Hello everyone ;

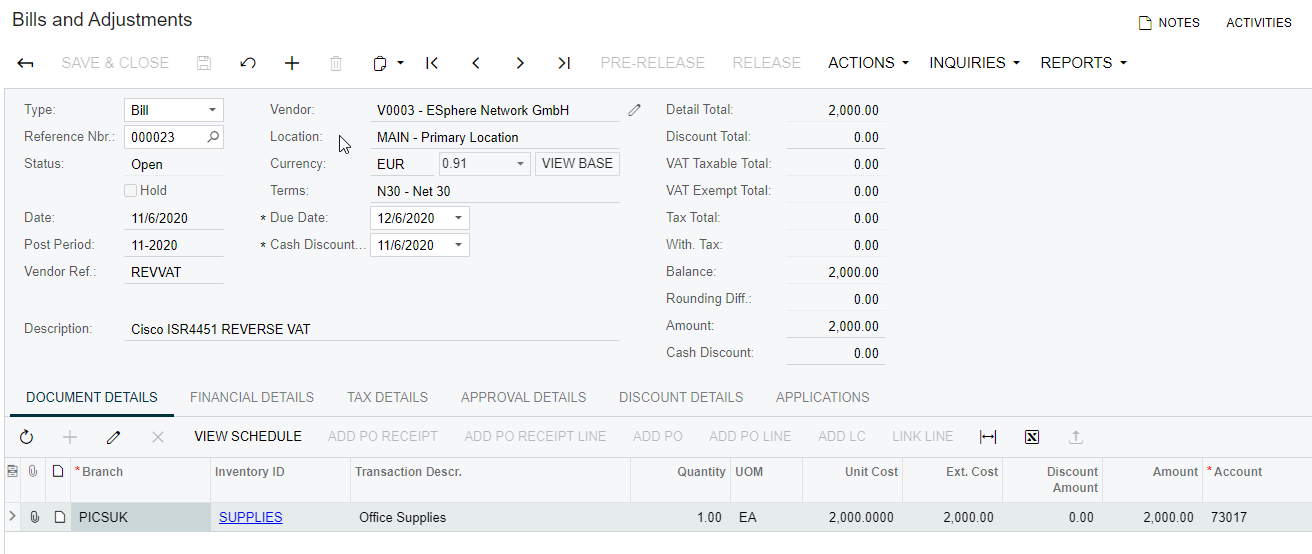

How exactely does the reverse vat work? I created a reverse vat and a general one to cancel it while billing but it doesn’t work. I’ll have the tax amount on the bills of a EU clients.

Help !!!

Thanks

Hello everyone ;

How exactely does the reverse vat work? I created a reverse vat and a general one to cancel it while billing but it doesn’t work. I’ll have the tax amount on the bills of a EU clients.

Help !!!

