One of the key financial differences between Acumatica, Netsuite and Intacct is that the latter of the two have account reconciliation modules. Of course, everybody has bank reconciliation which is one type of GL account that has to be reconciled, but many companies are required by banks or auditors to explain many other balance sheet accounts and this can be a real headache to members of the financial team. To help win over the finance department to Acumatica, we need to offer a competent reconciliation module to stay competitive.

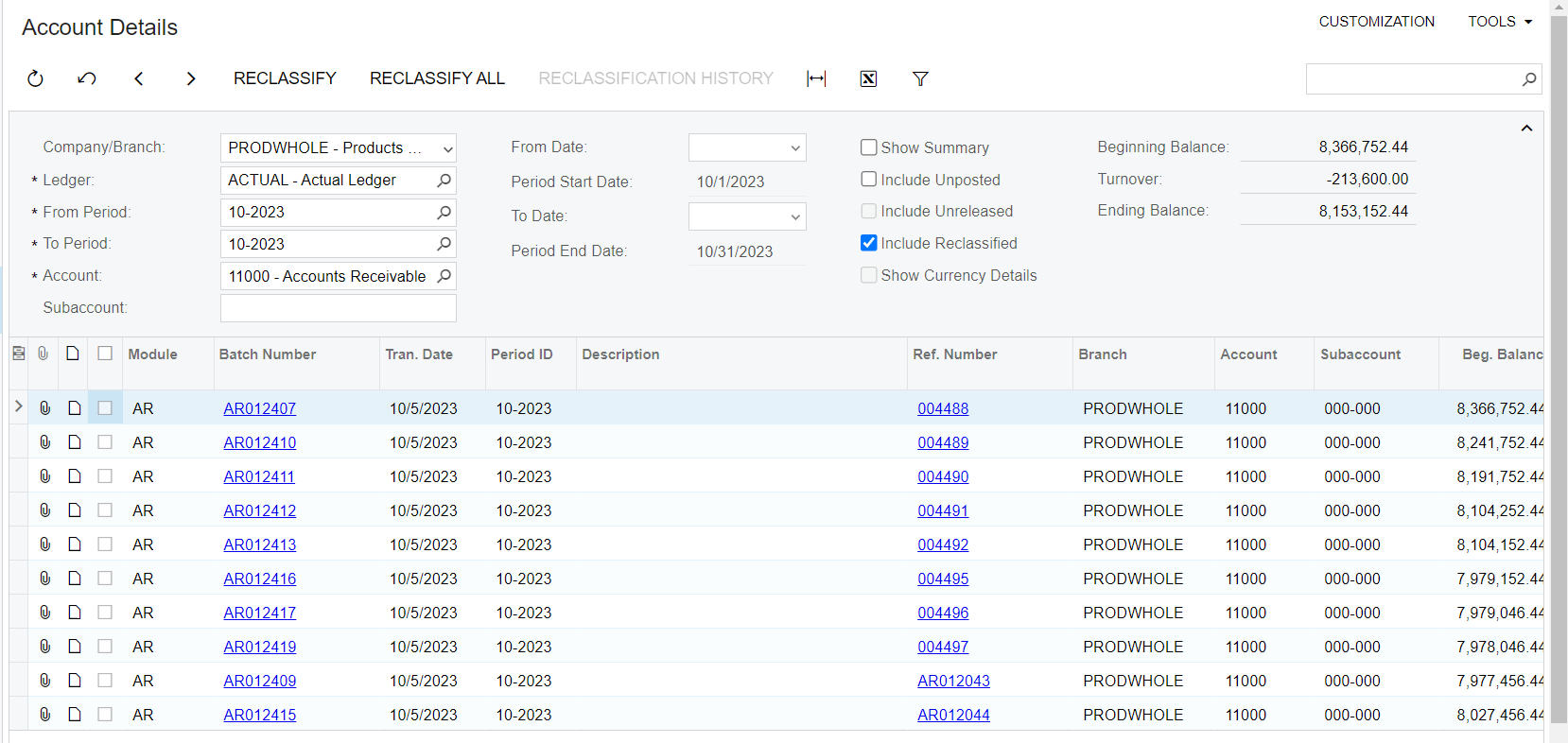

The essence of an account reconciliation module is that transactions that make up a balance sheet account at the end of a period are traceable to specific documents on the company side, and most importantly reconcile these against a statement or other documents from a third party. This could work in conjunction with the AP automation in that a PDF can be brought in and items on that PDF can be tied to the account balance. Some likely accounts are loans and notes receivable and payable, WIP, accruals and deferrals, loans to shareholders and equity,

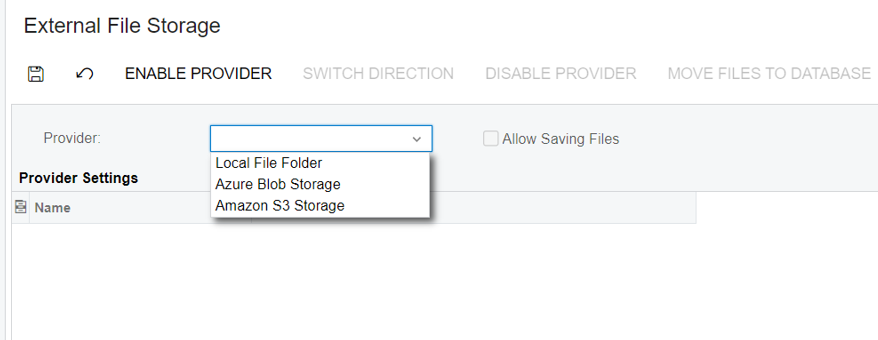

Besides a centralized set of tools for analysis, adjustments and approval, this is something that is best done by Acumatica as it works best by enforcing best practices when recording transactions such as storing document images with transaction records and insuring that transactions are recorded with sufficient comments and descriptions. Other modules such as projects and time and expense should be leveraged in this regard as well. One problem to overcome is that document storage eats up space at a horrifying rate and that can increase the cost of Acumatica rapidly - that must be addressed.

I would love to hear if anyone else thinks that this would be impactful to our customers and beneficial to the Acumatica community or would it be a misallocation of scarce resources.