Can we adjust ending cash account balance in module banking of acumatica

Can we adjust ending cash account balance in module banking of acumatica

Best answer by Laura03

Hello,

I thought of one more idea: Is this the very-first-ever bank reconciliation statement for the account shown?

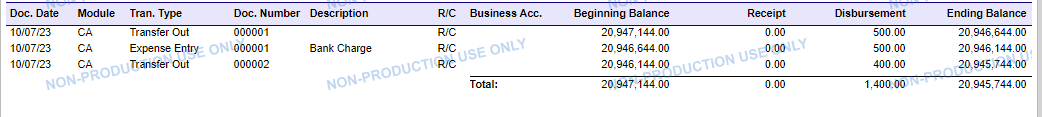

When we reconcile for the first time, Acumatica include all prior migrated cash account balances in the reconciliation statement.

There is a trick, to the very first reconciliation, needed because cleared checks are not flowing from Acumatica’s AP for this reconciliation; cleared checks are ‘rolled into’ a GL balance typically migrated via GL.

For example, if you are trying to reconcile June 30, assemble a list of Un-cleared checks as of June 30. This list will be found in the prior software, the “old system” that was replaced by Acumatica. For each un-cleared check (or deposit) make a Debit and a Credit to the Cash account via GL. Then return to your June 30 Bank Reconciliation STatement and clear the Debit GL entries you made for uncleared checks and clear the Credit GL entry you made to represent uncleared deposits.

The following “trick” will result in a correct bank reconciliation, with outstanding items and a correct ending account balance.

If we have not answered your question, please provide more details. Thank you!

Laura

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.