Thanks

Best answer by nvadera7

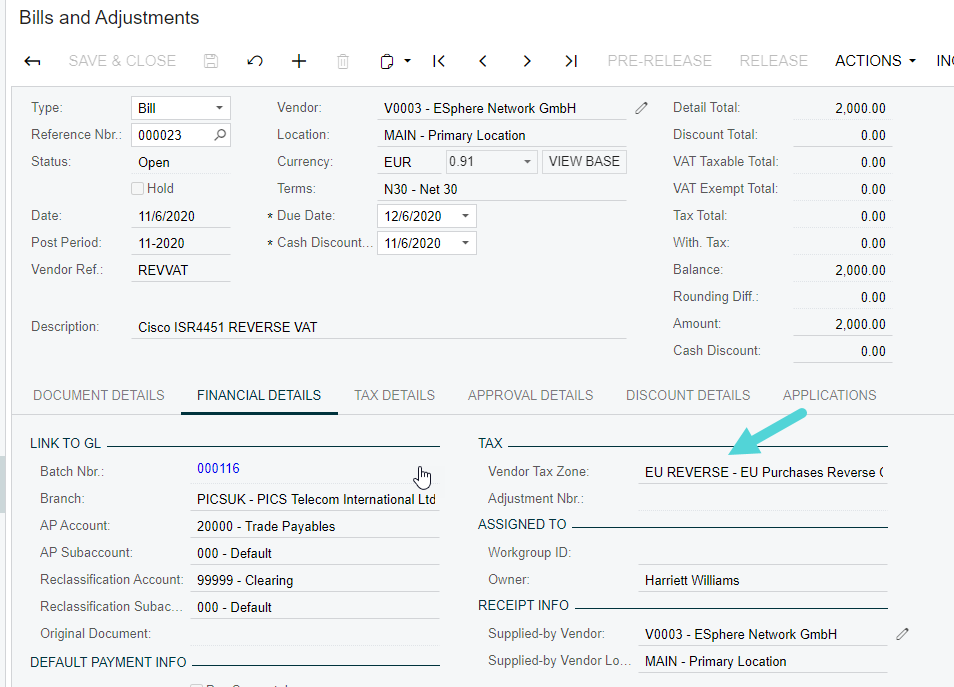

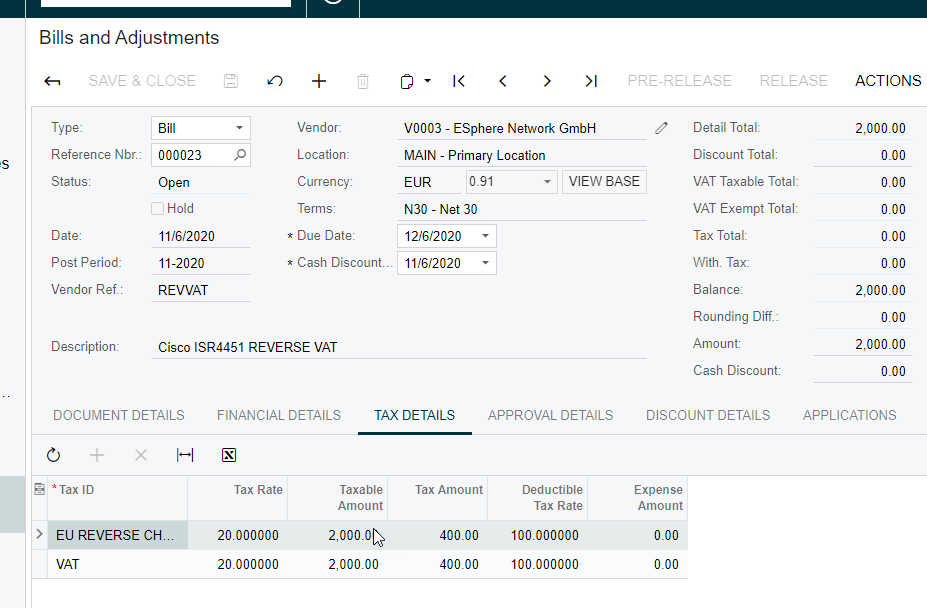

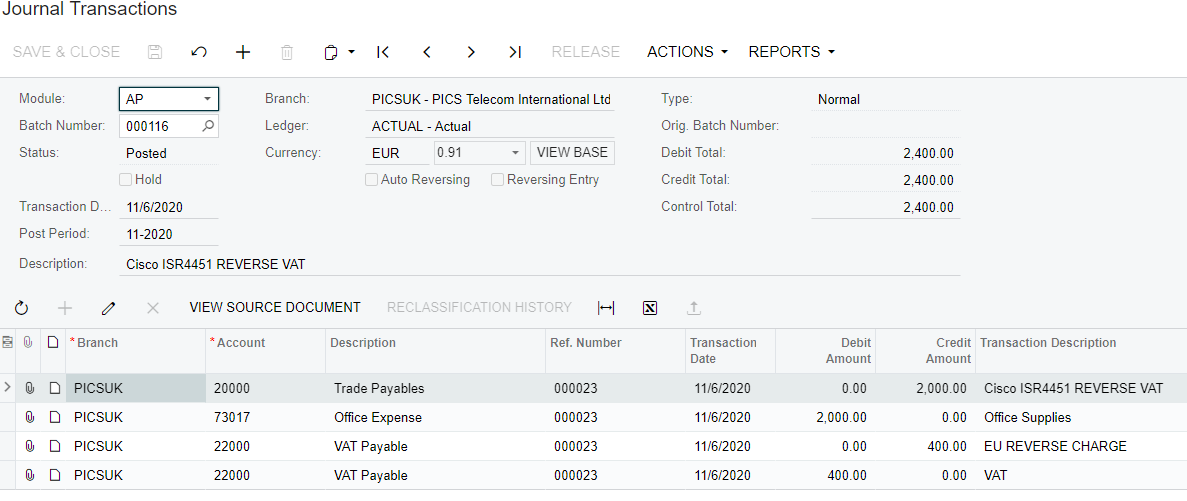

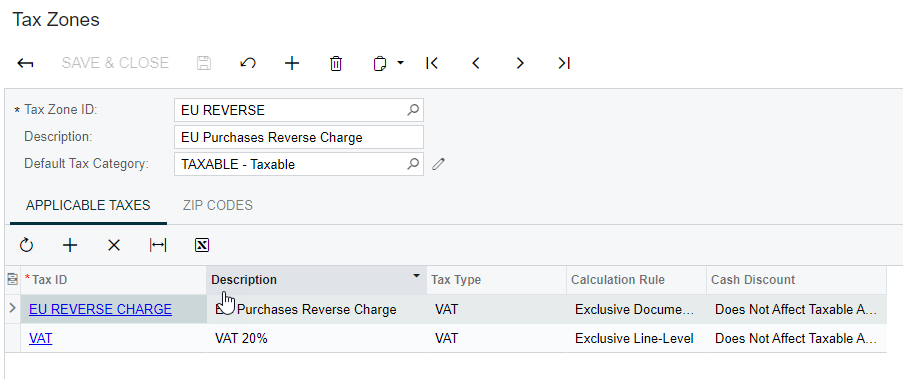

Hi Nawres

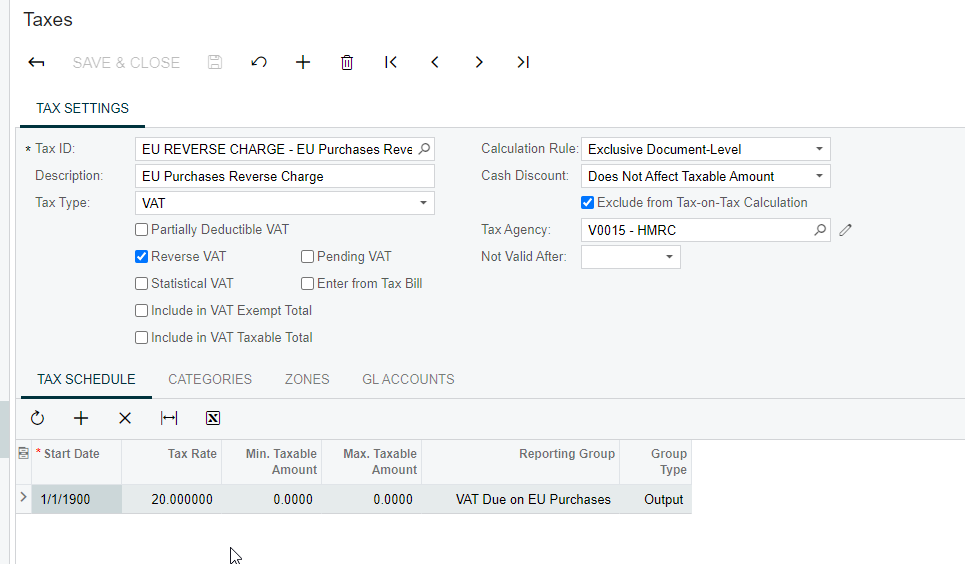

