HI All,

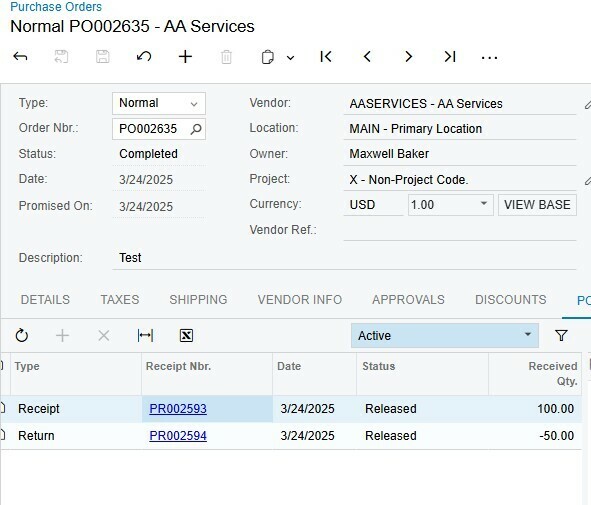

As per best practices and its Normal and Simple Process as per my Knowledge across during the years the following is the Transaction entries which will clear the Purchase Receipt and return

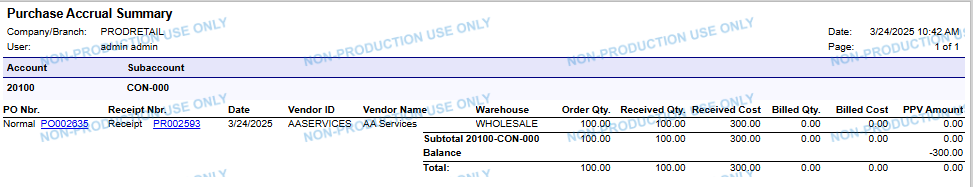

Purchase receipt

Inventory Account Dr.

Purchase Accrual Account Cr.

Return Before Invoice / Bill Created

Purchase Accrual Account Dr.

Inventory Account Cr

By this both the account get cleared and reconciled as well. if its Partial return Yes the balance remain and which can be cleared by Bill as its not retuned

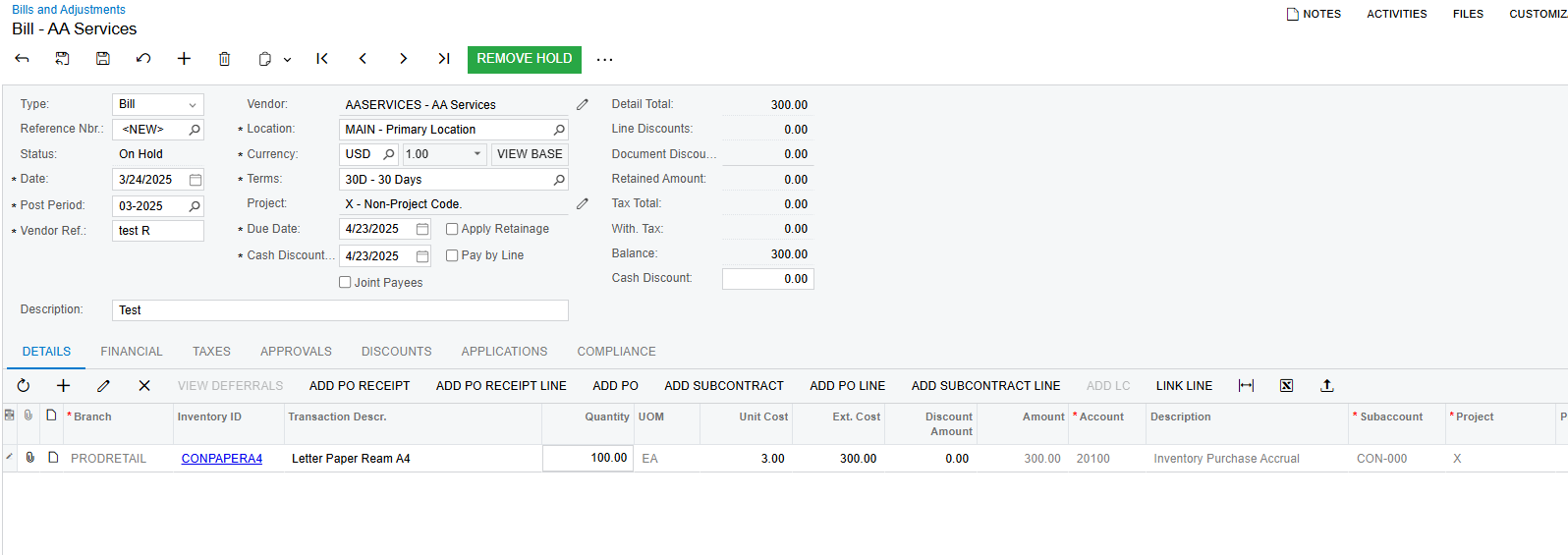

As per the Functionality of Acumatica we need to create a AP Bill and a Debit adjustment for any return ?? though both PR and return has been Processed both Transaction remain uncleared in the accrual Account

why this is required and the logic behind this Functionality ?