While working on entering the employees into "Employee Payroll Settings", there are a couple of setup concerns/questions:

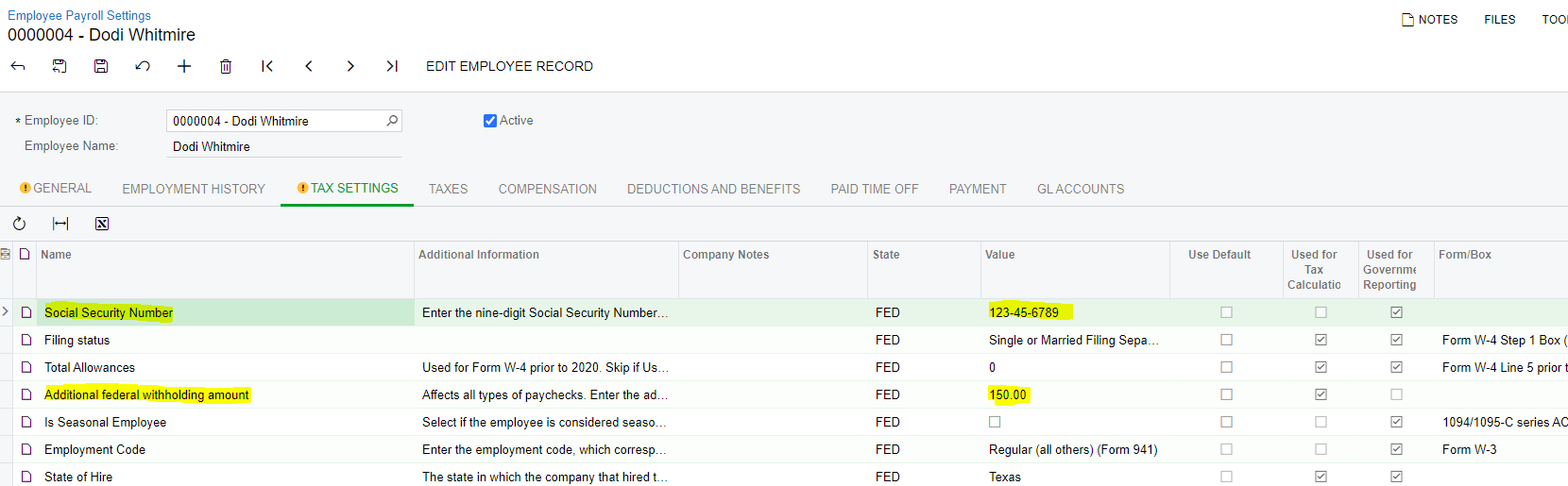

- The system is allowing me to enter all Social Security #s as the same number. I'm not getting an error message that the number is a duplicate or already used.

- One of our employees' tax setups in Sage has their Federal Withholding at an "Additional 25%"...not a dollar amount. The PR Settings does not allow a percentage...only an amount.

Please refer to the below screenshot