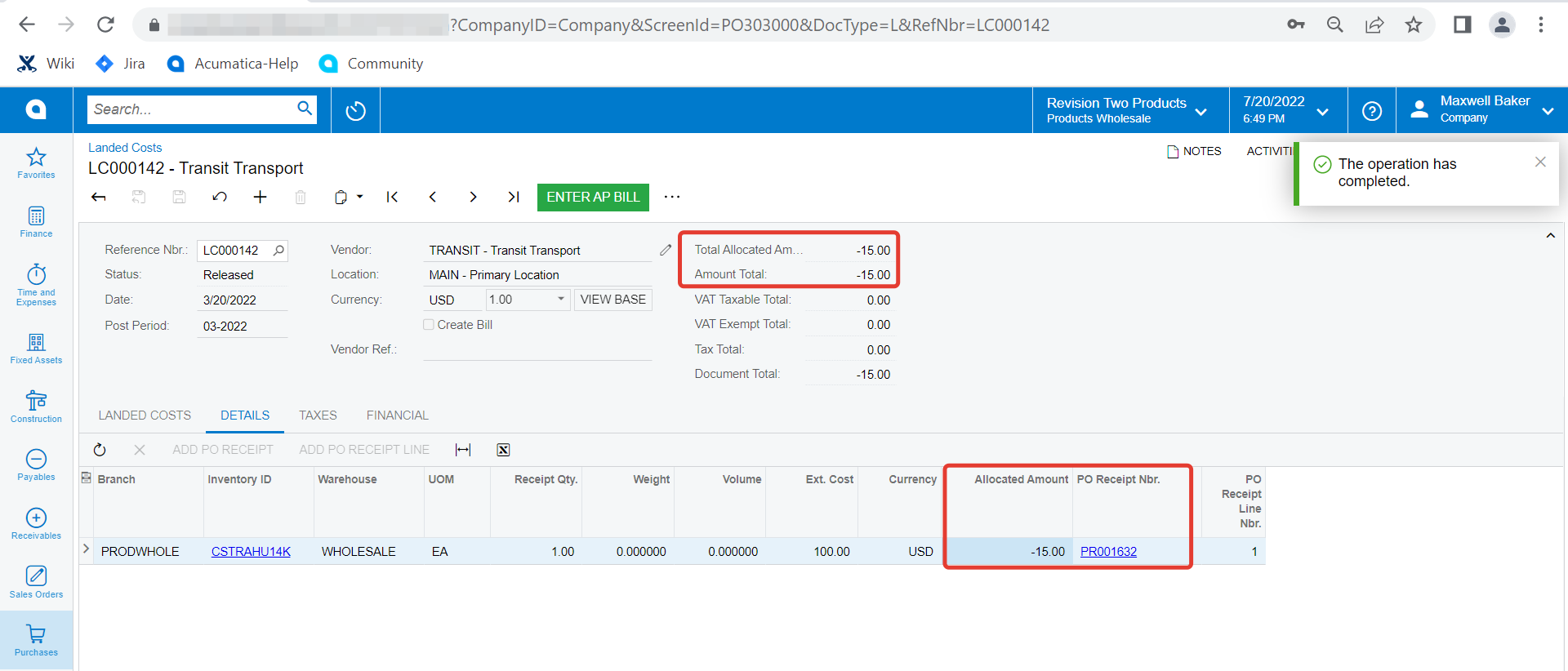

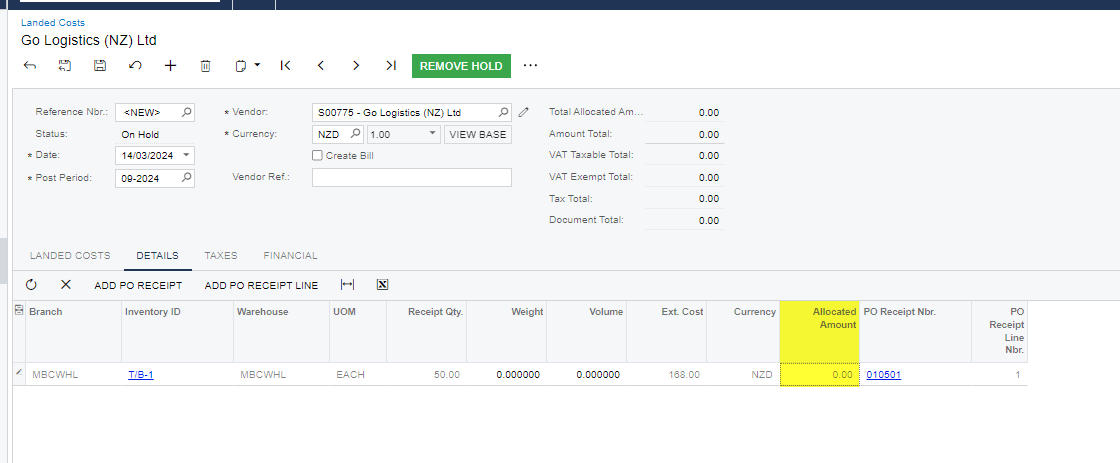

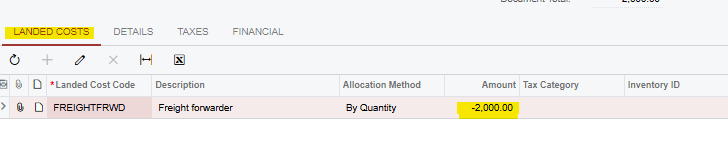

Does any one know how to reverse a Landed Cost? We had an entry with a clerical error and the amount was incorrect. Now inventory is overvalued and we have the amount sitting in the accrual account. The AP bill should address the accrual balance but will create a credit on the P&L variance account. Not sure how you address the inventory valuation. So looking for ways to edit, delete or otherwise correct the LC transaction.

