Hi Everybody,

Just a simple question as I’m new to Acumatica System.

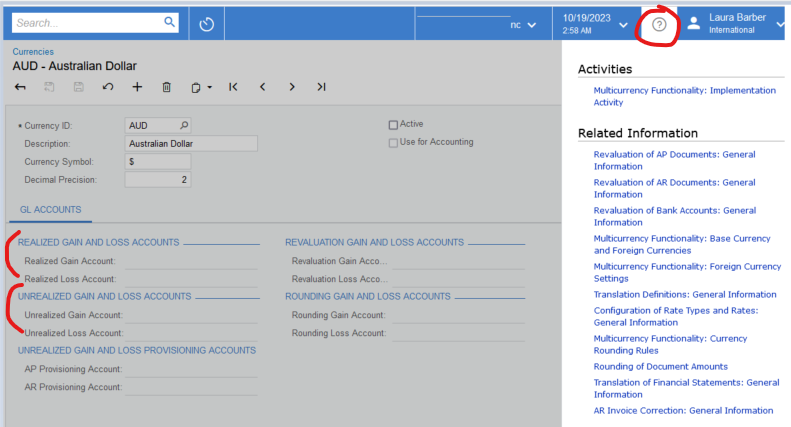

We have some AP and AR & Bank transactions in a foreign currency (USD) while our base currency is AUD.

In our old system we used to run an unrealized gain/loss report and it would tell us to make an adjustment to the AP/AR/Bank account, with the differences taken into a FX Unrealized Reserve GL in the equity section.

How do we do that same in Acumatica. Is there a report we run so make the same transaction?

Additionally, how does it calculate the realised gains and losses?

Thanks in advance.

Regards,

HAK