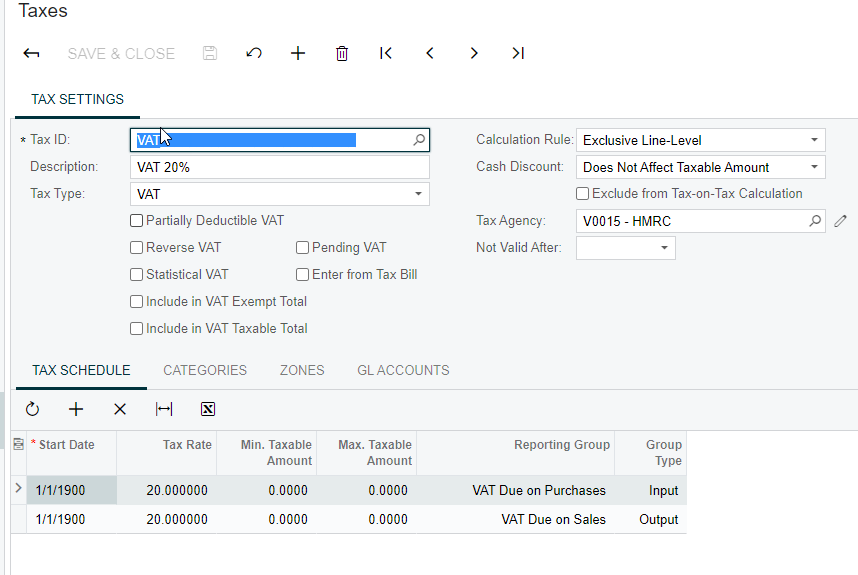

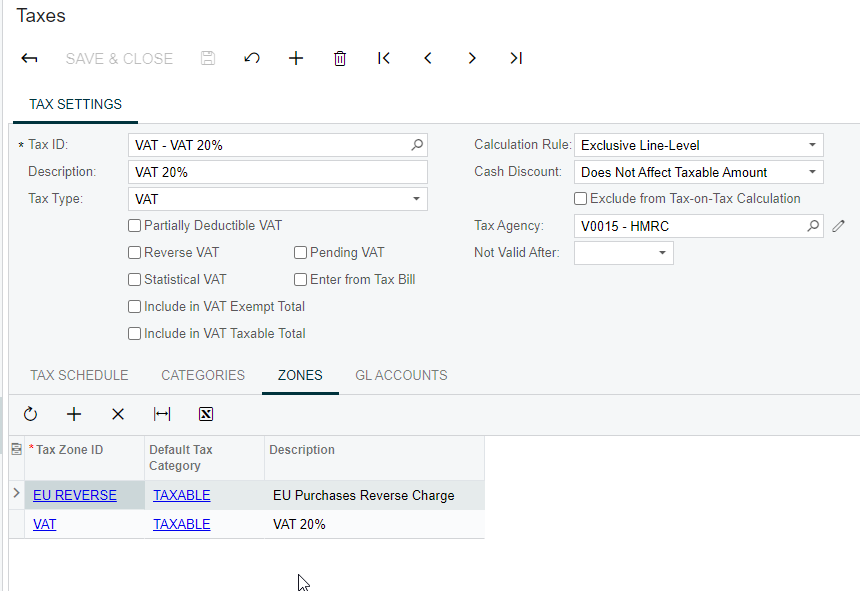

My setup for a client in the UK: Let me know if this helps or if you have found a better setup.

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.