I’m looking for best practices.

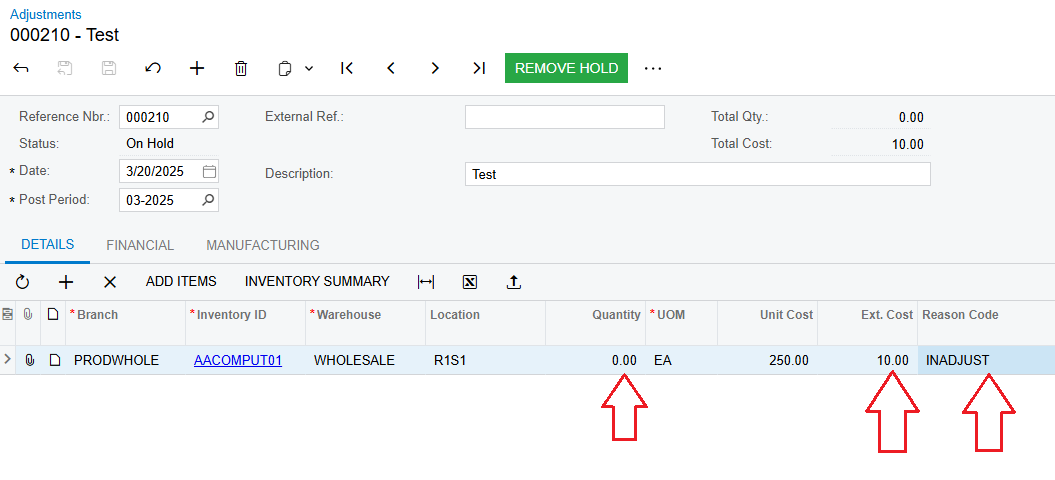

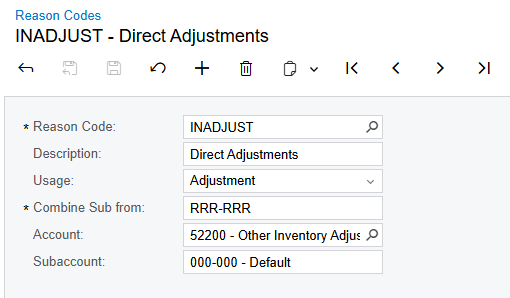

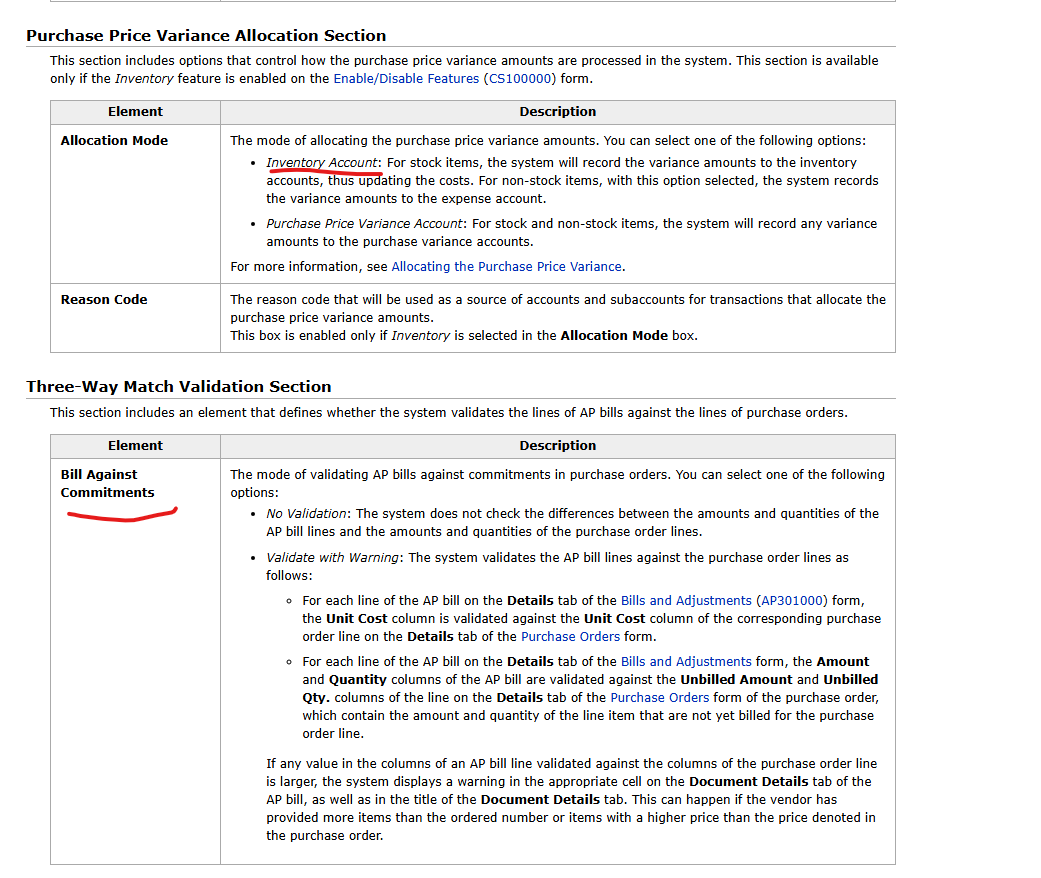

If our AP department receives an invoice/bill for product received but the purchase order totals and unit costs do not match what should we do?

Should we be sending an mail to our purchasers and asking them to reopen purchase orders and update the unit costs? I tried that in a test enviroment and the PO updated its costs like I expected, but since the purchase receipt has already been released those costs were not updated and hence when we go to enter the AP bill the old unit costs are the numbers in the AP bill.

I don’t feel like it’s reasonable to ask our AP person to adjust all the unit costs if they differ but I need to develop an SOP for our purchasing departments as well.

On a related note, which “unit cost” does the stock item use for the “Last unit cost” and “Average Unit Cost” equations?