I am posting this to see if there is any consensus about how other companies are handling the following circumstance. Welcoming all ideas.

We frequently see a situation where AP invoices flow into a company with dates from the prior period after the prior period was closed.

Example: November Closed: Vendor’s bill arrives by mail on 12/03 with an invoice date of 11/29.

I believe there are two options here:

- Date the invoice differently (like 12/03 (representing the time it was received) and post it into the 12-2023 period.

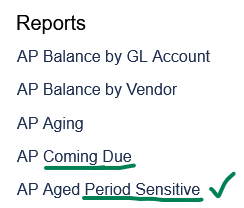

This will keep your GL account and your Aged Period Sensitive Report in balance. - Date the invoice with 11/29 and change the posting period to the OPEN 12-2023 period.

I believe this will automatically create a difference between your Aged Period Sensitive Report and your GL balance in November. Making it impossible to balance AP vs. the GL at EOM.

Many companies have a policy of entering the A/P Bills only using the date on Vendor Invoice. This makes Option 1 impossible from a policy standpoint.

From a technical/balancing standpoint, I’m in favor of Option 1 :-)