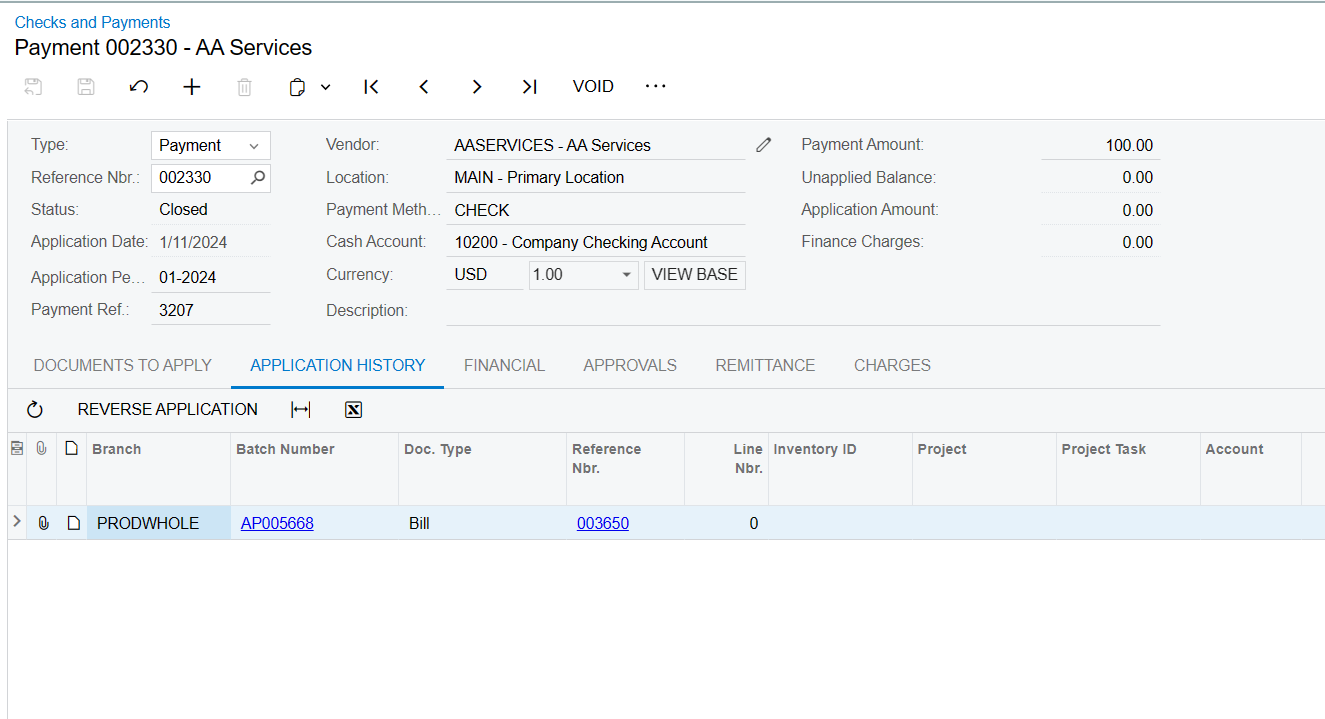

Entries on Payment

| Debit | Credit | |

| Bank Account | 85 | |

| Withholding Tax | 15 | |

| Payable Account | 100 |

|

Because the system defaults to the withholding tax will be extracted tax amount from the Amount on the Bill, the amount that the system calculates I have to pay is only 85$. I have to pay the Vendor 100$ and pay the Government 15$ in total 115$. This is incorrect in my case so can't use this method.

Has anyone got an idea how to record it?

I expect the system can calculate the tax amount after the user types in the taxable amount and Tax ID and the entries will be as Option 1.

Thanks in advance for all your recommendations.

Yên Chi