Solved

Reversing Landed Cost Transaction

Best answer by eshahid78

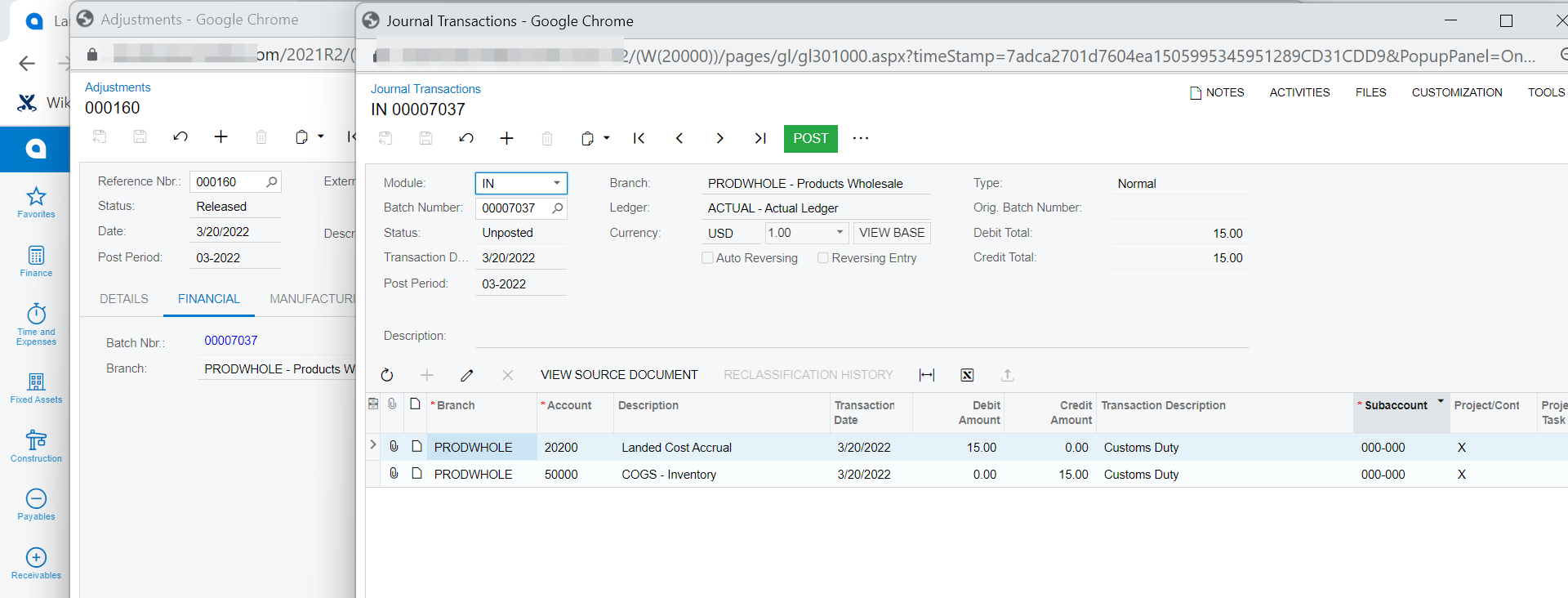

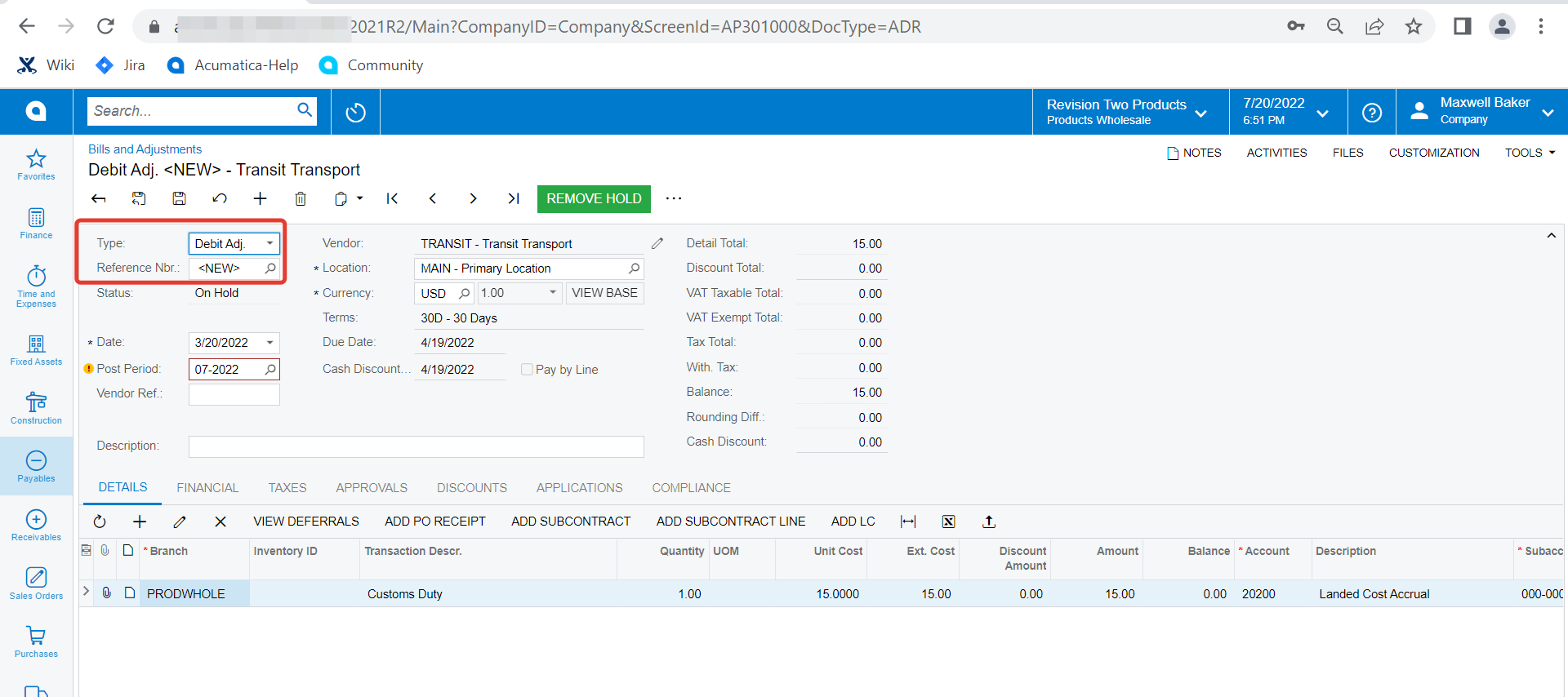

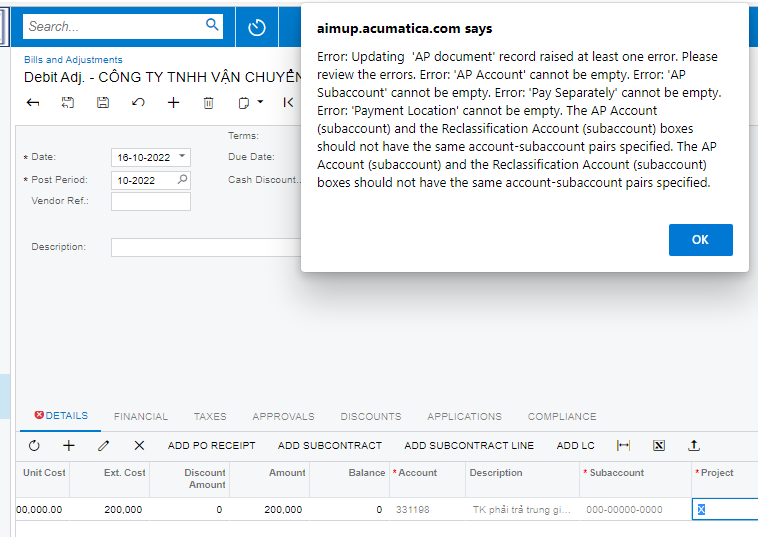

Looks like you will need to do a debit adjustment for off-set AP. Find the original inventory adjustment and reverse that manually.

As per discussion here -

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.