How do we apply a payment, using payments and applications, for something that is not invoiced or does not require an invoice. For example, we may get a government tax refund and need to apply the check we receive. How do do so using payments and applications?

Hi

For a refund from the government, are they set up as a vendor or customer? From what you have described, they should be a vendor.

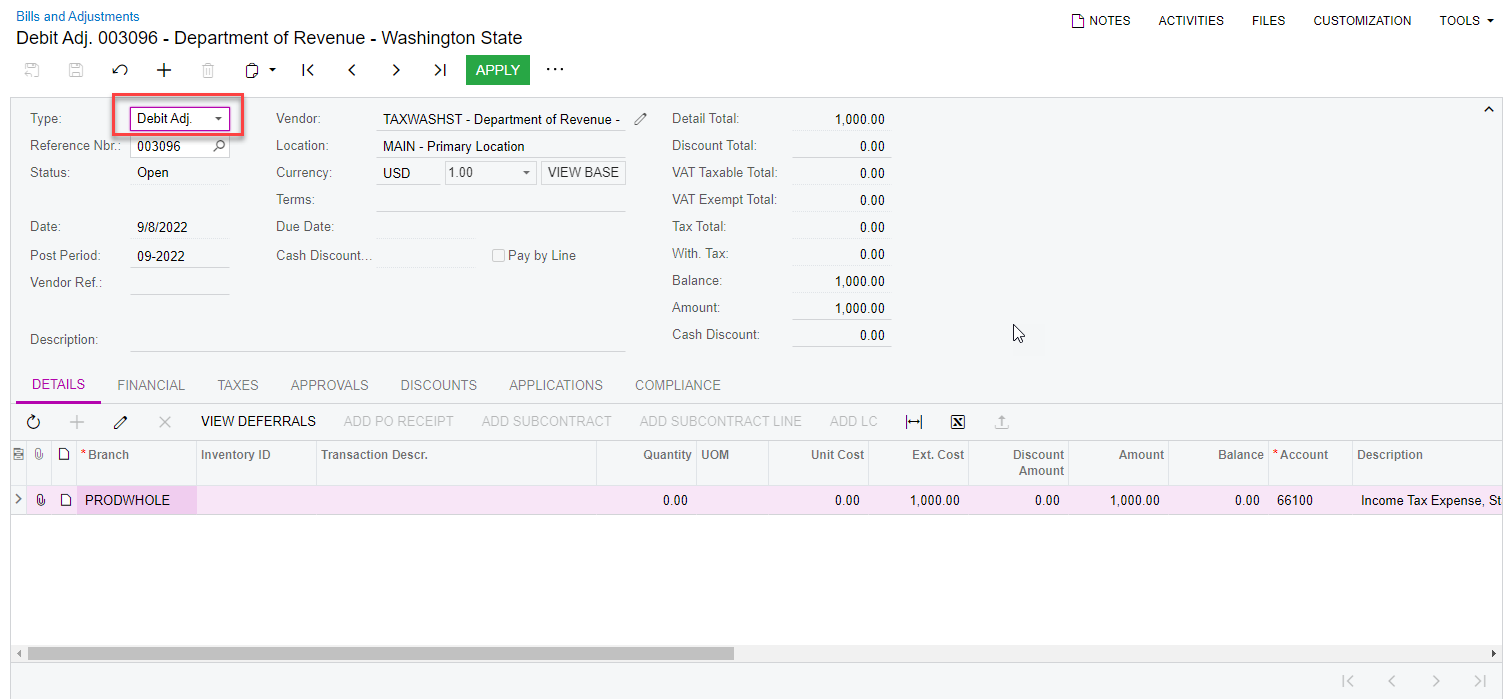

You would need to create a Debit Adjustment for the amount you are receiving:

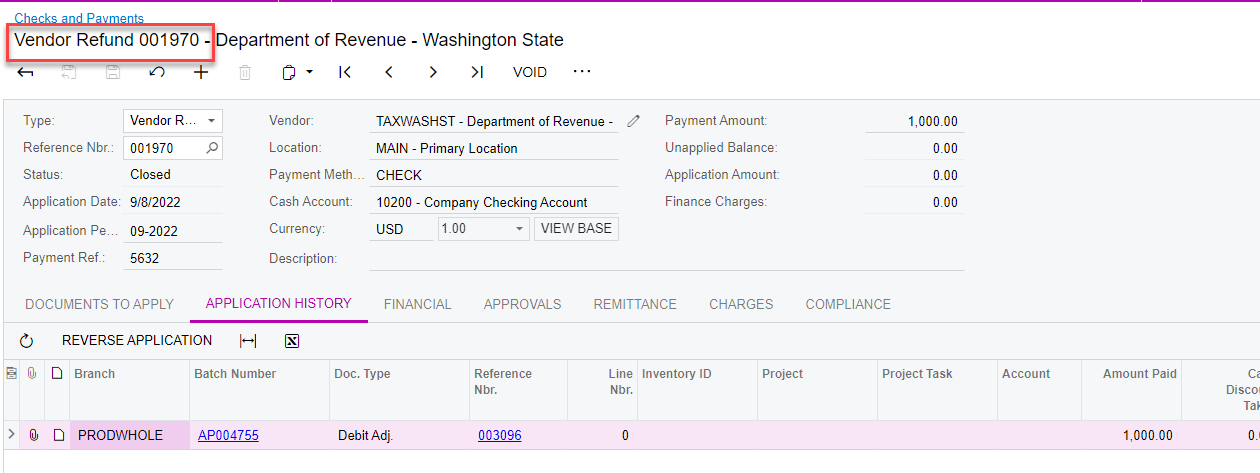

Then you would create a Vendor Refund for that Debit Adj.:

You need to have the Bill Type to have a refund.

What about the AR side to receive the funds?

What about the AR side to receive the funds?

HI

Are you saying a Customer Refund to the government?

No...I meant to receive the funds into your bank, but I see now the Vendor Refund transactions is recorded in bank reconciliations and account details. Not like the customer refund where you have to extend the customer to vendor and pay. I thought I would have to extend vendor to customer and deposit the payment.

Reply

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.