Wondering how everyone is handling the tariffs? It’s easy enough when a vendor issues a price increase that I can just pass through. My issue is when I am getting hit with tariff lines on invoices from vendors. Not sure how to accurately absorb those lines on incoming PO’s and pass them along on a Sales Order without a ton of manual work.

Tariffs

Best answer by Samvel Petrosov

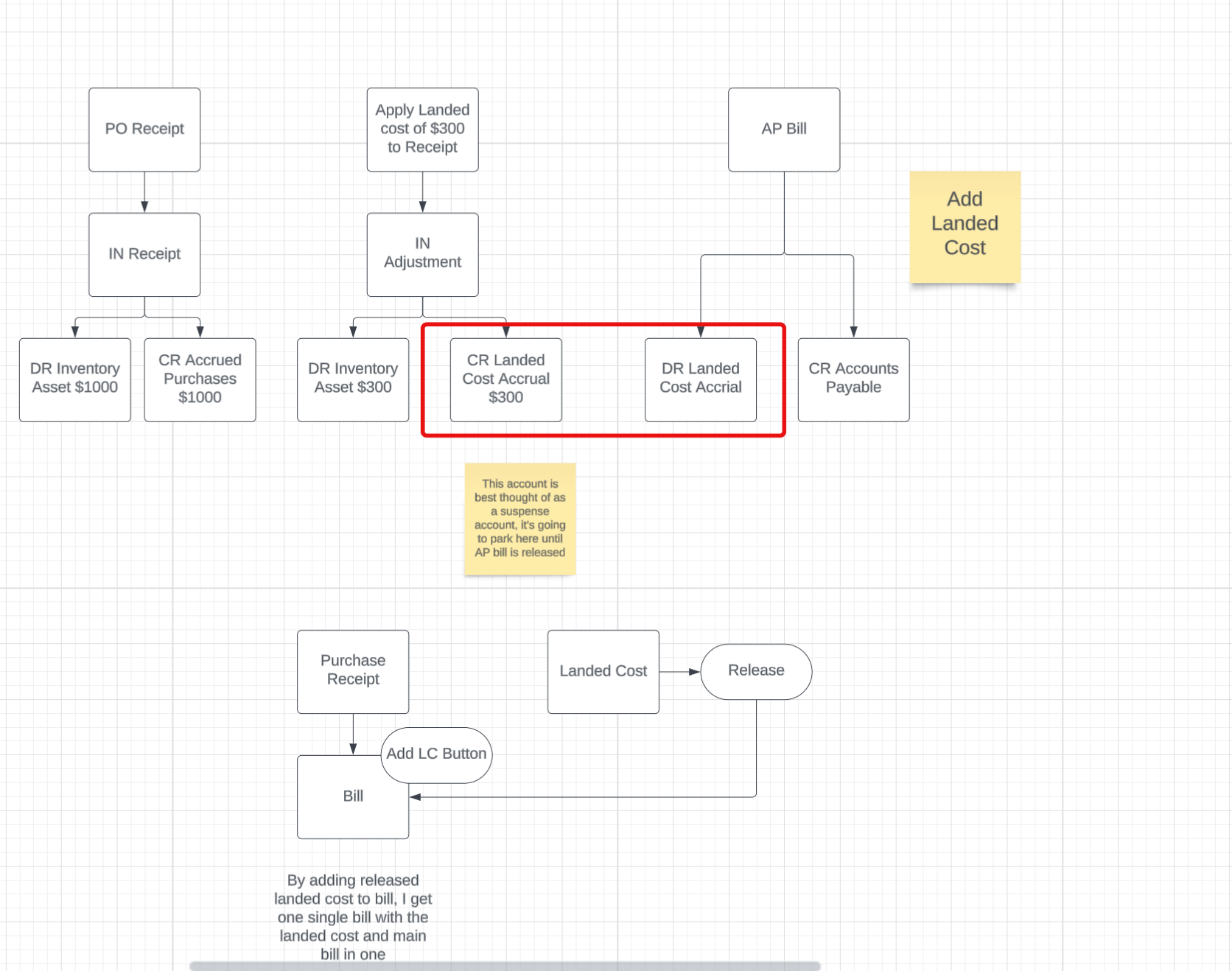

Acumatica allows processing Landed Cost transaction against Purchase Receipts.

So whenever you receive a bill for duty, tariff, or transportation of the goods, you can process a Landed Cost record against the corresponding Purchase Receipt.

Acumatica supports different allocation methods for the landed cost charges - by quantity, by amount, by weight, by volume and none (no adjustment of the inventory cost at all).

Of course, you also will need to take into account the valuation method of the inventory.

But in general, Acumatica receives the inventory into stock after you release the Purchase Receipt, then allows to adjust the cost of it with processing Landed Cost charges.

Here is the link to the help wiki Allocating Landed Costs

As another option you can look into Container management solutions AcuContainer - Container Tracking - Marketplace | Acumatica Cloud ERP

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.